This can be a day by day evaluation by CoinDesk analyst and Chartered Market Technician Omkar Godbole.

Bitcoin’s (BTC) technical outlook has deteriorated over the previous 24 hours, with costs dropping under a key transferring common for the primary time since April. This breakdown has left BTC at a drawback in comparison with main tokens corresponding to Ether (ETH), XRP, and Solana .

BTC loses 100-day SMA

BTC has dropped over 1% up to now 24 hours, hitting a low of $109,172 at one level.

Within the course of, the cryptocurrency has convincingly dipped under the 100-day easy transferring common (SMA), a broadly tracked momentum indicator and assist/resistance line, for the primary time since April 22.

Additional, costs have crossed under the Ichimoku cloud, indicating a bearish shift in momentum.

The twin breakdown has bolstered the bearish technical outlook urged by the current violation of the upward-sloping trendline from the April lows and the consecutive destructive prints on the longer-duration MACD histogram. Taken collectively, the current sample appears to be like just like the February breakdown that set the stage for a deeper sell-off to $75K.

The subsequent key degree to be careful for is $105,390, which is the 38.2% Fibonacci retracement of the April-July rally, adopted by the 200-day SMA at $100,928.

The bulls want to beat the decrease excessive of $117,416 created on Aug. 22 to negate the bearish technical setup.

- Resistance: $111,592, $117,416, $120,000

- Help: $105,390, $100,928, $100,000.

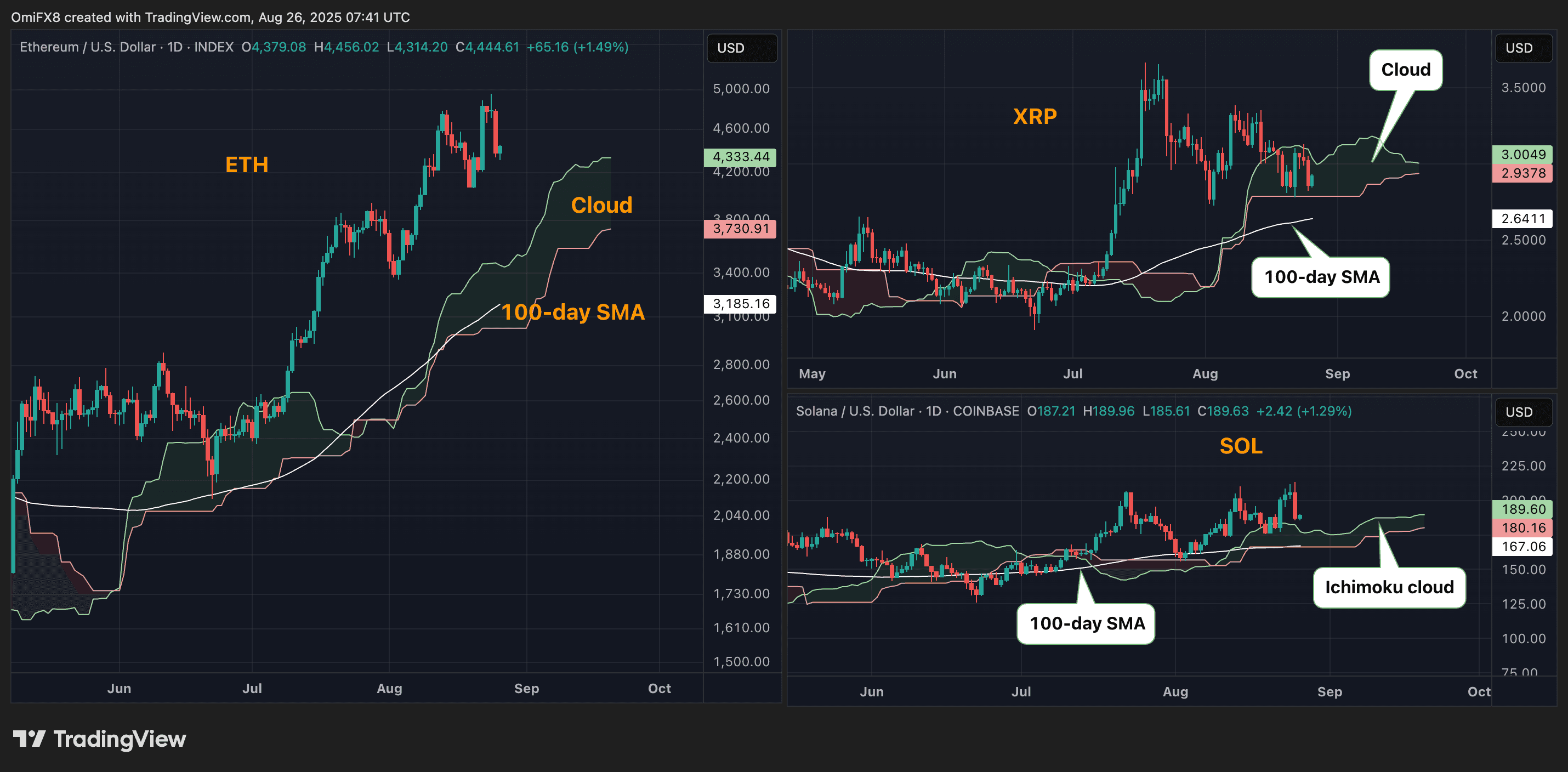

XRP, ETH and SOL maintain floor

Whereas bitcoin has suffered the twin breakdown, XRP continues to commerce above its 100-day SMA. Nonetheless, costs are “caught within the Ichimoku cloud,” whichmeans the token is buying and selling inside a zone of uncertainty and consolidation the place neither bulls nor bears are keen to steer the worth motion. It suggests indecision and lack of a robust pattern.

In the meantime, ether and SOL proceed to commerce above their respective 100-day SMAs and Ichimoku clouds. Due to this fact, a possible risk-on might see each ETH and SOL outperform BTC and XRP.

Learn extra: Large $14.6B Bitcoin and Ether Choices Expiry Reveals Bias for Bitcoin Safety