Prediction market Polymarket has added Donald Trump Jr. to its advisory board after receiving a strategic funding from 1789 Capital, which describes itself as a politically aligned car backing firms it sees advancing “American exceptionalism.”

The businesses didn’t revealed monetary phrases, however Axios estimated the funding at “double-digit hundreds of thousands of {dollars}.”

Trump Jr. turned a companion within the fund in 2024. In a Tuesday assertion, he mentioned that “Polymarket cuts by way of media spin and so-called ‘knowledgeable’ opinion by letting individuals guess on what they really imagine will occur on the earth.”

The funding follows Polymarket’s efforts to a regulated return to the US market, after being compelled to dam customers beneath a Commodity Futures Buying and selling Fee (CFTC) motion.

In 2022, the CFTC fined the corporate $1.4 million for working an unregistered swaps platform and ordered it to dam American customers. To re-establish a authorized foothold, it acquired CFTC-licensed derivatives alternate QCEX for $112 million in July 2025, coinciding with the closure of CFTC and Division of Justice investigations into the platform.

Polymarket burst onto the scene in 2020, letting customers wager crypto on bets starting from presidential elections to celeb gossip. The platform rapidly grew into one of many world’s largest prediction platforms, drawing hundreds of thousands in each day quantity but additionally scrutiny from regulators.

Kalshi, Polymarket’s essential US competitor, has additionally repeatedly clashed with regulators over its push to record contracts on political outcomes, together with management of Congress.

The scrutiny intensified in August when US Consultant Dina Titus urged the CFTC to research Brian Quintenz, a former commissioner nominated to chair the company, who additionally sits on Kalshi’s board — elevating conflict-of-interest issues that delayed his Senate affirmation.

Election betting, regulation and Polymarket’s subsequent section

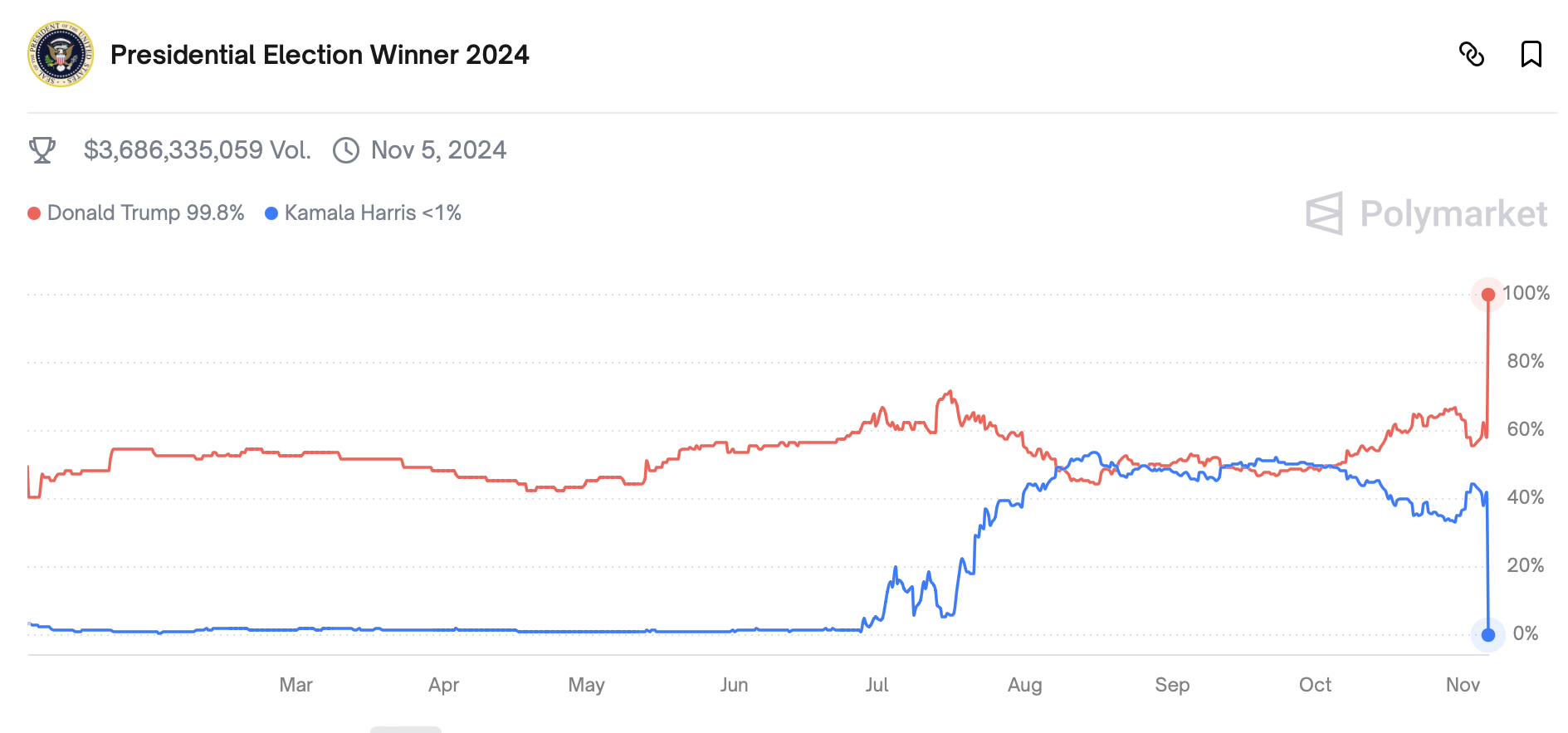

Throughout the 2024 US presidential race, Polymarket dealt with greater than $3.6 billion in bets, with roughly $2.7 billion staked on the Trump–Harris matchup alone. That surge of exercise drew criticism from a number of US lawmakers.

In Aug. 2024, Senators Elizabeth Warren, Jeff Merkley and others wrote a letter to the CFTC calling for a ban on election betting.

They argued that permitting individuals to put “extraordinary bets whereas concurrently contributing to a selected candidate or get together, and political insiders to guess on elections utilizing personal info, will additional degrade public belief within the electoral course of.”

The sentiment has additionally been echoed in sports activities. The Nationwide Soccer League (NFL) lately warned that prediction markets like Polymarket pose integrity dangers, arguing that with out the compliance and monitoring methods required of licensed sportsbooks, such platforms might go away video games weak to manipulation.

Regardless of lingering criticism, on July 21, Polymarket was reported to be finalizing a $200 million funding spherical valuing the platform at $1 billion.

The platform additionally revealed a US rulebook in August and ran digital adverts within the US that very same month selling its return.

Journal: Crypto has 4 years to develop so large ‘nobody can shut it down’ — Kain Warwick, Infinex