Whereas the US GENIUS Act is being celebrated as a market catalyst for stablecoin adoption, Japan’s earlier reforms present the flip aspect: Readability doesn’t mechanically translate into fast real-world utility.

Japan had the world’s first complete stablecoin regime in 2023, however adoption has been muted. Licensed issuers exist on paper, but there’s no thriving yen-stablecoin financial system.

In an interview with Cointelegraph, Takashi Tezuka, nation supervisor at Web3 infrastructure developer Startale Group, stated the adoption hole between the US and Japan displays a philosophical distinction in regulatory design.

“The GENIUS Act was greeted with a mixture of reduction and curiosity,” Tezuka stated, “as a result of the US has lastly caught up with what Japan did two years earlier — placing a complete authorized framework round stablecoins.”

Beneath Japan’s 2023 modification to the Fee Companies Act, solely licensed banks, belief banks and registered cash switch brokers are permitted to subject stablecoins.

The US strategy beneath the GENIUS Act, in contrast, opens the door extra extensively: Not solely banks, but in addition federally licensed non-bank firms can pursue stablecoin issuance, supplied they meet reserve and compliance requirements.

This underscores a philosophical divide. “Japan prizes systemic stability above innovation pace, whereas the US is signaling a much bigger market-opening play,” Tezuka famous.

Nonetheless, the hole could not final lengthy. Japan’s infrastructure-first technique “mirrors broader business alerts — world gamers are constructing infrastructure to help programmable, enterprise-grade capital markets, and Japan’s measured, infrastructure-first mindset positions the nation to compete because the regulatory panorama matures.”

Associated: Japan’s finance minister endorses crypto as portfolio diversifier

First yen-backed stablecoin set to launch this 12 months

After laying the regulatory groundwork for the previous two years, Japan is about to approve its first yen-den stablecoin this fall, opening the door to blockchain-based remittances and funds of its nationwide foreign money.

The primary stablecoin will reportedly be issued by native fintech firm JPYC, which is registering as a cash switch operator. It will likely be a totally collateralized stablecoin, backed one-to-one with financial institution deposits and Japanese authorities bonds.

Tokyo-based Monex Group can be contemplating issuing its personal yen-pegged stablecoin. Like JPYC’s, it might be totally collateralized with authorities bonds and different liquid property, and aimed toward use circumstances equivalent to company settlements and world remittances.

Monex’s potential entry is particularly notable. As a publicly traded firm with subsidiaries together with Tradestation and Coincheck — collectively serving tens of millions of customers — it might deliver scale and credibility to Japan’s nascent stablecoin market.

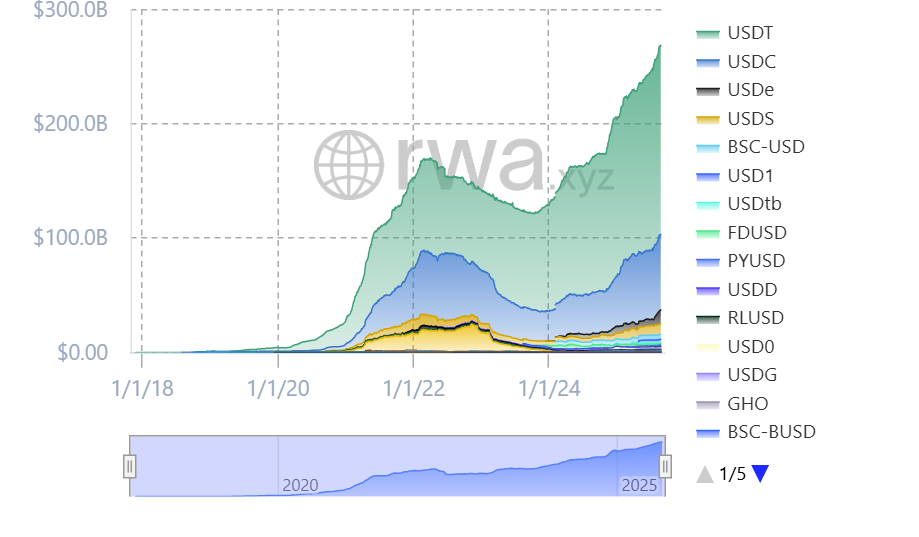

If realized, these initiatives would mark the yen’s long-awaited entry into the $270 billion world stablecoin market, which as we speak stays overwhelmingly dominated by US-dollar tokens, particularly Tether’s USDt (USDT) and Circle’s USDC (USDC).

Associated: GENIUS Act yield ban could push trillions into tokenized property — ex-bank exec

Stablecoin adoption heats up in Japan

Tezuka’s firm, Startale, has pushed for larger stablecoin adoption in Japan, culminating in a latest partnership with native monetary large SBI, which additionally signed separate agreements with USDC issuer Circle and funds developer Ripple.

As a part of the collaboration, SBI is working with Startale to construct a platform for tokenized shares and different real-world property.

“The purpose is to present institutional and retail traders the instruments to commerce tokenized property, together with US and Japanese native shares, with true 24/7 entry, near-instant cross-border settlements, and fractional possession for larger accessibility,” Tezuka instructed Cointelegraph.

Past tokenization, Startale can be centered on increasing company use of stablecoins by enhancing liquidity.

“The subsequent step is programmable treasuries: utilizing stablecoins alongside tokenized property for automated FX hedging, conditional funds, and real-time capital allocation,” Tezuka stated.

Associated: GENIUS Act scrutinized for stablecoin yield ban as TradFi tokenization features steam