Key takeaways:

-

$33 trillion in debt will mature throughout superior economies in 2026, forming a refinancing wall that might drain liquidity and weigh on risk-on belongings as borrowing prices stay excessive.

-

International liquidity is projected to peak in late 2025, traditionally a precursor to tighter markets.

-

Secular bull markets since WWII have lasted 18 to 19 years; the present one, beginning in 2009, could stretch into 2028 regardless of mid-cycle turbulence.

A rising variety of crypto market consultants argue that the acquainted four-year Bitcoin cycle is gone. They level to a number of components: 95% of Bitcoin is already mined, roughly 1 million BTC now sits in company treasuries, and macroeconomic and regulatory forces more and more form worth dynamics.

Whether or not the halving cycle has disappeared totally or just made room for different worth drivers, Bitcoin is not a world aside. It strikes with conventional finance, the place cycles in liquidity, refinancing, and longer-term valuations set the tone. Understanding these TradFi rhythms could possibly be as essential for Bitcoin’s future as its personal halving cycle.

The refinancing cycle: A 2026 stress take a look at

International debt reached about $315 trillion in Q1 2024, in response to the Institute of Worldwide Finance. With a mean maturity of seven years, roughly $50 trillion in obligations have to be rolled over annually, factors out the Monetary Occasions.

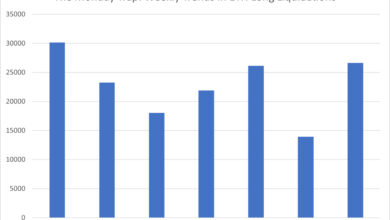

The true take a look at is available in 2026, when the annual “maturity wall” in superior economies will climb practically 20%, topping $33 trillion—virtually thrice these economies’ yearly capital expenditures. Refinancing such volumes at as we speak’s greater charges might pressure governments and firms alike, particularly these with weaker credit score profiles.

This maturity wall could possibly be an actual stress take a look at for risk-on belongings—equities, high-yield bonds, emerging-market debt, and crypto. Large refinancing wants will take in market liquidity, leaving much less room for riskier belongings. With tight funding situations (even when the Fed begins chopping charges this fall, they are going to stay properly above 2010–2021 ranges when a lot of this debt was issued), this units up a squeeze the place capital prices rise, credit score spreads widen, and buyers demand greater threat premiums. Threat-on belongings, which rely closely on ample liquidity and low funding prices, might face valuation stress, lowered inflows, and sharper volatility as refinancing demand crowds out marginal debtors.

For Bitcoin, this case will correspond to the ultimate leg of its four-year cycle — the bear market. With out increasing international liquidity considerably (FT analysts argue that an 8–10% improve is now required yearly to maintain the system secure), the refinancing wall might have severe penalties.

Might liquidity cycles tighten in 2026?

For now, international liquidity retains rising. M2 throughout the 4 largest central banks rose 7% year-to-date, reaching $95 trillion in June 2025. A broader measure from economist Michael Howell (counting short-term credit score liabilities plus family and company money) hit $182.8 trillion in Q2 2025, up $11.4 trillion since end-2024 and about 1.6 occasions international GDP.

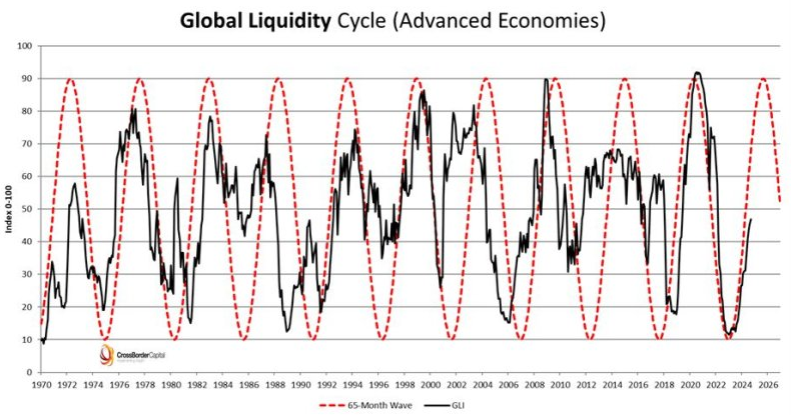

Nevertheless, liquidity additionally strikes in cycles, as proven by Howell’s international liquidity index. It bottomed in December 2022 and now factors to a peak by late 2025. Traditionally, peaks in liquidity usually precede volatility: as funding tightens afterward, cash market charges can spike and buyers begin dumping risk-on belongings.

US financial institution reserves inform an identical story. At $3.2 trillion, reserves stay “ample,” in response to the New York Fed, although balance-sheet reductions goal to convey them right down to a merely “ample” degree.

From this attitude, if liquidity begins contracting in 2026, Bitcoin would probably really feel the impression, deepening any ongoing bear market. But if mounting debt pressures pressure central banks to reverse course and inject liquidity—overriding Howell’s projected liquidity cycle—the ensuing growth might as a substitute present Bitcoin with a recent tailwind.

Associated: BTC bull run over at $111K? 5 issues to know in Bitcoin this week

Secular traits might come to a head in 2028

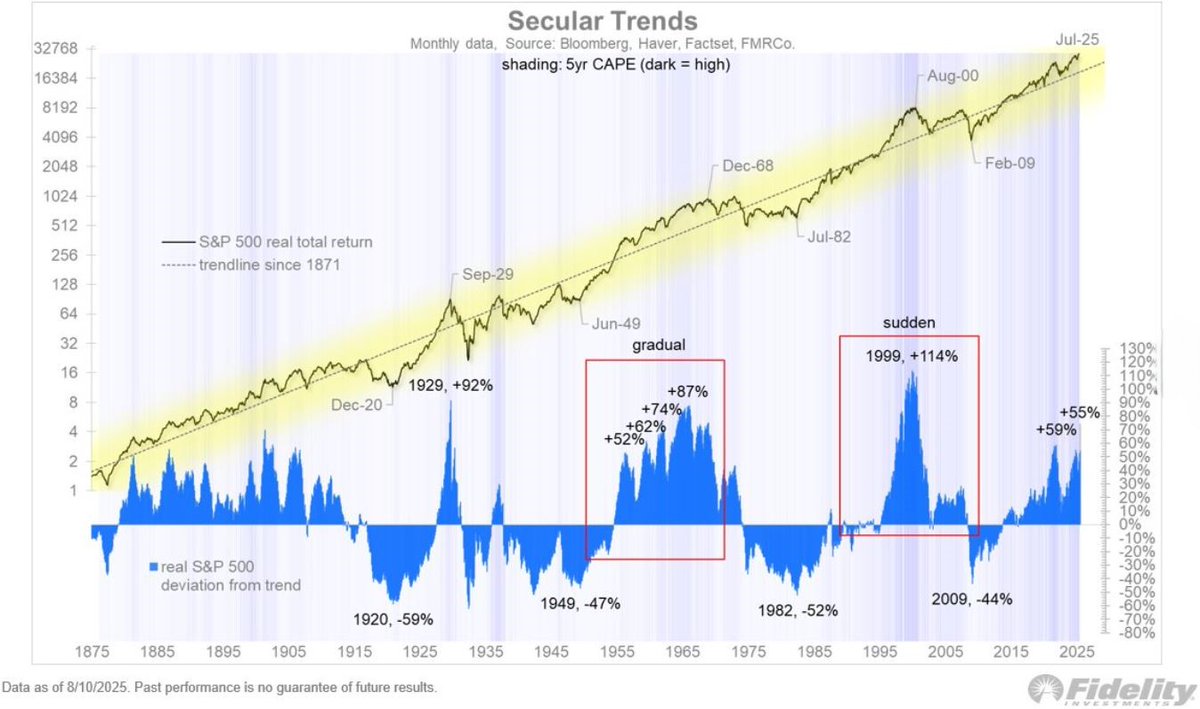

Past liquidity and refinancing, longer-term market cycles matter too. The Kobeissi Letter, utilizing the CAPE (Cyclically Adjusted Worth-to-Earnings) mannequin, reveals the present secular bull market started in 2009 and has lasted 16 years up to now. The 1982–2000 cycle gained 114% earlier than ending within the dot-com crash, whereas the 1949–1968 run noticed smaller peaks and deeper pullbacks close to the tip.

In keeping with the analysts, as we speak’s market resembles the Sixties sample greater than the late-Nineteen Nineties blow-off. CAPE fashions counsel returns might speed up a bit additional earlier than this secular wave ends, which might occur someplace in 2028, if the previous cycles, lasting 19 and 18 years, are any indication. They add,

“This bull run is extremely sturdy.”

For Bitcoin, this might imply a neater bear market in 2026 and an enthusiastic restoration in 2027 and 2028, the 12 months of the brand new halving.

Finally, no single metric defines the longer term. Debt masses, liquidity cycles, coverage shifts, innovation, and investor psychology all pull the financial system in several instructions. Markets rise and fall on the interaction of those forces quite than anyone issue alone. For Bitcoin too, the trail forward might be formed not simply by halvings or liquidity peaks, however by the total complexity of the world it now inhabits.

This text doesn’t include funding recommendation or suggestions. Each funding and buying and selling transfer includes threat, and readers ought to conduct their very own analysis when making a call.