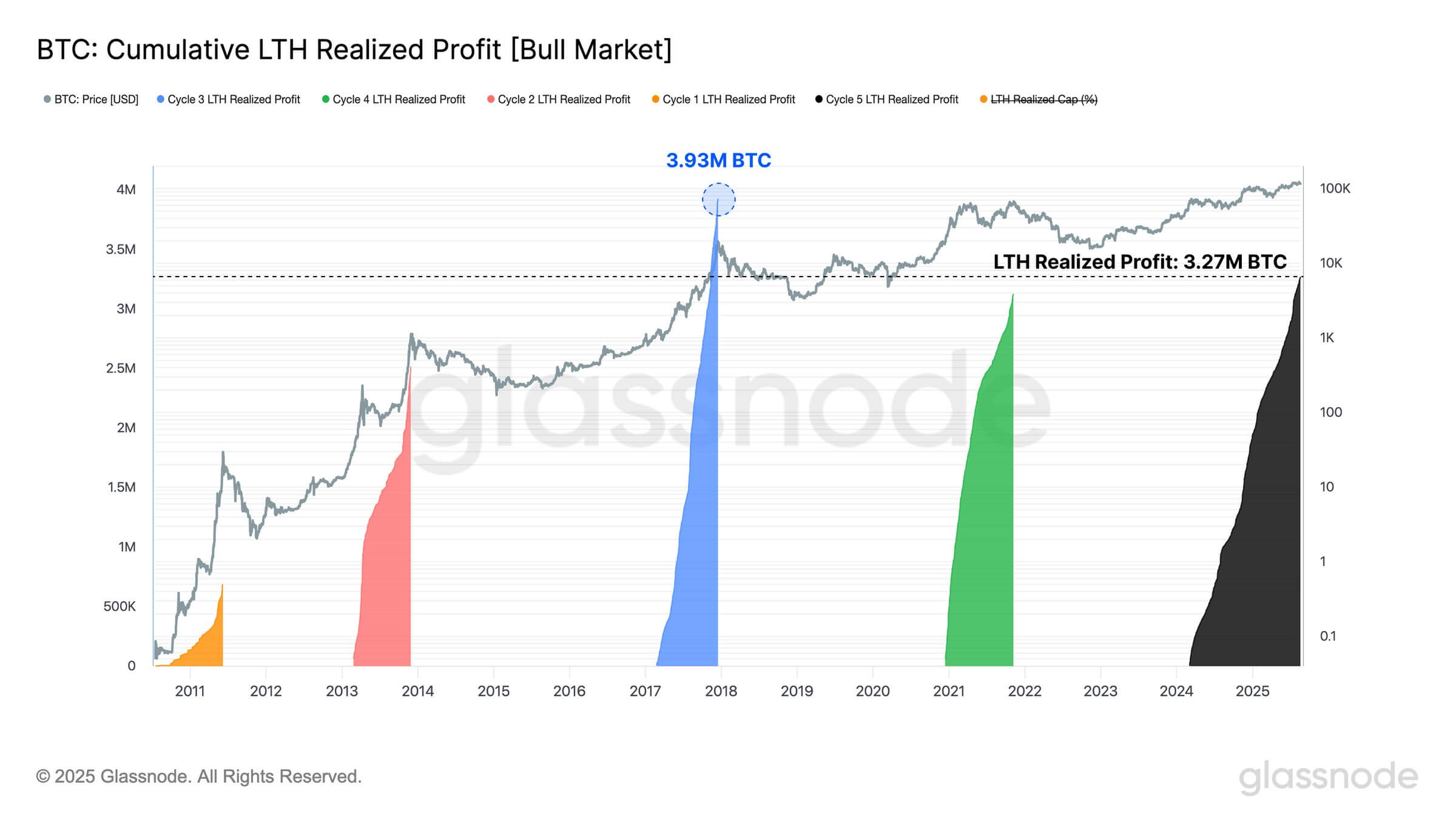

Bitcoin traders with long-term positions are realizing earnings at ranges not seen in almost a decade, in line with blockchain analytics agency Glassnode.

Knowledge from the agency reveals that long-term holders have realized roughly 2.37 million BTC in revenue throughout the ongoing 2024–2025 cycle. At present costs, that equates to about $260.7 billion.

That is the very best realized revenue for the reason that 2016–2017 bull run, when long-term traders booked positive factors of roughly 3.93 million BTC.

Glassnode famous that the sharp enhance in realized positive factors illustrates rising sell-side stress. The agency urged that traders seem to capitalize on Bitcoin’s current rally by decreasing their publicity to the highest crypto after months of sustained upward momentum.

Over the previous yr, Bitcoin has steadily climbed to new highs, peaking at $124,167 on Aug. 14, in line with CryptoSlate’s information. The asset was buying and selling at $110,761 at press time, down almost 11% from that report.

This pullback means that profit-taking has turn into widespread, in keeping with prior cycles, by which robust rallies have been typically adopted by quieter, much less aggressive phases of market exercise.