Cryptocurrencies have gotten a core a part of the economic system in Venezuela as residents flip to digital property to defend themselves from a collapsing foreign money and tighter authorities controls.

From small household shops to massive retail chains, retailers throughout the nation now settle for crypto by means of platforms corresponding to Binance and Airtm. Some companies even use stablecoins to pay workers, whereas universities have begun providing programs devoted to digital property.

“There’s plenty of locations accepting it now,” shopper Victor Sousa, who paid for telephone equipment with USDt (USDT), informed the Monetary Instances. “The plan is to in the future have my financial savings in crypto.”

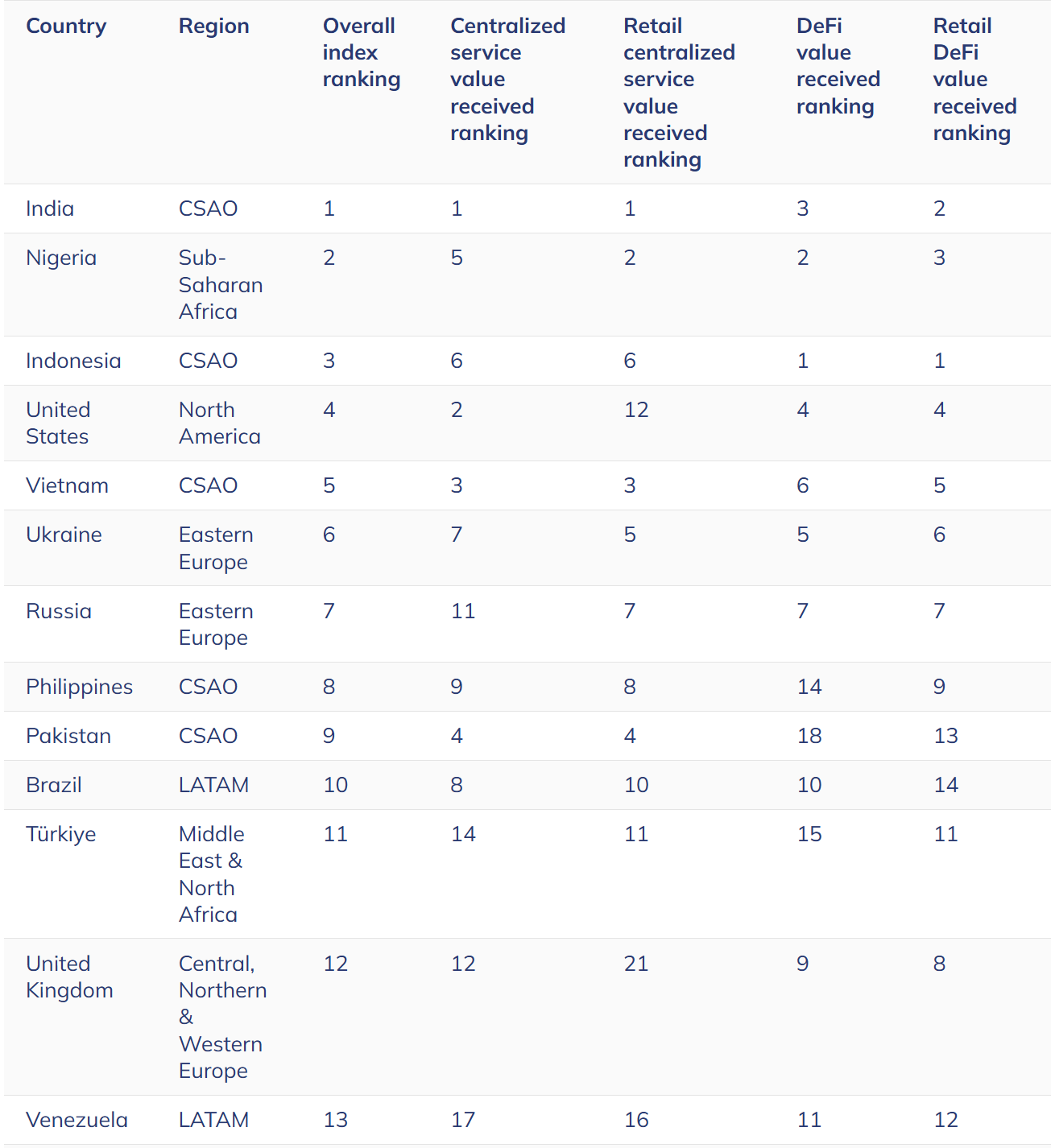

Venezuela ranked thirteenth globally for crypto adoption, based on the Chainalysis 2024 Crypto Adoption Index report, which famous a 110% enhance in utilization within the 12 months.

Associated: Venezuela blocks Binance, X amid presidential election dispute

Bolívar’s crash pushes Venezuelans into crypto

The continued slide of the bolívar foreign money has intensified demand for crypto. For the reason that authorities stopped defending the foreign money in October, it has misplaced greater than 70% of its worth. Inflation reached 229% in Might, based on the Venezuelan Finance Observatory (OVF).

“Venezuelans began utilizing cryptocurrencies out of necessity,” mentioned economist Aarón Olmos. He famous that they face inflation, low wages, overseas foreign money shortages and issue opening financial institution accounts.

Nonetheless, entry will not be all the time easy. With US sanctions on Venezuela’s monetary sector, Binance restricts providers linked to sanctioned banks and people. Connectivity points additionally hinder widespread use. Nonetheless, consultants say the ecosystem is resilient, per the FT report.

The federal government’s stance on crypto stays inconsistent. Venezuela launched its personal digital foreign money, the petro, in 2018, however the venture collapsed final 12 months. The primary alternate regulator was shut down in 2023 following corruption allegations tied to oil-linked transactions.

Cointelegraph reached out to Binance for remark, however had not acquired a response by publication.

Associated: Venezuela opposition’s Bitcoin reserve plan should overcome political turmoil first

Crypto remittances surge in Venezuela

As Cointelegraph reported, crypto remittances have grow to be a vital lifeline for Venezuelans because the nation’s economic system sinks deeper into disaster. In 2023, digital property made up 9% of the $5.4 billion in remittances despatched dwelling, about $461 million.

Households are more and more counting on cryptocurrencies over conventional providers like Western Union, that are weighed down by excessive charges, delays and foreign money shortages.

In the meantime, navy tensions are rising between the US and Venezuela. On Tuesday, Venezuela’s protection minister introduced the deployment of naval vessels and drones to patrol the nation’s Caribbean coast following Washington’s choice to ship an amphibious squadron of three warships, joined later by a missile cruiser and a nuclear-powered submarine, to the area.

The buildup comes after the Trump administration accused President Nicolás Maduro of working with cartels and expanded its pursuit of Venezuelan leaders, doubling the reward for Maduro’s seize to $50 million and providing $25 million for Inside Minister Diosdado Cabello.

Journal: Can privateness survive in US crypto coverage after Roman Storm’s conviction?