Pound Sterling positive factors barely in opposition to US Greenback as Trump fires Fed's Cook dinner

- The Pound Sterling ticks as much as close to 1.3460 in opposition to the US Greenback as US President Trump fires Fed Governor Cook dinner.

- The elimination of Fed’s Cook dinner has dampened the central financial institution’s independence.

- Traders await BoE Mann’s speech for contemporary cues on the financial coverage outlook.

The Pound Sterling (GBP) ticks as much as close to 1.3460 in opposition to the US Greenback (USD) in the course of the European buying and selling session on Tuesday. The GBP/USD pair edges increased because the US Greenback falls barely after the ousting of Federal Reserve (Fed) Governor Lisa Cook dinner by United States (US) President Donald Trump, which has elevated considerations over the central financial institution’s independence.

On early Tuesday, US President Trump shared a letter on Reality.Social wherein he introduced the elimination of Fed Governor Cook dinner, citing that she made false statements on a number of mortgage agreements.

Market consultants have seen Fed Cook dinner’s elimination by US President Trump as a critical dent within the central financial institution’s independence. They’ve additionally argued that the intention behind Cook dinner’s elimination is to suit individuals within the Federal Open Market Committee (FOMC) to assist Trump’s financial agenda.

“The priority is the intent of the Trump administration: it’s to not protect Fed integrity, it’s to put in Trump’s personal individuals on the Fed,” analysts at Capital.com stated, Reuters reported.

Nonetheless, Cook dinner stated that she’s going to proceed to hold out her duties as Fed Governor. In a press release shared by her attorneys, “President Trump purported to fireplace me ‘for trigger’ when no trigger exists underneath the regulation, and he has no authority to take action.”

Previously, President Trump has additionally attacked the Fed’s independence a number of instances by threatening Chair Jerome Powell for not decreasing rates of interest. Nonetheless, Trump praised Powell after his speech on the Jackson Gap Symposium on Friday, wherein he surprisingly delivered a dovish rate of interest steerage, citing labor market considerations.

US Greenback Value As we speak

The desk beneath reveals the proportion change of US Greenback (USD) in opposition to listed main currencies right now. US Greenback was the weakest in opposition to the Japanese Yen.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.09% | -0.13% | -0.24% | -0.06% | -0.02% | 0.08% | 0.16% | |

| EUR | 0.09% | 0.03% | -0.03% | 0.04% | 0.12% | 0.41% | 0.28% | |

| GBP | 0.13% | -0.03% | -0.06% | 0.03% | 0.14% | 0.36% | 0.25% | |

| JPY | 0.24% | 0.03% | 0.06% | 0.10% | 0.09% | 0.46% | 0.19% | |

| CAD | 0.06% | -0.04% | -0.03% | -0.10% | 0.05% | 0.34% | 0.07% | |

| AUD | 0.02% | -0.12% | -0.14% | -0.09% | -0.05% | 0.10% | 0.02% | |

| NZD | -0.08% | -0.41% | -0.36% | -0.46% | -0.34% | -0.10% | -0.13% | |

| CHF | -0.16% | -0.28% | -0.25% | -0.19% | -0.07% | -0.02% | 0.13% |

The warmth map reveals proportion modifications of main currencies in opposition to one another. The bottom foreign money is picked from the left column, whereas the quote foreign money is picked from the highest row. For instance, should you choose the US Greenback from the left column and transfer alongside the horizontal line to the Japanese Yen, the proportion change displayed within the field will symbolize USD (base)/JPY (quote).

Every day digest market movers: Pound Sterling trades broadly steady forward of BoE Mann’s speech

- The Pound Sterling trades calmly forward of Financial institution of England (BoE) Financial Coverage Committee (MPC) member Catherine Mann’s speech at 16:00 GMT. Traders pays shut consideration to BoE Mann’s speech to get cues about whether or not the UK (UK) central financial institution will minimize rates of interest once more within the the rest of the 12 months.

- Monetary market contributors doubt whether or not the BoE to ease financial coverage additional as inflationary pressures are turning out to be persistent. Inflation within the UK economic system has been accelerating at a sooner tempo in latest months.

- Traders ought to observe that BoE’s Mann was one of many MPC members who voted for holding rates of interest within the financial coverage assembly earlier this month. Within the assembly, the BoE diminished its key borrowing charges by 25 foundation factors (bps) to 4%, with a slim majority.

- Within the US, buyers await the Private Consumption Expenditures Value Index (PCE) knowledge for July, which is scheduled to be launched on Friday. The inflation knowledge will affect market expectations for the Fed’s financial coverage outlook.

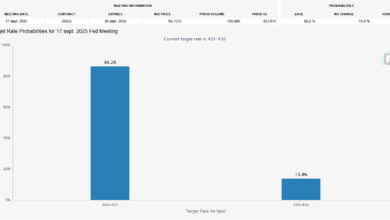

- In keeping with the CME FedWatch software, there’s an 84% likelihood that the Fed will minimize rates of interest within the September financial coverage assembly.

- Fed dovish expectations intensified earlier this month after the Nonfarm Payrolls (NFP) report for July confirmed downward revisions in Could and June.

Technical Evaluation: Pound Sterling wobbles round 20-day EMA

The Pound Sterling strikes barely increased to close 1.3460 in opposition to the US Greenback on Tuesday. The near-term outlook of the GBP/USD pair is unsure because it wobbles close to the 20-day Exponential Transferring Common (EMA), which trades round 1.3460.

The 14-day Relative Power Index (RSI) oscillates contained in the 40.00-60.00 vary, suggesting a pointy volatility contraction.

Wanting down, the August 11 low of 1.3400 will act as a key assist zone. On the upside, the July 1 excessive close to 1.3790 will act as a key barrier.

Financial Indicator

BoE’s Mann speech

Dr Catherine L Mann joined the Financial Coverage Committee of the Financial institution of England on 1 September 2021. She is a member of the Council on International Relations and the American Financial Affiliation, amongst others. Beforehand she was Chair of the Financial Advisory Committee of the American Bankers Affiliation and of the advisory committees of the Federal Reserve Banks of Chicago, Boston, and New York, amongst others.

Learn extra.

Subsequent launch:

Tue Aug 26, 2025 16:00

Frequency:

Irregular

Consensus:

–

Earlier:

–

Supply:

Financial institution of England