Key takeaways:

-

XRP open curiosity has dropped 30%, signaling cooling futures exercise.

-

A good worth hole at $2.33–$2.65 is a key demand zone if promoting stress persists.

-

Elevated whale inflows trace at profit-taking, however XRP’s long-term uptrend towards $5 in 2025 stays intact.

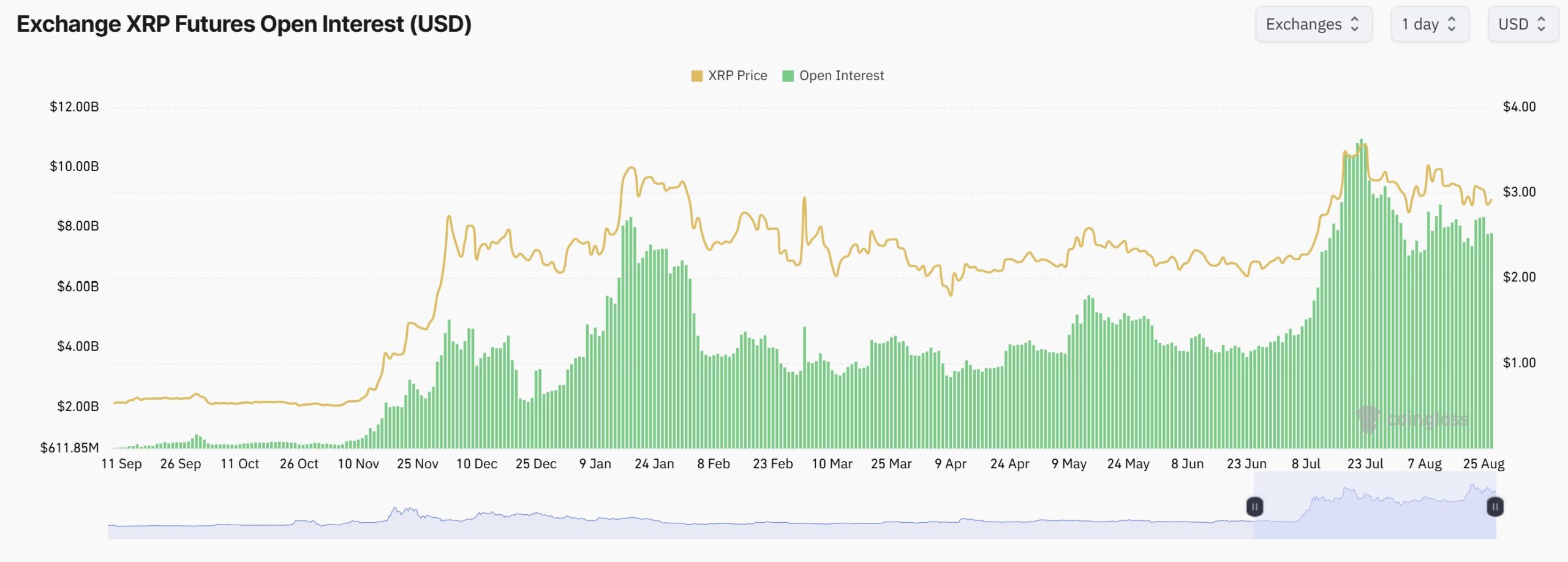

XRP (XRP) futures open curiosity (OI) has decreased by 30% over the previous month, falling to $7.7 billion from $11 billion, whereas costs have retreated from a peak of $3.66. A decline in open curiosity sometimes displays a dip in speculative exercise, signaling both profit-taking or waning conviction amongst leveraged merchants.

The same final result occurred in Q1, with XRP’s OI plummeting to $3 billion from $8.5 billion, a steep 65% drawdown, with spot costs falling greater than 50%. The present setup echoes that development, although with much less severity, suggesting merchants may exhibit accumulation as soon as OI finds a brand new base vary.

Technically, XRP has a each day honest worth hole between $2.33 and $2.65, making this vary a possible demand zone if open curiosity continues to say no. A moderation in OI typically precedes durations of value stabilization or a recent accumulation section, which traditionally has provided enticing re-entry factors earlier than renewed rallies.

Importantly, liquidations stay comparatively subdued. Solely $22 million in longs had been worn out on Monday, and $56 million throughout the 6% pullback on Aug. 14. In comparison with typical washouts in overheated markets, these figures spotlight a managed leverage flush, lowering the danger of cascading promote stress.

Total, whereas the drop in open curiosity does increase warning, it additionally leaves room for a value backside. If XRP holds the $2.33–$2.65 zone, merchants might interpret the cooling leverage backdrop as a possible springboard for the following leg larger, reasonably than a breakdown to new lows.

Associated: XRP value fails to beat $3: Is a breakout nonetheless attainable?

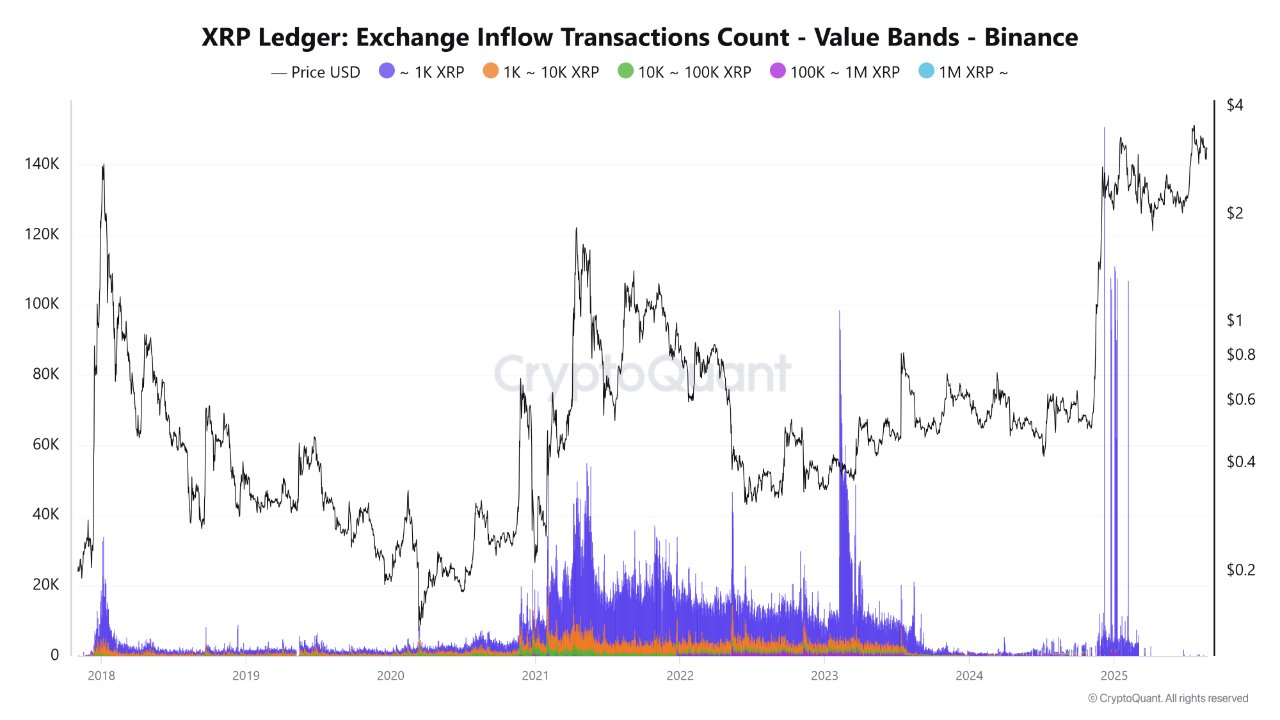

XRP whale inflows preserve value underneath near-term stress

Knowledge from CryptoQuant signifies XRP’s current rally to $3.66 was accompanied by important inflows to exchanges throughout all worth bands, with the biggest exercise coming from whale cohorts holding 100,000 to 1 million XRP. Traditionally, such spikes in change inflows have preceded main market tops, as seen in 2018 above $3, in 2021 close to $1.90, and round $0.90 in 2023, suggesting that giant traders are once more positioning to take income.

At current, XRP is consolidating slightly below $3 whereas inflows stay elevated, highlighting near-term promoting stress. If whales proceed to dump, draw back danger towards $2.6 help zone may materialize.

Nevertheless, a robust protection of $3 would sign resilience and doubtlessly set the stage for an additional bullish push. Structurally, XRP’s broader uptrend stays intact. In contrast with previous cycles, the crypto asset stays in a more healthy technical surroundings, leaving long-term targets above $5 in 2025 nicely inside attain regardless of short-term volatility.

Associated: Gemini flips Coinbase on app retailer after XRP Mastercard launch

This text doesn’t comprise funding recommendation or suggestions. Each funding and buying and selling transfer entails danger, and readers ought to conduct their very own analysis when making a choice.