StanChart says Ethereum treasury corporations are undervalued, revises ETH forecast to $7,500 by year-end

Normal Chartered stated Ethereum (ETH) and the businesses holding it of their treasuries stay undervalued, even because the second-largest crypto surged to a file $4,955 on Aug. 25.

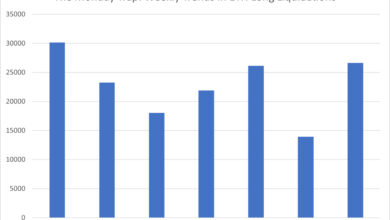

Geoffrey Kendrick, the financial institution’s head of crypto analysis, stated treasury companies and exchange-traded funds have absorbed almost 5% of all Ethereum in circulation since June. Treasury corporations purchased 2.6%, whereas ETFs added 2.3%.

Mixed, that 4.9% stake represents one of many quickest accumulation streaks in crypto historical past, surpassing the pace at which Bitcoin (BTC) treasuries and ETFs acquired 2% of provide in late 2024.

Constructing towards 10%

Kendrick stated the latest shopping for spree marks the early part of a broader accumulation cycle. In a July observe, he projected that treasury companies may finally management 10% of all ether excellent.

Kendrick argued that with corporations corresponding to BitMINE publicly focusing on 5% possession, the purpose seems attainable. He famous that this would depart one other 7.4% of provide nonetheless in play, creating sturdy tailwinds for Ethereum’s value.

The sharp tempo of accumulation emphasizes the rising function of institutional buildings in crypto markets. Kendrick stated the alignment of ETF flows with treasury purchases highlights a suggestions loop that might tighten provide additional and assist increased costs.

Kendrick revised the lender’s earlier forecasts and stated Ethereum may climb to $7,500 by year-end. He additionally referred to as the most recent pullback a “nice entry level” for traders positioning forward of additional inflows.

Valuation gaps

Whereas shopping for strain has lifted costs, valuations of ether-holding companies have moved in the other way.

Internet asset worth (NAV) multiples for SharpLink and BitMINE, the 2 most established ETH treasury corporations, have dropped beneath these of Technique, the most important Bitcoin treasury agency.

Kendrick stated the low cost is unjustified provided that ETH treasuries can seize a 3% staking return, whereas Technique generates no such earnings on its Bitcoin stash.

He additionally pointed to SBET’s latest plan to repurchase shares if its NAV a number of falls beneath 1.0, saying that creates a tough flooring for valuations.