It’s now clear to most buyers, particularly those that have survived a number of crypto winters, that Bitcoin strikes in cycles of about 4 years. Many argued till 2022 that Bitcoin would at all times stay above its earlier highs.

This occurred in 2011, in 2014 and in 2018. In 2022, nevertheless, the value of Bitcoin fell, as a result of collapse of FTX, to $15,000, under the fateful threshold of $20,000, which was briefly reached, albeit for a couple of days in December 2017.

Whereas everyone seems to be attempting to foretell what the utmost worth of Bitcoin might be on this cycle, which is more likely to finish in late October 2025, the analysis division at Diaman Companions has tried to know easy methods to estimate what the minimal worth of Bitcoin might be in 2026, ought to the crypto winter materialize within the coming months. Many specialists speculate that Bitcoin’s cyclical part is over and that we are actually coming into a brand new, extra ‘mature’ part of extra regular development.

There are numerous causes to help this thesis. ETFs in America are elevating some huge cash, institutional demand, rising treasury firms, and pension funds that may now purchase Bitcoin (at the least in the USA).

Sustaining a skeptical engineering perspective, nevertheless, one tends to imagine that Bitcoin cycles will proceed, albeit with much less depth, for years. On the very least, from a danger administration perspective, the likelihood {that a} crypto winter might occur can now not be ignored.

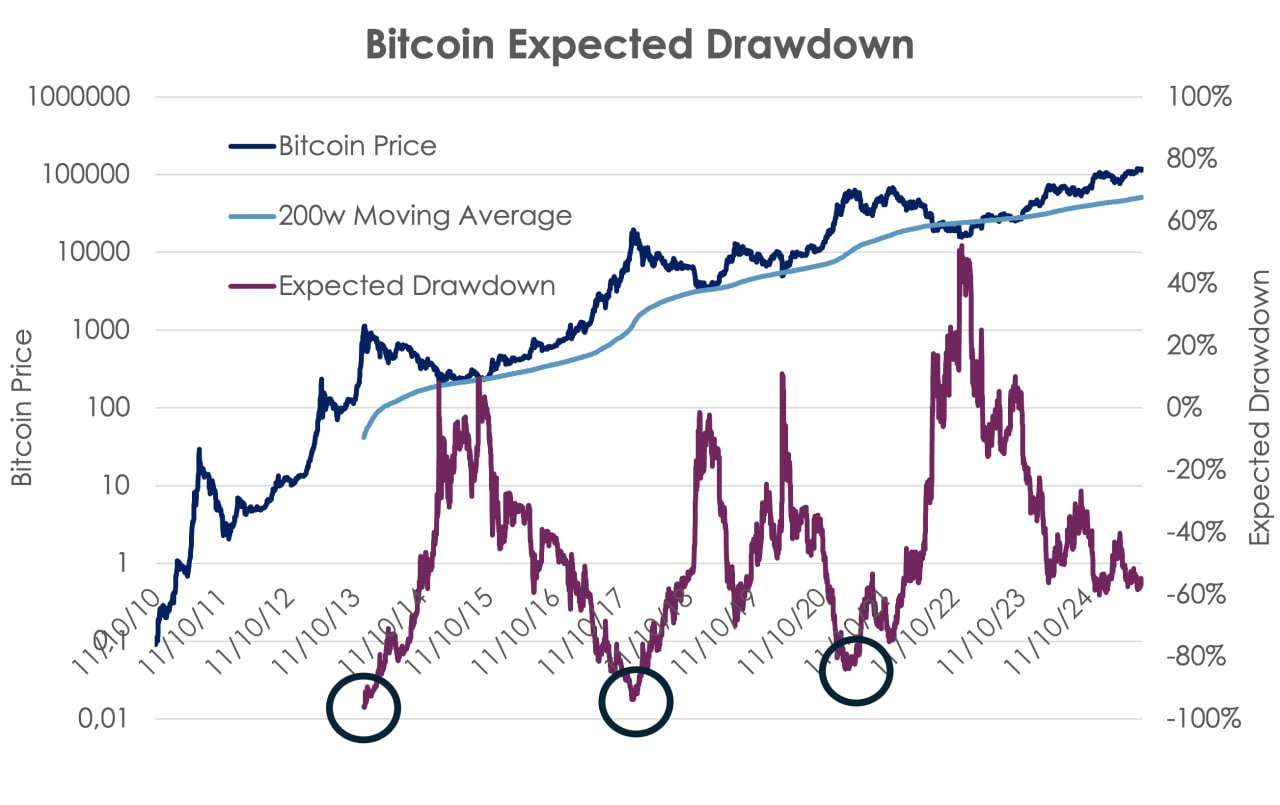

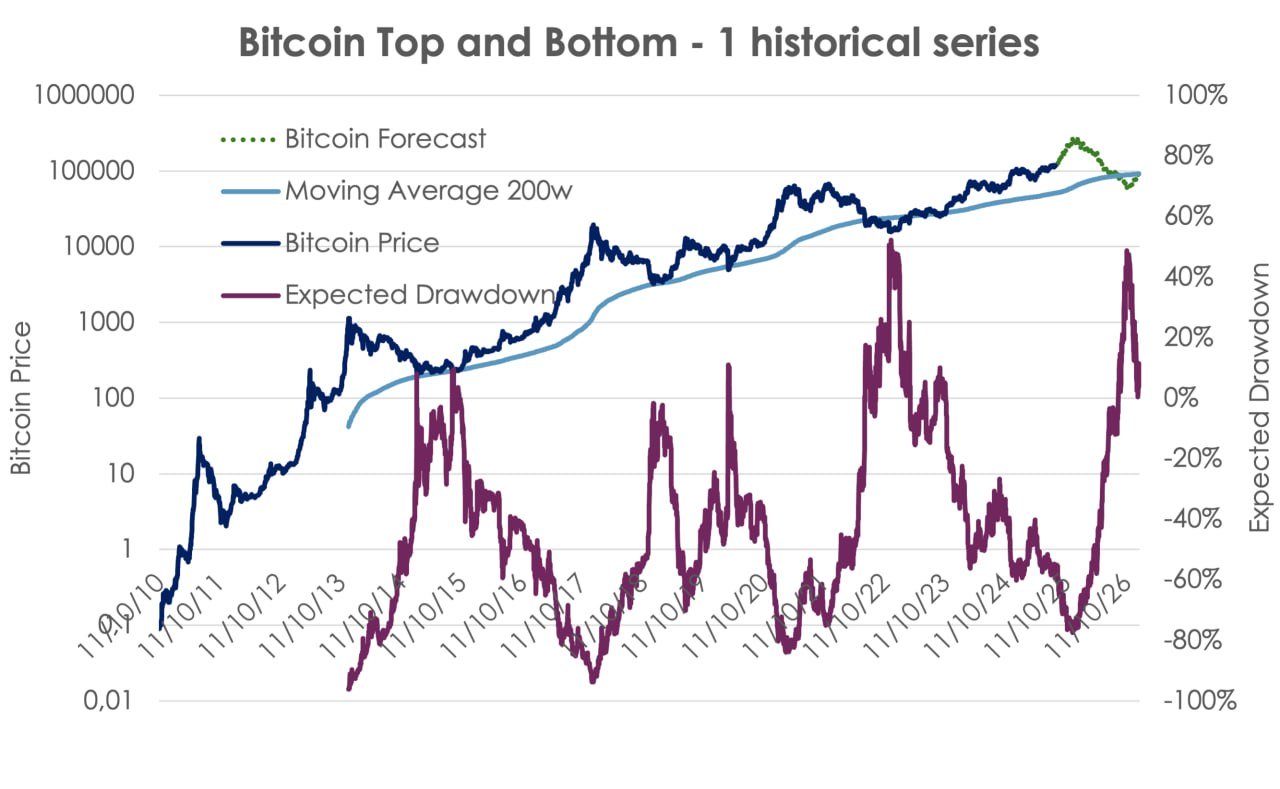

It needs to be famous that the concept of utilizing the strong 200-week common mannequin is an idea from Adam Again that’s well-trusted.

The chart reveals that, besides in 2022, the place, as talked about above, costs fell greater than anticipated as a result of FTX impact, the 200-week transferring common supplied wonderful help for the value decline. In the identical chart, the crimson line represents the proportion distinction between the value of Bitcoin and the typical itself, following the concept that the 200-week common represents a resistance, a type of most drawdown to be anticipated within the occasion of a crypto winter.

An attentive observer may recommend that going from the excessive to the low takes a while. Throughout this time, the typical continues to develop, so this ratio overestimates the potential loss, and that is true; if we have a look at as we speak’s values, the place the typical is above $51,000, maybe a 60% loss is overestimated, and that is completely true.

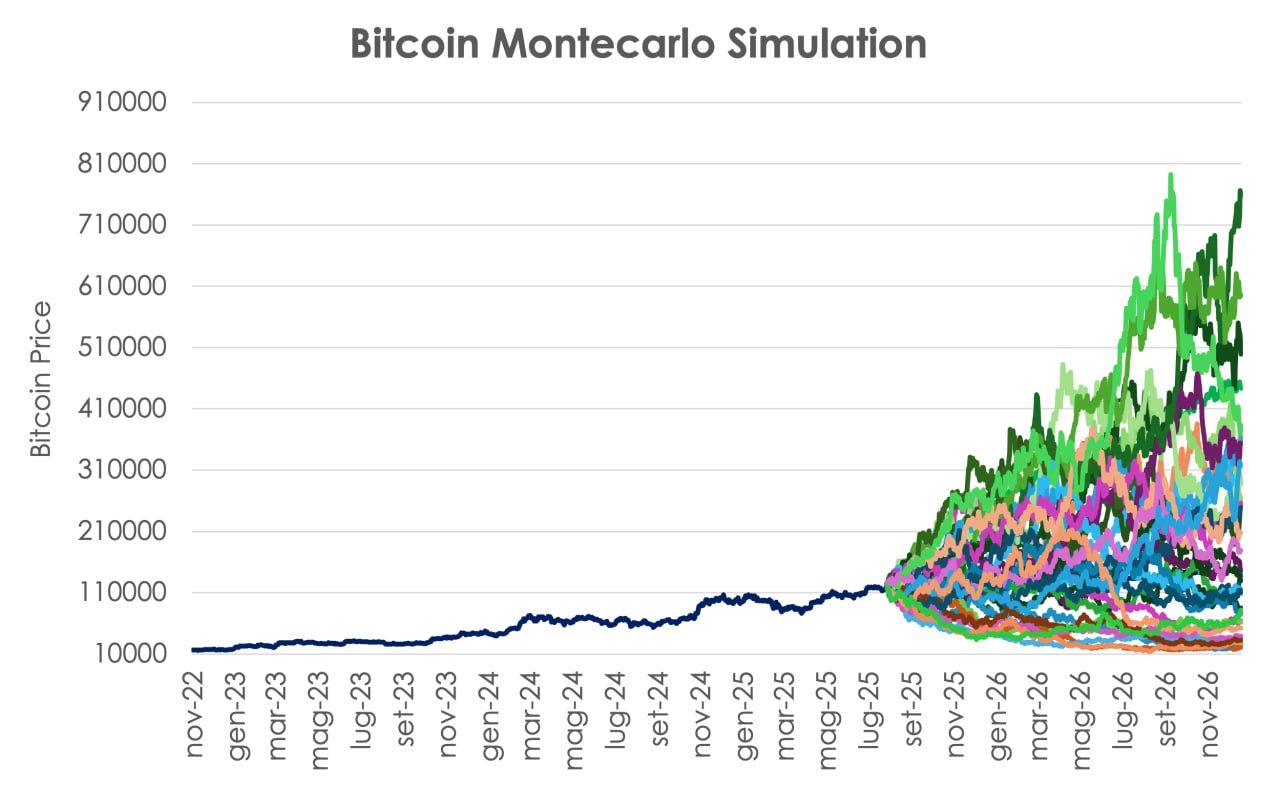

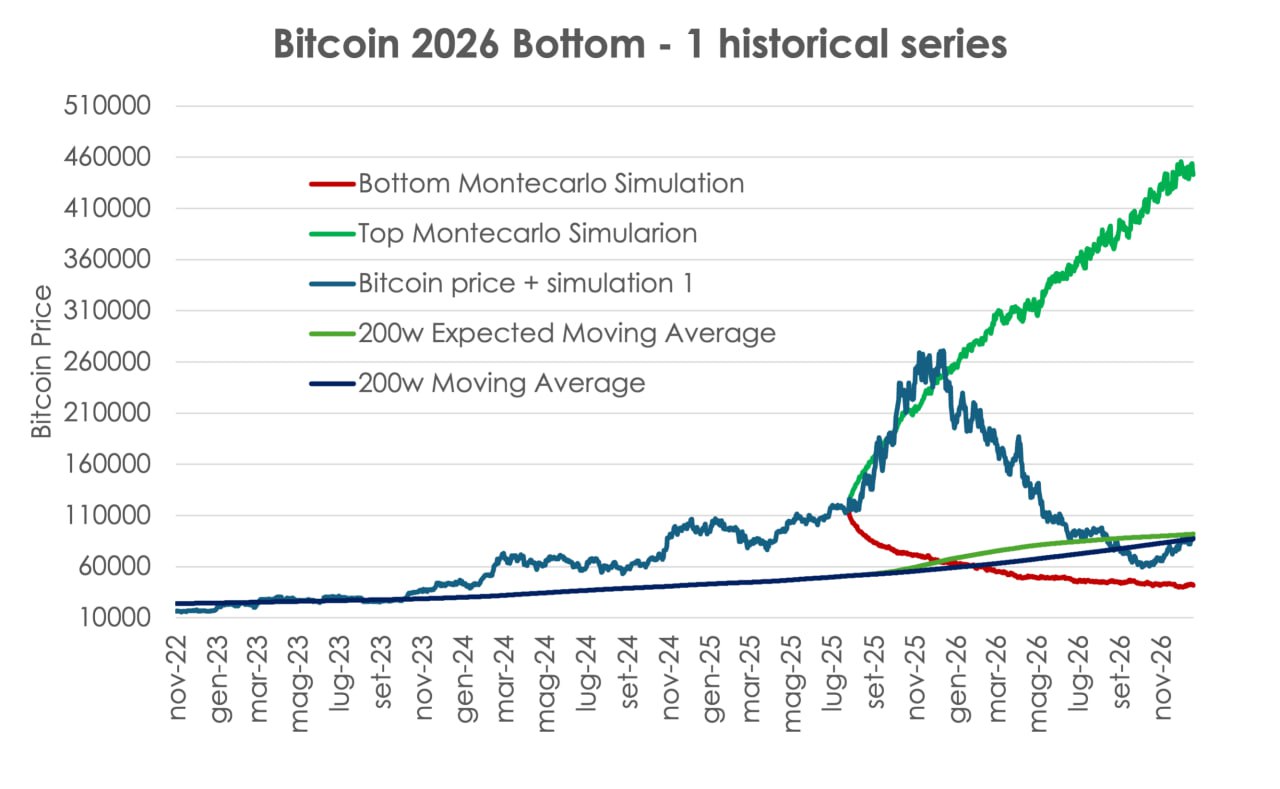

To estimate the place the 200-week common might be towards the tip of 2026, the estimated finish of the crypto winter (if there’s one) and if it follows the amplitude of earlier cycles, Diaman Companions carried out a Monte Carlo simulation to estimate each the chance {that a} historic sequence may very well be at a sure worth, but additionally to estimate a spread of values by which the 200-week common needs to be in the meanwhile when there’s the very best chance, in response to earlier Bitcoin cycles, that the value will discover help utilizing it as resistance.

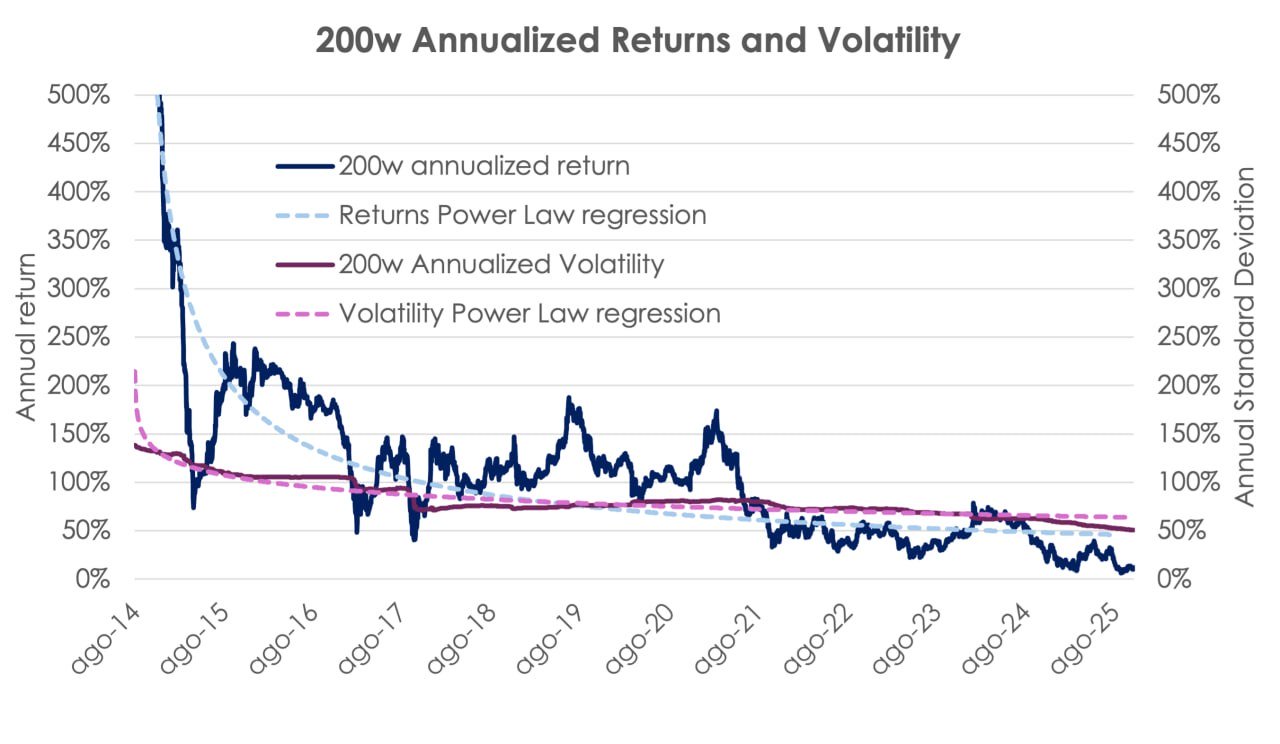

For followers of a Monte Carlo simulation, there’s a mannequin with lowering returns and volatility (reasonably than the traditional static imply and variance fashions) following energy regulation capabilities on annualized returns on 200-week rolling home windows for consistency, as proven within the chart under.

This precaution is important as a result of technical construction of Bitcoin’s returns and volatility, which has decreased considerably over time (which is why we’re satisfied that Bitcoin can now not expertise exponential development, at the least based mostly on common previous returns).

This graph reveals that Bitcoin returns should not exponential, in order Bitcoin grows in capitalization, we are able to anticipate. Certainly, it’s cheap to anticipate a lower in common annual returns and volatility over time. The bigger an asset turns into in capitalization, the extra power is required to maneuver it.

Associated: Bitcoin Q2 dip similarities ‘uncanny’ as Coinbase Premium flips inexperienced

Nonetheless, assuming that there might be no extra drawdowns of -50% or extra with the present volatility is just too unrealistic, so we imagine assessing the potential drawdown of this fourth cycle of Bitcoin’s life is important.

From this simulation, which was carried out by creating 1,000 random historic sequence, it seems that Bitcoin has solely a 5% chance of getting a price under $41,000 in December 2026, which might imply that the value would have exceeded the transferring common, which might be round $60,000 regardless of the value decline. If we take the 5°nd percentile (crimson line within the chart), the goal worth for the tip of the crypto winter cycle, indicated by the 200-week transferring common, could be round $60,000.

If, however, the value of Bitcoin have been to proceed to rise after which fall solely in 2026, or in any case stay according to the Monte Carlo simulations, then the help worth for the cycle low on the finish of 2026 could be over $80,000.

To hypothesize such a case, out of all 1,000 simulations, we took the one representing robust development for Bitcoin within the coming months, adopted by a major decline till virtually the tip of 2026.

If we reverse engineer, ranging from the potential backside of 2026 at $80,000, the desk reveals what the utmost loss may very well be within the subsequent crypto winter based mostly on the utmost that Bitcoin will attain within the coming months. Contemplating that drawdowns within the numerous cycles have at all times been declining (-91%, -82%, -81%, -75%), anticipating -69% may very well be believable, and subsequently, the value goal of $260,000 might not be so unimaginable to attain by 2025.

Then again, if we have a look at the logarithmic chart, a development such because the one hypothesized is much from out of step with earlier cycles. Clearly, this research doesn’t represent funding recommendation, however merely an mental effort to foretell a completely unsure and much from sure future, and the utmost and minimal values are merely based mostly on fashions that won’t essentially come true.

This text is for basic info functions and isn’t meant to be and shouldn’t be taken as authorized or funding recommendation. The views, ideas, and opinions expressed listed below are the writer’s alone and don’t essentially replicate or signify the views and opinions of Cointelegraph.