Key takeaways:

-

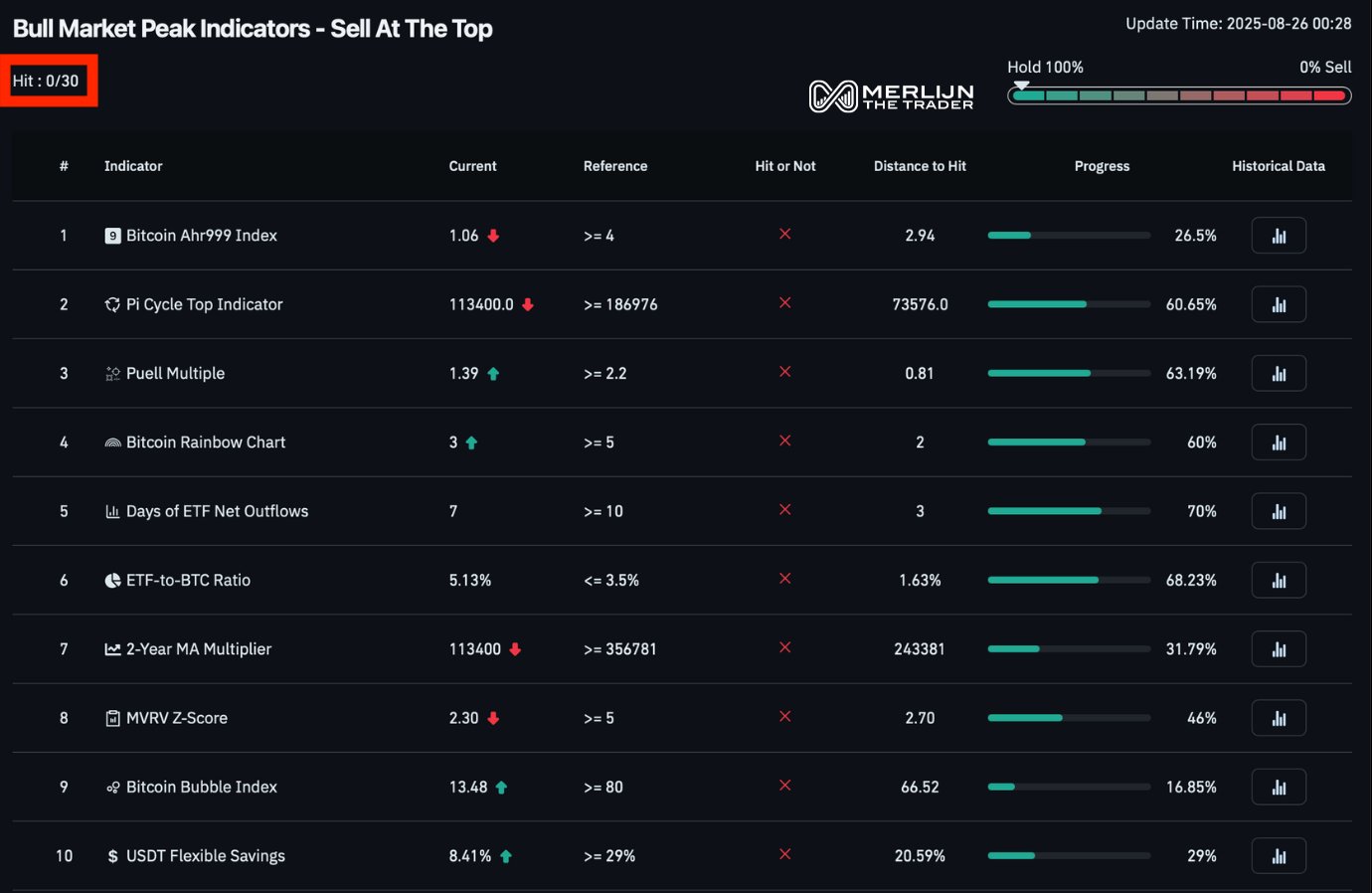

Bitcoin’s $124,500 excessive is unlikely to be the cycle prime, with all 30 peak indicators nonetheless impartial.

-

Current losses present new buyers capitulating as seasoned holders are unfazed.

-

Holding above the 20-week EMA retains Bitcoin’s path open towards $150,000.

Bitcoin’s (BTC) retreat from its file highs is fueling issues over whether or not the market has already peaked for 2025. However the so-called “$124K prime” is nothing however “noise,” based on analyst Merlijn The Dealer.

30/30 indicators trace Bitcoin has extra room to rise

In a Tuesday submit, Merijn harassed that none of Bitcoin’s 30 broadly adopted peak indicators have flashed pink to this point.

Traditionally, Bitcoin cycle tops have coincided with a number of “overheating” indicators throughout well-known onchain instruments.

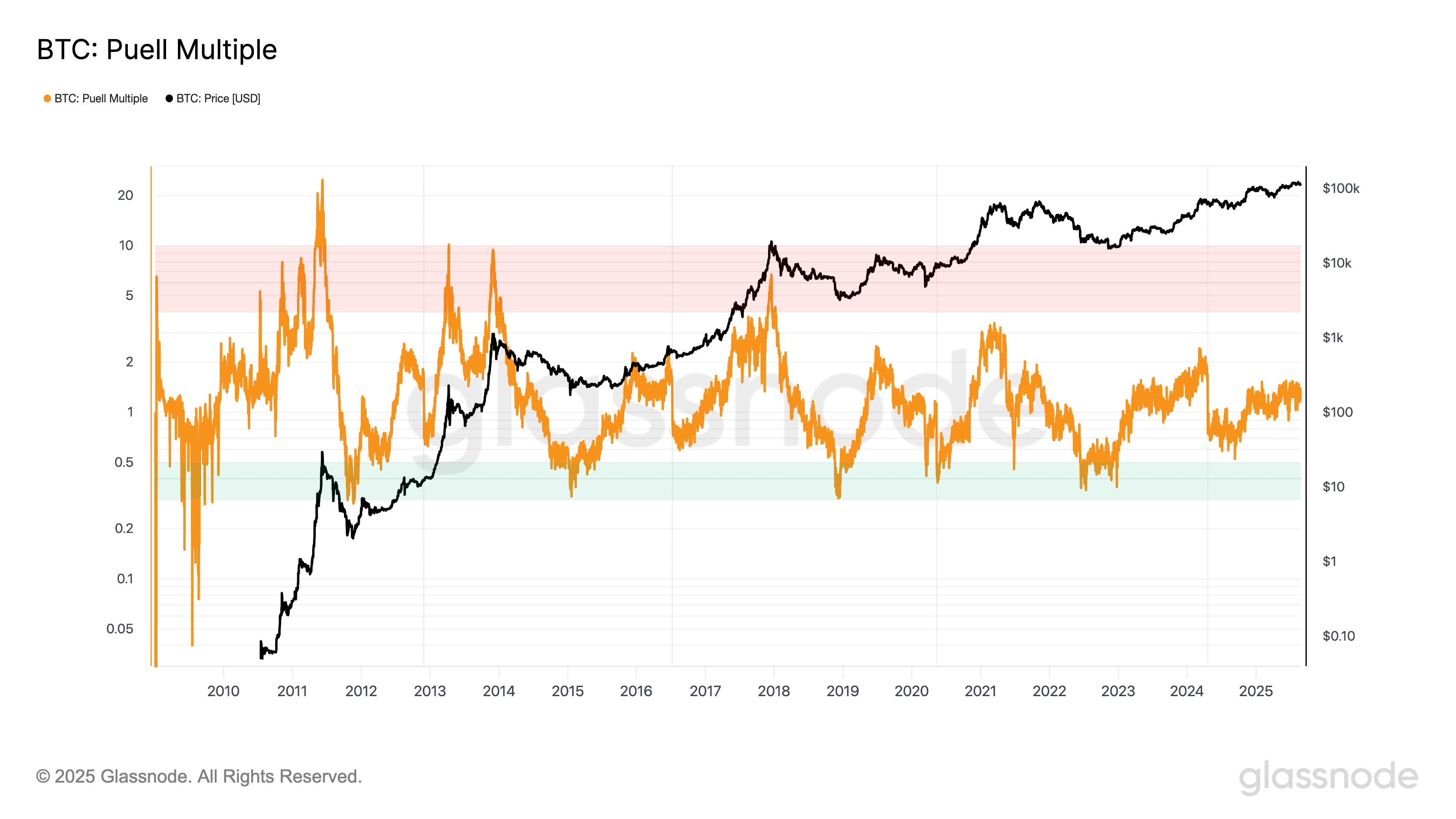

As an illustration, the Puell A number of, which spikes when miners earn unsustainably excessive revenues, is sitting at simply 1.39, properly beneath the two.2 hazard zone seen earlier than previous value peaks.

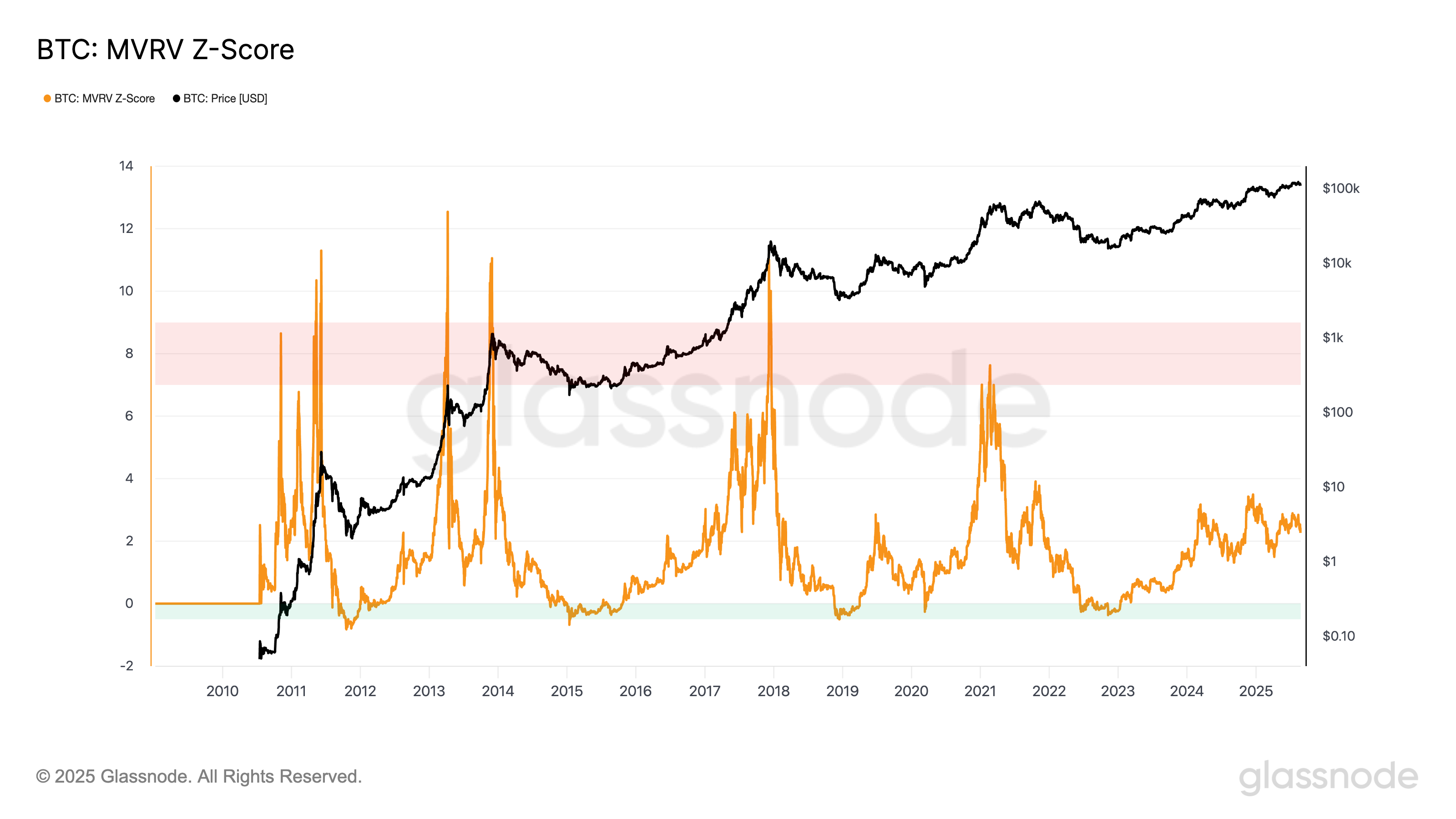

Equally, the MVRV Z-Rating, which compares Bitcoin’s value to its precise capital inflows, stays in impartial territory somewhat than on the overheated extremes that marked prior tops.

Seasoned BTC holders are unfazed

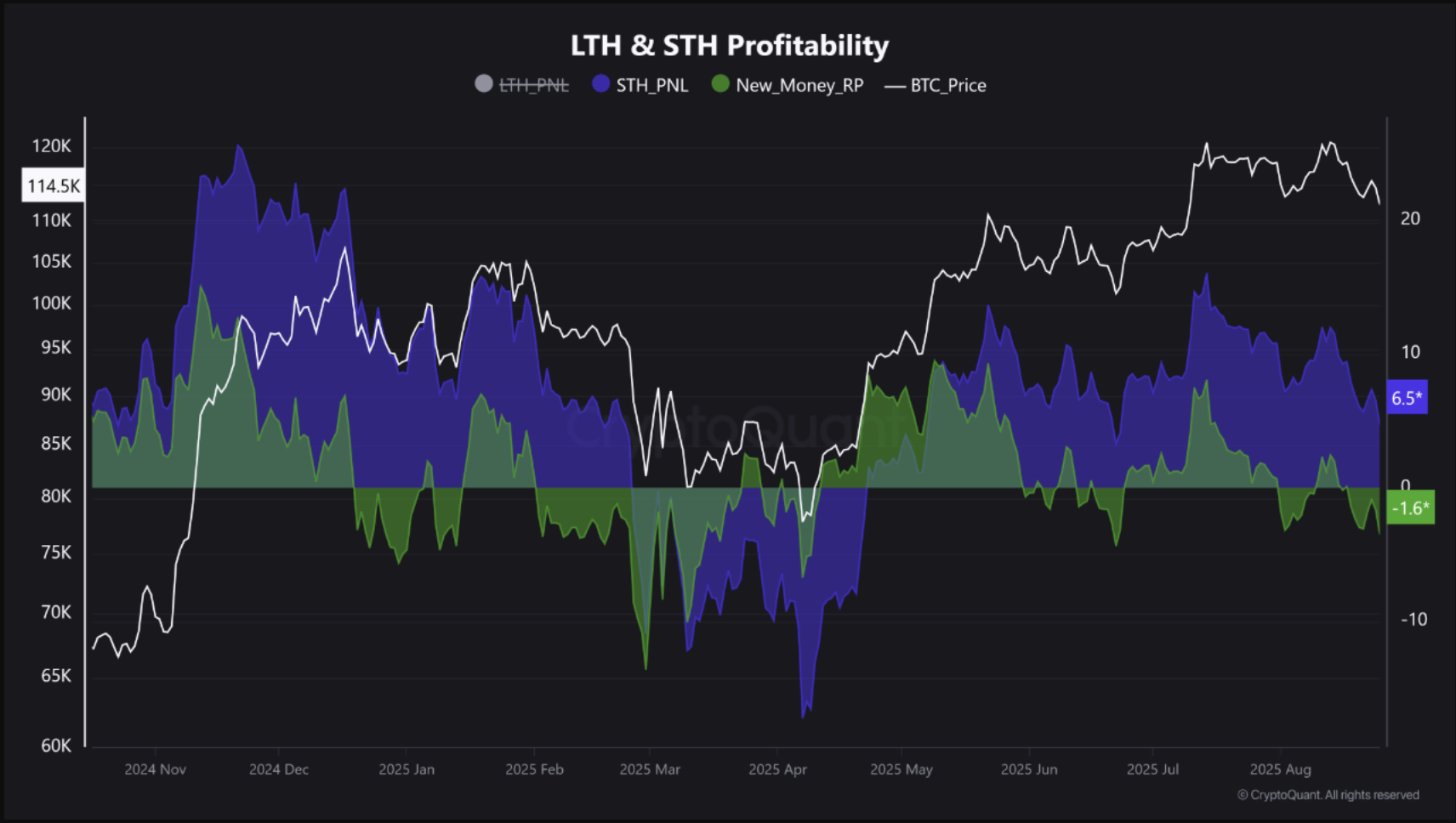

On-chain information helps the bullish view, displaying a traditional capitulation part underway.

The latest Bitcoin buyers—these holding BTC for lower than a month—are sitting on common unrealized losses of round -3.50% and at the moment are promoting, based on information shared by analyst CrazzyBlockk.

Conversely, the broader Brief-Time period Holder (STH) cohort, which has held for one to 6 months, stays worthwhile with an combination unrealized acquire of +4.50%.

“This can be a bullish structural improvement,” writes CrazzyBlockk, including:

“The market is purging its weakest arms, transferring their BTC to holders with a decrease price foundation and better conviction […] This shakeout, whereas painful for current top-buyers, is exactly the type of occasion that builds a robust help base for the subsequent vital transfer greater.”

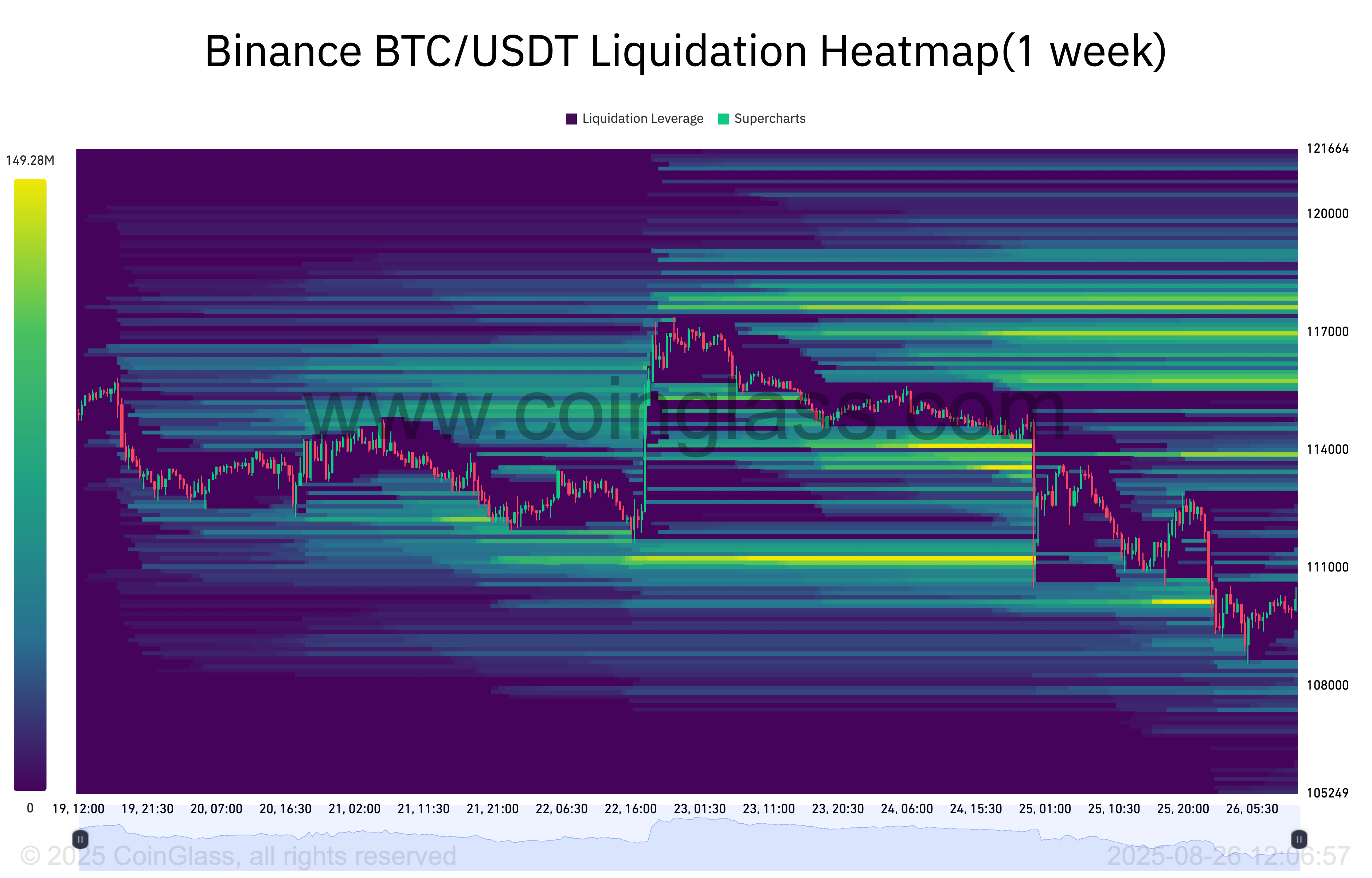

$70 million in BTC longs liquidated

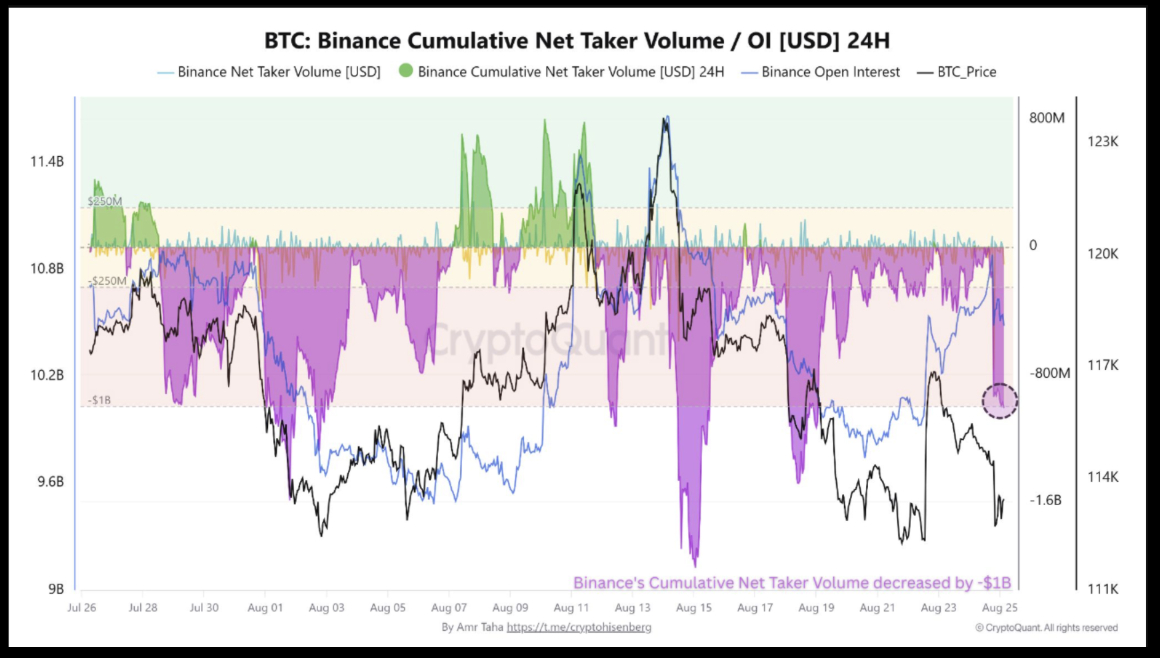

Onchain analyst Amr Taha additional argues in favor of a restoration subsequent, citing the current $70 million flush of leveraged longs following BTC’s value dip beneath $111,000 on Binance.

Open curiosity (OI) dropped considerably after the liquidation occasion. Binance Cumulative Web Taker Quantity plunged by round $1 billion, indicating aggressive sell-side dominance and capitulation amongst late patrons.

The following cluster of liquidity lies round $117,000–$118,000, which might act as a value magnet if BTC recovers within the coming days. Beneath, there’s restricted help till round $105,000.

“With overleveraged patrons eliminated and open curiosity reset, the market is structurally more healthy,” Taha writes, including:

“The absence of a brief squeeze suggests latent upside potential, particularly if BTC reclaims key ranges and triggers quick masking.”

Can Bitcoin value nonetheless drop $100,000?

On the weekly chart, Bitcoin’s pullback seems much less like a market prime and extra like a traditional bull market correction.

Since early 2023, BTC has repeatedly posted sharp drawdowns within the 20–30% vary earlier than resuming its uptrend.

The newest 12% decline is relatively shallow and nonetheless sits above the 20-week exponential transferring common (20-week EMA; the inexperienced wave) close to $108,000, a stage that has acted as dynamic help all through the rally.

A rebound from the 20-week EMA might put Bitcoin again on observe to problem its all-time excessive above $125,500, whereas holding the door open for a broader rally towards $150,000, if not greater by 2025’s finish.

Associated: Technique buys $357M in Bitcoin as value drops to $112K

Conversely, a breakdown beneath the 20-week EMA may lead to a deeper correction towards the 50-week EMA (the pink wave) close to $95,300. This wave help has traditionally marked Bitcoin’s native bottoms throughout prior bull market pullbacks.

This text doesn’t comprise funding recommendation or suggestions. Each funding and buying and selling transfer includes threat, and readers ought to conduct their very own analysis when making a call.