XRP futures turned the quickest contract in CME Group historical past to cross $1 billion in open curiosity (OI), attaining the milestone in simply over three months.

CME Group reported its crypto futures suite surpassed $30 billion in notional open curiosity for the primary time, with XRP and Solana futures every crossing the $1 billion threshold. Moreover, Ethereum reached the OI file of $10.5 billion.

The derivatives change acknowledged:

“Our Crypto futures suite simply surpassed $30B in notional open curiosity for the primary time ever. Our SOL and XRP futures, together with ETH choices, every crossed $1B in OI, with XRP being the fastest-ever contract to take action, hitting the mark in simply over 3 months.”

Sturdy buying and selling exercise

XRP futures recorded their largest every day quantity since July 15 on Aug. 25, with 7,533 contracts traded and over $1 billion in complete quantity, in accordance with CME knowledge.

The exercise demonstrates urge for food for regulated XRP publicity via CME’s CFTC-supervised platform.

The milestone comes as conventional finance corporations search cryptocurrency derivatives merchandise. CME launched XRP futures in Could 2025, offering establishments with standardized contracts settling to the CME CF XRP-Greenback Reference Fee.

Nate Geraci, president of NovaDius Wealth, related the futures exercise to potential spot ETF demand on Aug. 26.

He stated:

“CME Group says XRP futures contracts have crossed over $1 billion in open curiosity… Quickest-ever contract to take action (took simply over 3mos). There’s already $800+mil in futures-based xrp ETFs. Suppose individuals is likely to be underestimating demand for spot xrp ETFs.”

After the CME XRP futures launch on Could 19, Geraci famous that spot ETFs had been solely a matter of time. The affirmation is probably going as a result of analysts view regulated futures markets as a vital requirement for spot crypto ETF approvals.

A number of asset managers have filed for spot XRP ETFs with the SEC, together with purposes from 21Shares, Bitwise, Canary Capital, and Grayscale.

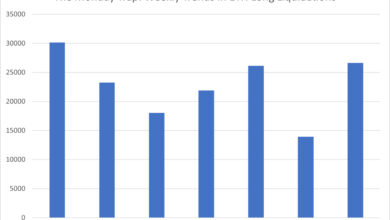

CME’s crypto derivatives now embrace Bitcoin, Ethereum, Solana, and XRP. BTC futures account for the biggest share, with over $16 billion in open curiosity, whereas Ethereum futures maintain roughly $10.5 billion. Moreover, each XRP and Solana just lately joined the billion-dollar membership.

The $30 billion milestone represents institutional adoption of crypto derivatives as portfolio administration instruments.