Good Morning, Asia. Here is what’s making information within the markets:

Welcome to Asia Morning Briefing, a every day abstract of high tales throughout U.S. hours and an summary of market strikes and evaluation. For an in depth overview of U.S. markets, see CoinDesk’s Crypto Daybook Americas.

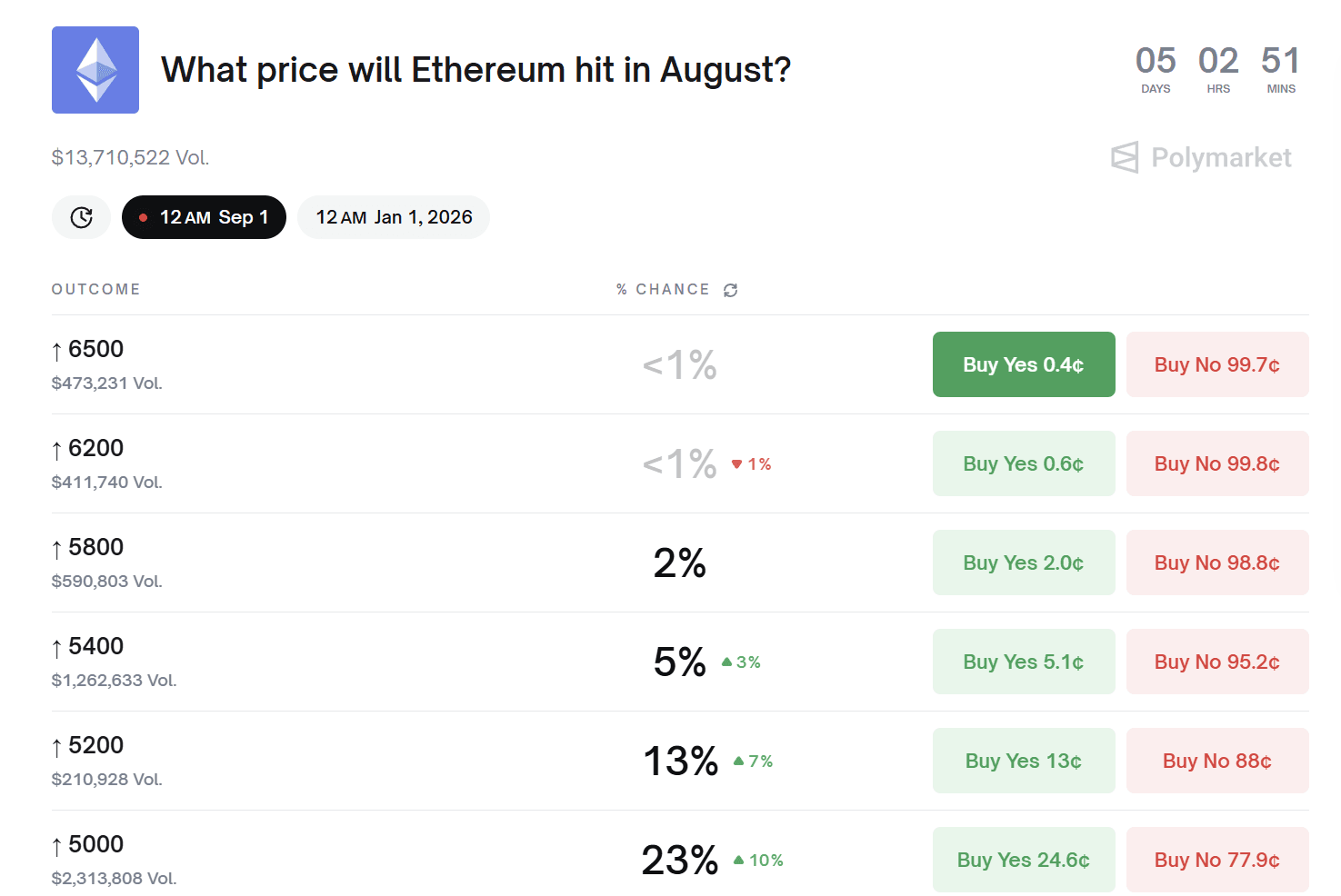

ETH’s probabilities of hitting $5,000 this month climbed to 26% on Polymarket, up from 16% just some days in the past, as merchants priced in momentum from institutional accumulation and shifting BTC-ETH flows.

“Ethereum’s latest power is especially showcased by the extent of flows into it, the place a significant liquidity flooring has been constructed by establishments,” stated March Zheng, Common Accomplice at Bizantine Capital in a notice to CoinDesk.

He added that the ETH/BTC ratio had been sitting at a localized low, making a rebound overdue, and that this cycle is supported by stronger fundamentals comparable to world stablecoin adoption and clearer regulation.

Market rotation added additional coloration to the rally, Enflux, a market maker, wrote to CoinDesk in a notice. XRP joined ETH in main the majors, whereas capital chased new narratives, comparable to CRO, following Trump Media’s “Cronos Treasury” initiative.

Hyperliquid’s surge in buying and selling quantity, surpassing Robinhood in July, highlighted how retail hypothesis is tilting towards native infrastructure, with its $HYPE token gaining double digits. These undercurrents recommend that what issues most just isn’t the day’s closing print however the structural reallocation of liquidity throughout the crypto panorama, Enflux famous.

Liquidity is being redistributed throughout the crypto panorama, market observers say, however ETH’s function on the heart is bolstered by institutional conviction.

“Markets react to headlines, however longer-term worth is pushed by fundamentals,” Gracie Lin, CEO of OKX Singapore, instructed CoinDesk in a notice.

“That is why Ethereum continues to indicate power by means of actual utility — at the same time as costs pull again, large institutional strikes like BitMine’s ETH accumulation show there’s deep conviction in its function on the core of crypto,” Lin continued. “With new macro information just like the US PCE coming in later this week, we’re about to see how that conviction holds up amidst volatility.”

ETH has outpaced BTC by a large margin, gaining 20% over the previous 30 days in comparison with bitcoin’s 6% decline, market information exhibits, and buying and selling volumes present ETH commanding extra liquidity than BTC regardless of its smaller market cap.

Market Actions

BTC: Bitcoin is buying and selling at $111,733.63, however weak on-chain exercise and $940M in liquidations sign fading momentum.

ETH: Ether is buying and selling at $4,598.67, under its latest all-time excessive of $4,946, as institutional inflows energy the rally whereas DeFi exercise and TVL stay weaker than in previous cycles.

Gold: Gold is buying and selling at $3,410.80, holding above $3,400 as Powell’s rate-cut hints, Trump’s Fed shake-up, and file central financial institution shopping for gasoline safe-haven demand with merchants eyeing a run towards $3,500.

Nikkei 225: Asia-Pacific markets largely fell Wednesday regardless of Wall Road’s in a single day beneficial properties, with Japan’s Nikkei 225 down 0.17%.

S&P 500: The S&P 500 rose 0.41% to six,465.94 on Tuesday as buyers seemed previous Trump’s removing of Fed Governor Lisa Prepare dinner and awaited Nvidia’s earnings.

Elsewhere in Crypto:

- Trump-backed World Liberty Token Might Decimate Retail Traders, Compass Level Warns (Decrypt)

- U.S. CFTC, a Prime Crypto Watchdog, Is About to Shrink Fee to Solely One Member (CoinDesk)

- Bitcoin Miner Hut 8 Surges 10% on 1.5GW Enlargement Plans (CoinDesk)