Altcoins bounced again sharply on Tuesday after a steep sell-off over the prior 48 hours, with merchants seizing decrease costs as a possibility to re-enter the market.

XRP led the restoration, gaining 6% over the previous 24 hours. Solana (SOL) and dogecoin (DOGE) every climbed about 4.5%, whereas ethereum (ETH) added 5% over the identical interval. Open curiosity throughout these tokens additionally ticked increased, signaling renewed speculative exercise. XRP as soon as once more stood out, with its open curiosity rising 4.2% previously day.

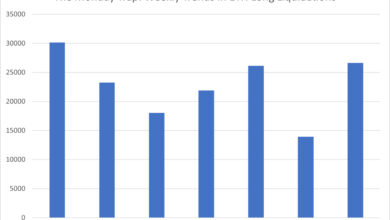

The uptick comes as CME Group introduced earlier Tuesday that its crypto futures suite surpassed $30 billion in notional open curiosity for the primary time. SOL and XRP futures every crossed the $1 billion mark, with XRP changing into the quickest contract to achieve that degree—doing so in simply over three months. Analysts see this milestone as proof of market maturity and rising institutional participation in crypto derivatives, to not point out the kind of curiosity a spot XRP ETF may generate.

“Assume individuals is perhaps underestimating demand for spot XRP ETFs,” wrote ETF skilled Nate Geraci.

The broader market additionally strengthened, with the CoinDesk 20 Index (CD20) up 3.6% on Tuesday. Bitcoin (BTC) lagged behind, gaining solely about 1%, however did cross again over the $111,000 mark after dropping under $109,000 at one level hours earlier.

Each bitcoin and ether hit file highs earlier this month, lifted by expectations of financial easing and elevated institutional demand. But sentiment could also be operating too scorching, in keeping with blockchain analytics agency Santiment. In a report revealed Sunday, the agency warned that optimism round a possible Federal Reserve fee minimize in September has reached ranges that always precede corrections.

“Whereas optimism a few fee minimize is fueling the market, social knowledge suggests warning is warranted,” Santiment stated, pointing to a spike in on-line chatter across the Fed resolution. The agency cautioned that if expectations of easing fail to materialize, the market might see a “swift correction.”

Merchants are actually watching Friday’s launch of the Private Consumption Expenditures (PCE) Worth Index as a key sign for the Fed’s subsequent transfer.