US prosecutors have appealed the sentence of time served given to the co-founders of HashFlare, a crypto mining service and alleged $577 million Ponzi scheme.

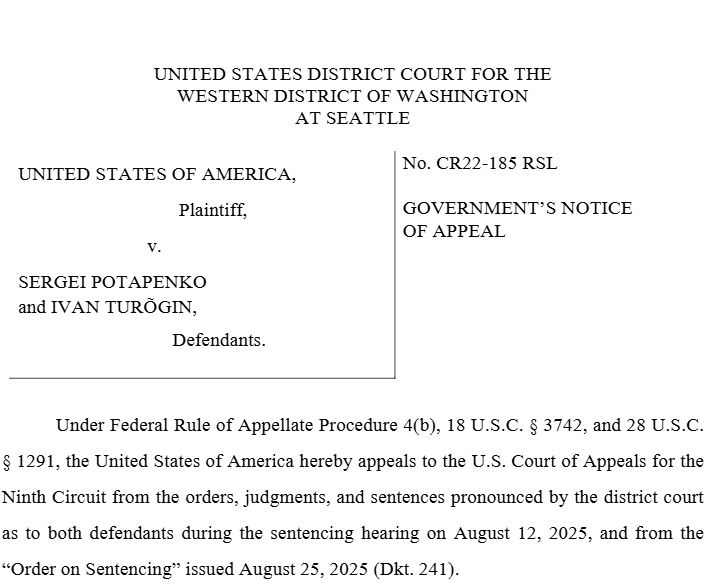

Prosecutors informed a Seattle federal court docket on Tuesday that the federal government was interesting the sentences that it handed down earlier this month to Sergei Potapenko and Ivan Turõgin to the Ninth Circuit.

Potapenko and Turõgin have been in custody for 16 months of their native Estonia after their arrest in October 2022 and have been extradited to the US in Might 2024, the place they pleaded responsible to conspiracy to commit wire fraud.

The federal government had argued that the pair ought to get ten years in jail, saying that the HashFlare scheme triggered critical hurt to victims and was probably the most important fraud the court docket had ever tried. Potapenko and Turõgin argued for time served.

On Aug. 12, Seattle Federal Court docket Decide Robert Lasnik sentenced the pair to time served, a $25,000 wonderful and ordered them to finish 360 hours of group service whereas on supervised launch, which is anticipated to be served in Estonia.

Blockchain crime investigators and corporations have flagged a scarcity of serious penalties and dropped enforcement actions towards dangerous actors as key drivers for crypto crime, because of a perceived lack of penalties for prison acts.

HashFlare founders say victims have been repaid

Prosecutors mentioned that between 2015 and 2019, HashFlare’s gross sales totaled over $577 million, and the co-founders posted pretend dashboards that falsely reported the agency’s mining capability and the returns traders have been making from the scheme.

Present members have been paid out with funds from newer prospects, which the federal government mentioned “proved to be a basic Ponzi scheme.”

Legal professionals for Potapenko and Turõgin argued that regardless of overstating HashFlare’s mining capability, the corporate’s prospects finally acquired crypto price excess of their preliminary investments, primarily from the rise in crypto market costs for the reason that scheme closed.

Additionally they mentioned victims can be paid in full from the greater than $400 million price of property forfeited as a part of Potapenko and Turõgin’s plea deal in February. Nevertheless, prosectors alleged that the information was fabricated, and these arguments have been inaccurate.

Sleuths warn lack of penalties for dangerous actors

Blockchain investigators ZachXBT and Taylor Monahan mentioned in June that crypto court docket instances deserted by US regulators and a perceived lack of serious penalties for dangerous actors working scams have been serving to gas crypto crime.

Specialists informed Cointelegraph final month that, in some instances, regulators have swung from overreach to underreaction, with early enforcement actions usually being harsh; there has now been a swing to the opposite approach, the place there’s little accountability.

Associated: Key participant in $13M crypto Ponzi scheme pleads responsible

Crypto crime losses hit a brand new document within the first half of 2025, beating the earlier document set in 2022 and practically equal to the overall losses from all of 2024.

Different Ponzi operators have been jailed

Former rugby participant Shane Donovan Moore was sentenced to two-and-a-half years behind bars in July for defrauding greater than 40 traders out of $900,000 in a crypto mining Ponzi scheme.

In the meantime, Dwayne Golden was convicted of wire fraud and cash laundering and sentenced to eight years in June for his position in a $40 million crypto Ponzi scheme operated via three digital asset corporations, EmpowerCoin, ECoinPlus, and Jet-Coin.

Journal: ETH ‘god candle,’ $6K subsequent? Coinbase tightens safety: Hodler’s Digest, Aug. 17 – 23