Key takeaways:

-

Ether rallied 5% after a “Monday lure,” however leverage threat is rising with Binance’s ELR at report highs.

-

$1.65 billion in stablecoin inflows and 208,000 ETH withdrawals present sturdy accumulation.

-

ETH holding $4,700 retains the door open to $5,000, whereas shedding it dangers a sharper correction.

Ether (ETH) is displaying resilience towards Bitcoin (BTC) after shaking off the most recent “Monday Lure,” a recurring sample the place leveraged longs face steep liquidations in the beginning of the week. Whereas ETH rallied as a lot as 5% on Tuesday, BTC’s return has been restricted to only one%.

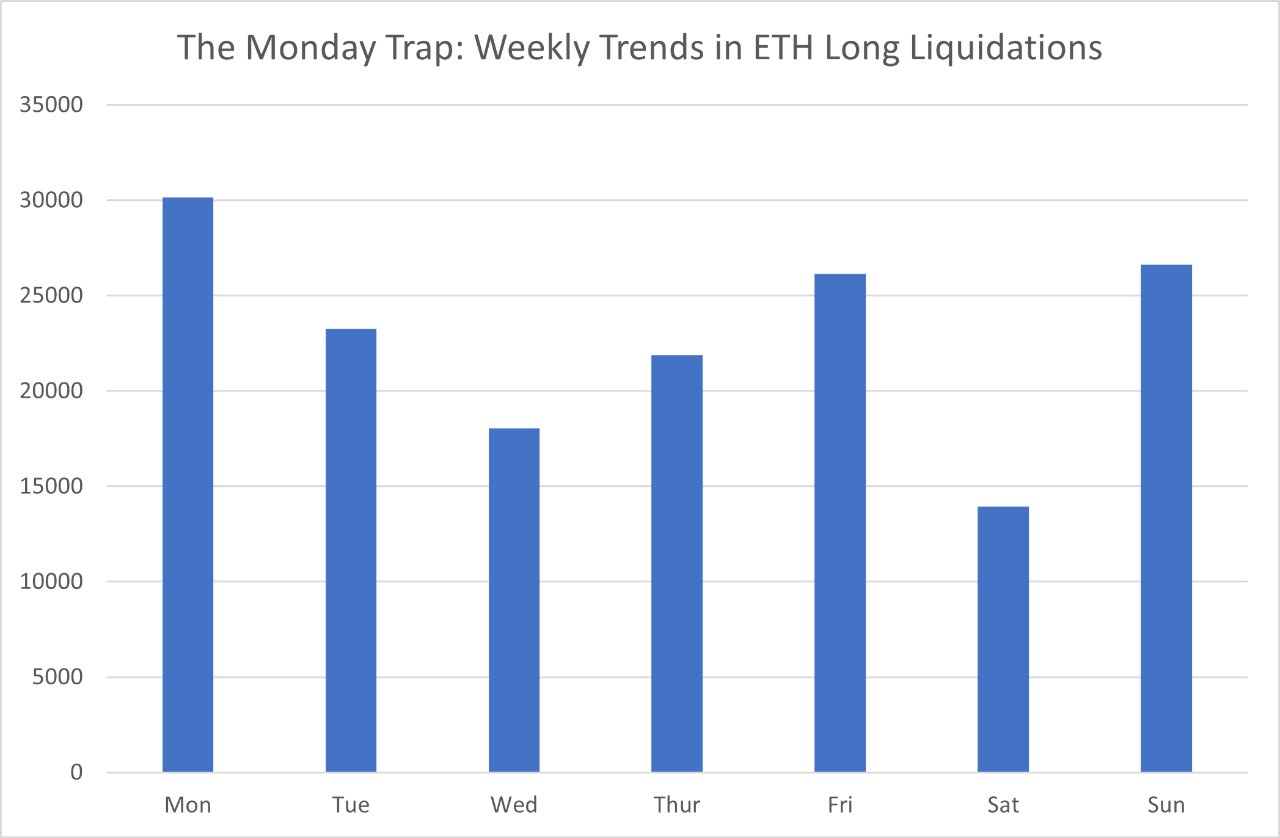

Information reveals that Monday has persistently recorded the very best lengthy liquidations, with spikes topping 300,000 ETH throughout April and June’s drawdowns. The sample underscores how weekend optimism flips into losses as soon as liquidity returns early within the week.

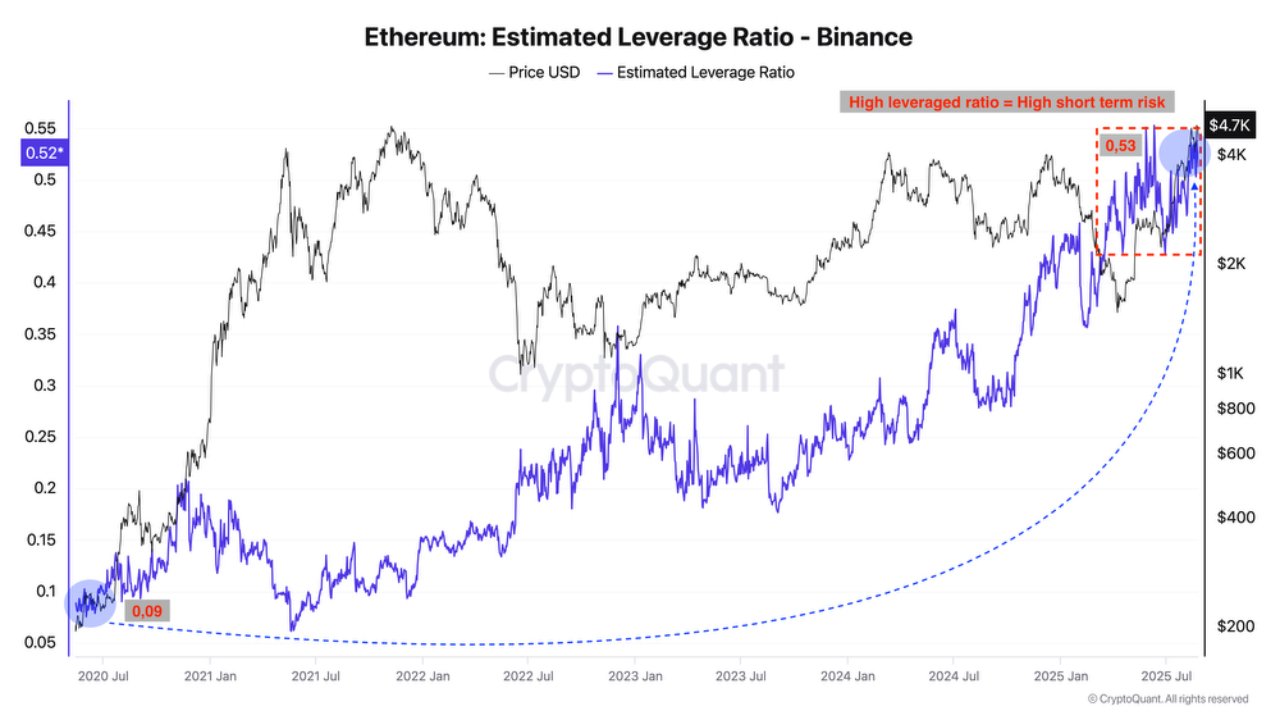

Regardless of the restoration, ETH’s derivatives panorama alerts overheating. Binance’s Estimated Leverage Ratio (ELR) on ETH has surged to a report 0.53, up dramatically from simply 0.09 in mid-2020.

ELR tracks the ratio of open curiosity to change reserves, providing a gauge of how closely merchants are utilizing leverage. Increased values counsel extreme optimism and a larger threat of pressured liquidations.

With ETH open curiosity hitting a brand new all-time excessive of $70 billion on Aug. 22, such extremes sign short-term threat, as extreme positions usually precede sharp deleveraging occasions that flush out merchants earlier than the subsequent leg greater.

But, the spot flows paint a contrasting image of energy. Crypto analyst Amr Taha factors out that Binance exhibited over $1.65 billion in stablecoin deposits this month, marking the second such surge above $1.5 billion in August.

These inflows sign recent liquidity making ready to enter the market. In the meantime, Ether withdrawals from Binance totaled practically 208,000 ETH, i.e., $1 billion, throughout Aug. 24–25, suggesting traders are transferring belongings into chilly storage, decreasing sell-side strain and reinforcing long-term bullish positioning.

The mixture of rising leverage and institutional accumulation leaves ETH at a crossroads. Whereas liquidity inflows and change outflows tilt bullish, excessive leverage heightens the danger of near-term volatility.

Associated: SharpLink added $252M ETH final week, $200M battle chest left

Ether bulls should reclaim $4,700 to regain management

Ether rallied strongly on Tuesday, climbing to $4,579 after absorbing liquidity from a each day order block and retesting long-term help at $4,350. Momentum on decrease timeframes stays constructive, however sustainability is essential for continuation.

On the mid-term chart, worth motion is at the moment filling a bearish truthful worth hole between $4,600 and $4,450, with threat of extension towards the $4,000 degree if promoting strain persists.

For this hole to be invalidated, ETH should reclaim prior equal lows close to $4,662 and safe a decisive each day shut above $4,700. Such a transfer would align each decrease and better timeframe constructions, restoring bullish momentum and opening the trail towards $5,000.

Conversely, sustained consolidation under $4,700 would counsel the rally is being pushed primarily by brief protecting, the place shorts closing their positions generate momentary upward strain, whereas sellers search to re-enter at greater ranges to drive worth decrease.

Failure to reclaim $4,700 retains ETH locked in a decisive vary between $4,700 and $4,350, with a break beneath $4,350 probably triggering a deeper correction in keeping with seasonality and a possible market construction shift.

Till then, $4,700 stays the pivot separating a correction from a renewed bullish leg.

Associated: Worth predictions 8/25: SPX, DXY, BTC, ETH, XRP, BNB, SOL, DOGE, ADA, LINK

This text doesn’t include funding recommendation or suggestions. Each funding and buying and selling transfer includes threat, and readers ought to conduct their very own analysis when making a choice.