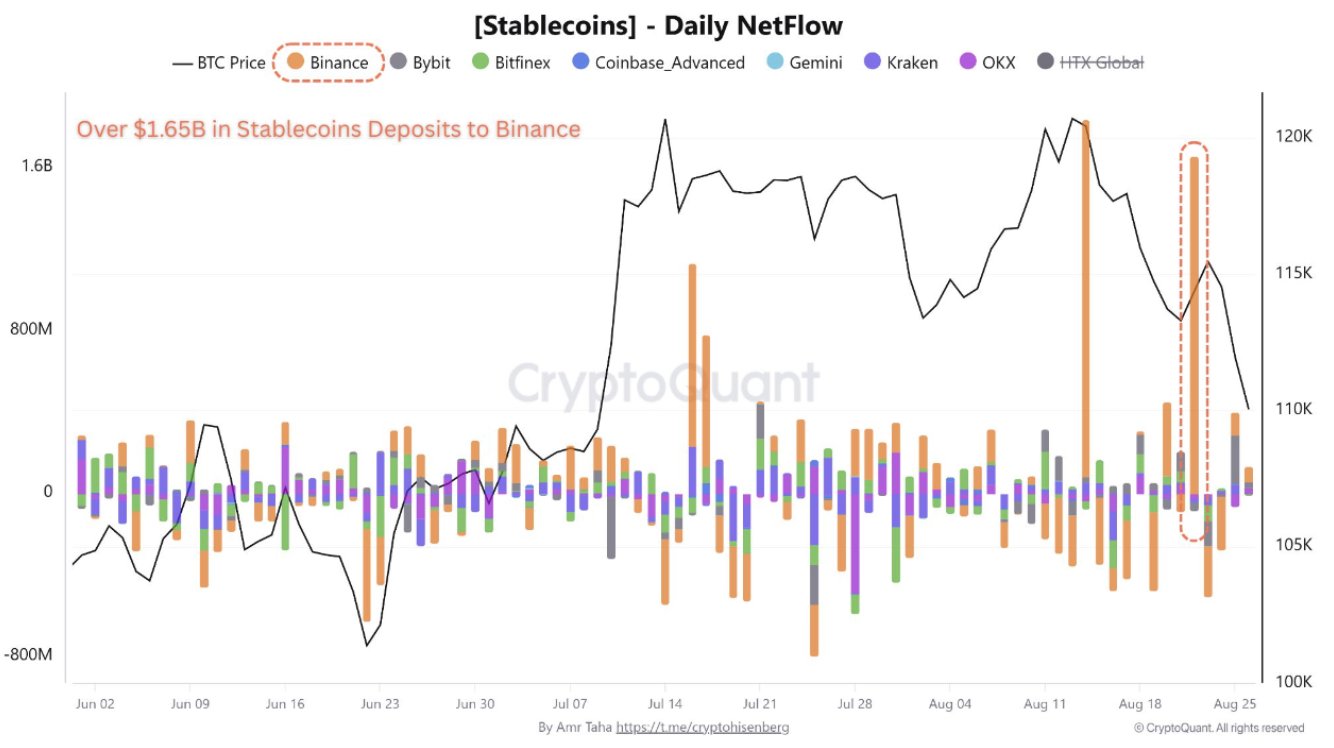

Customers of the Binance cryptocurrency change deposited $1.65 billion in stablecoins, a big influx typically seen as a precursor to renewed demand for spot cryptocurrencies following the current market sell-off.

The deposit coincided with practically $1 billion in Ether (ETH) withdrawals from Binance, in accordance with onchain analytics supplier CryptoQuant. It additionally marked the second time this month that web stablecoin deposits on the change exceeded $1.5 billion, “underscoring a renewed wave of capital getting into the spot market,” wrote CryptoQuant’s Amr Taha.

Binance, the world’s largest cryptocurrency change by buying and selling quantity, is intently watched for indicators of broader market shifts. On Tuesday, it processed greater than $29.5 billion in trades, practically six occasions the quantity dealt with by runner-up Bybit, in accordance with CoinMarketCap.

Stablecoins are the first funding supply for cryptocurrency merchants, and their motion onto exchanges sometimes alerts readiness to buy digital property.

The timing was notable on Tuesday, as crypto markets prolonged their early-week droop: Bitcoin (BTC) and Ether gave again Friday’s positive aspects, which had been fueled by feedback from Federal Reserve Chair Jerome Powell signaling readiness to chop rates of interest in September.

The current market turbulence stemmed from a wave of lengthy Bitcoin liquidations after a significant sell-off over the weekend, when a whale offloaded 24,000 BTC on Sunday, sparking heavy promoting strain.

The BTC value briefly dipped under $109,000 on Tuesday, in accordance with TradingView knowledge.

Associated: Bitcoin late longs worn out as sub-$110K BTC value calls develop louder

Greatest Bitcoin-M2 divergence in two years

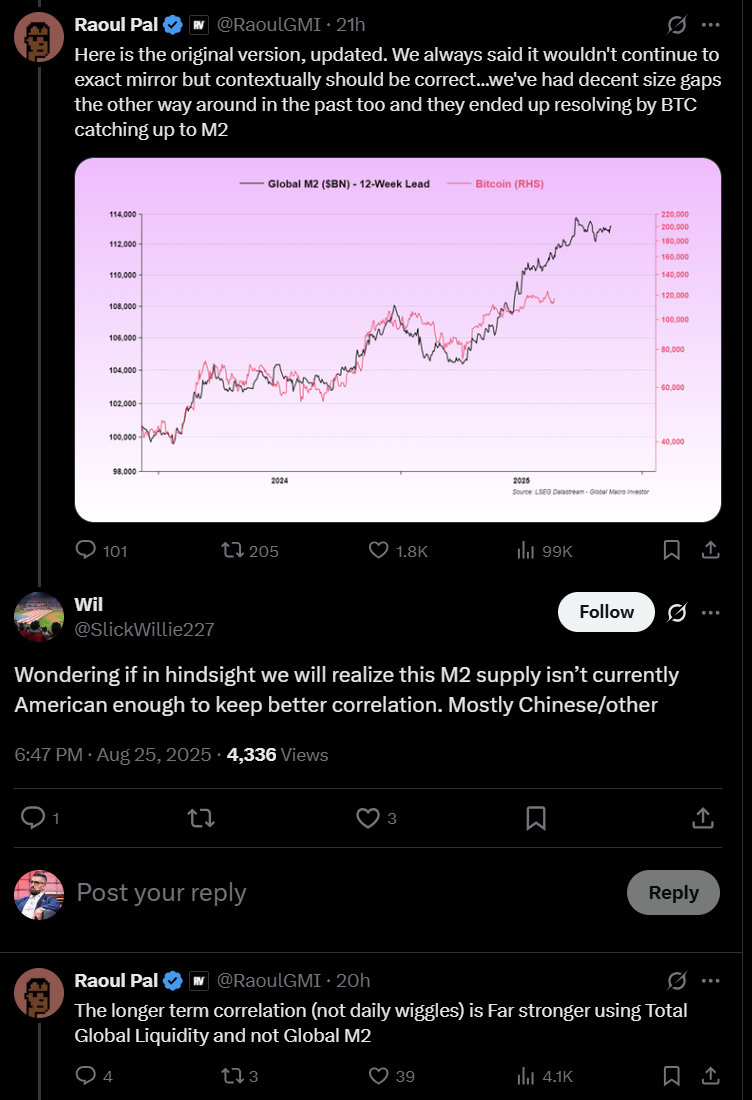

Bitcoin’s early-week droop stood out because it marked the sharpest deviation in two years from its sometimes shut alignment with the worldwide M2 cash provide — a key measure of broad cash circulating within the economic system.

For the reason that pandemic, Bitcoin has proven a powerful correlation with international M2, normally with a two- to three-month lag, offering merchants with a comparatively dependable information to short-term value traits.

That mentioned, as Actual Imaginative and prescient founder Raoul Pal — one of many first to spotlight the connection — famous, the longer-term correlation is stronger when measured towards whole international liquidity, relatively than M2 alone.

One other driver of Bitcoin’s current volatility has been the regular outflow from US spot exchange-traded funds (ETFs). In keeping with CoinShares, Bitcoin ETFs recorded over $1 billion in outflows final week.

The silver lining got here on Monday, when the merchandise noticed their first day of web inflows in six classes.

Journal: Stablecoins in Japan and China, India mulls crypto tax modifications: Asia Specific