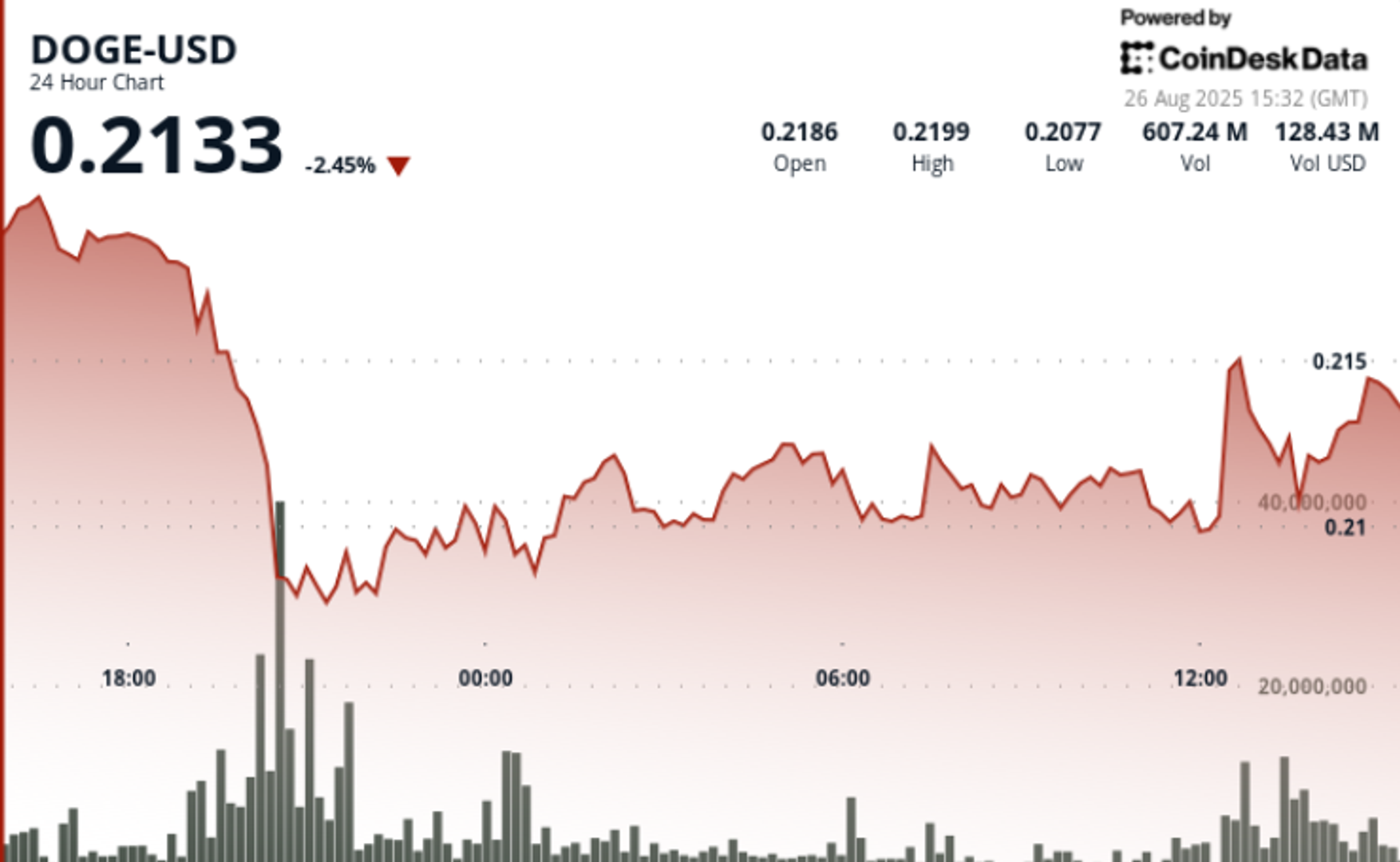

Dogecoin traded by way of heavy volatility over the August 24–26 window, swinging inside a $0.013 vary earlier than consolidating close to $0.21. A pointy drop from $0.218 to $0.208 on August 25 got here amid huge 1.57 billion quantity, whereas broader stress was tied to a 900 million DOGE switch to Binance that unsettled merchants.

Regardless of near-term warning, whales proceed accumulating, leaving sentiment break up between breakdown dangers and dip-buying optimism.

Information Background

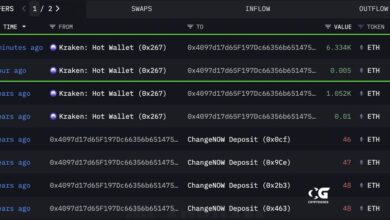

- Whale transfers added gasoline to volatility: between August 24–25, a single 900 million DOGE ($200+ million) was moved to Binance from a long-term holding pockets.

- Market sentiment soured on fears of a sell-off, with open curiosity in DOGE futures dropping 8% as speculative merchants pared publicity.

- Regardless of the influx, on-chain information reveals whales collected over 680 million DOGE in August, countering retail distribution.

- Fed Chair Powell’s Jackson Gap feedback sparked a 12% meme coin sector rally, aligning DOGE with broader risk-on momentum.

Value Motion Abstract

- DOGE posted a 6.06% unfold within the 23-hour session ending August 26 at 12:00, buying and selling between $0.221 and $0.208.

- The sharpest transfer got here throughout 19:00–20:00 GMT on August 25, when DOGE fell from $0.218 to $0.208 on 1.57 billion quantity.

- Value additionally whipsawed after the whale switch, swinging from a $0.25 excessive to check $0.23 help earlier than stabilizing.

- A rebound lifted DOGE from $0.210 session lows to $0.211–$0.212 within the 11:27–12:26 GMT window on August 26, aided by a 17.85 million quantity spike at 11:58.

Technical Evaluation

- Assist established at $0.208 following the high-volume drop.

- Resistance holds at $0.218–$0.221, capping rallies.

- Present consolidation between $0.210–$0.212 suggests accumulation.

- RSI recovered from oversold ranges close to 42 to mid-50s, exhibiting stabilizing momentum.

- MACD histogram narrowing towards bullish crossover, signaling potential upside reversal.

- Open curiosity decline of 8% factors to lowered speculative leverage, limiting volatility but additionally dampening near-term upside.

- Sustained buying and selling above $0.21 with elevated volumes (+16% vs. 30-day averages) strengthens bullish case.

What Merchants Are Watching

- Bulls goal a breakout towards $0.23–$0.24 if consolidation resolves upward and whale shopping for persists.

- Bears spotlight $0.208 as the important thing draw back set off, with a break opening danger towards $0.200.

- The tug-of-war between alternate inflows (distribution danger) and whale accumulation (supportive demand) stays the decisive issue for the following leg.