What’s a tough cap?

A tough cap is the utmost provide of a cryptocurrency that may ever exist. It’s hardcoded into the blockchain’s code and units a strict restrict on what number of tokens or cash may be created. This restrict promotes shortage, which might help increase the worth of every token over time.

Take Bitcoin (BTC), for instance. Its creator, Satoshi Nakamoto, set a tough cap of 21 million cash. Regardless of how a lot demand there’s or what number of miners attempt to produce new Bitcoin, the provision won’t ever exceed 21 million.

Why does a tough cap matter?

Absolute shortage is an enormous deal in crypto; it’s like Bitcoin being digital gold, however much more restricted. If demand will increase, the value might rise as a result of no new cash may be created to fulfill that demand. The one manner a cryptocurrency might enhance its provide can be by altering its core code — principally reinventing itself.

Evaluate this to gold: If it had been simpler for everybody to mine gold instantly, the provision would enhance, and the value would drop. Bitcoin doesn’t have this situation due to its mounted, onerous cap.

Onerous cap vs. tender cap in ICOs

The time period “onerous cap” additionally reveals up on this planet of preliminary coin choices (ICOs). When tasks elevate cash by ICOs, the onerous cap is the utmost quantity they goal to gather, whereas the tender cap is the minimal wanted to launch the challenge.

Consider the tender cap because the minimal fundraising objective, whereas the onerous cap is extra of a stretch objective. The onerous cap is often set larger to permit for extra fundraising potential, but it surely doesn’t all the time imply the challenge will attain that concentrate on.

In each instances — whether or not speaking about whole provide or fundraising limits — a tough cap helps set clear boundaries, selling transparency and shortage.

Now, let’s discover Bitcoin’s 21-million onerous cap — why it’s so essential and what might occur if this cover had been modified.

The importance of the 21-million Bitcoin onerous cap

Bitcoin’s 21-million onerous cap ensures its shortage, appearing as digital gold and a retailer of worth, however ongoing debates query whether or not it might ever be modified.

Bitcoin’s onerous cap of 21 million cash is like its DNA, and it’s what makes Bitcoin the treasured asset it’s in the present day. It’s the digital equal of gold’s shortage, and it’s an enormous motive why individuals see it as a retailer of worth. Bitcoin can be thought of the apex asset inside the cryptocurrency asset class. However as Bitcoin grows and evolves, some people have began to marvel: Might this difficult cap ever be modified?

Let’s break it down and see why that is such a sizzling subject.

Think about if somebody instantly determined to print extra gold. It wouldn’t be as valuable anymore, proper?

It’s fundamental economics between provide and demand. As provide will increase, the perceived worth sometimes decreases, and vice versa.

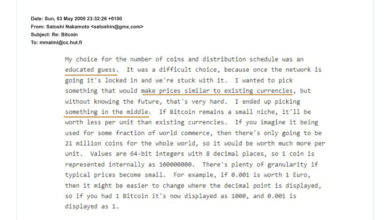

The identical goes for Bitcoin. The 21-million onerous cap was baked into its code by Satoshi Nakamoto, Bitcoin’s mysterious creator. It’s what offers Bitcoin its digital shortage, a function that’s fairly uncommon on this planet of fiat currencies.

Even on this planet of cryptocurrencies, different blue-chip property like Ether (ETH) and Solana (SOL) don’t get pleasure from the identical standing as Bitcoin with respect to their financial mannequin.

Right here’s why this cover is such an enormous deal.

- Retailer of worth: Bitcoin is commonly referred to as “digital gold” as a result of, like gold, it’s scarce. There’s solely a lot of it, and nobody can simply make extra. This shortage is a large a part of its worth.

- Decentralization and belief: In contrast to fiat currencies, the place central banks can print cash each time they need, Bitcoin’s provide is mounted. This implies nobody can mess with it for their very own achieve.

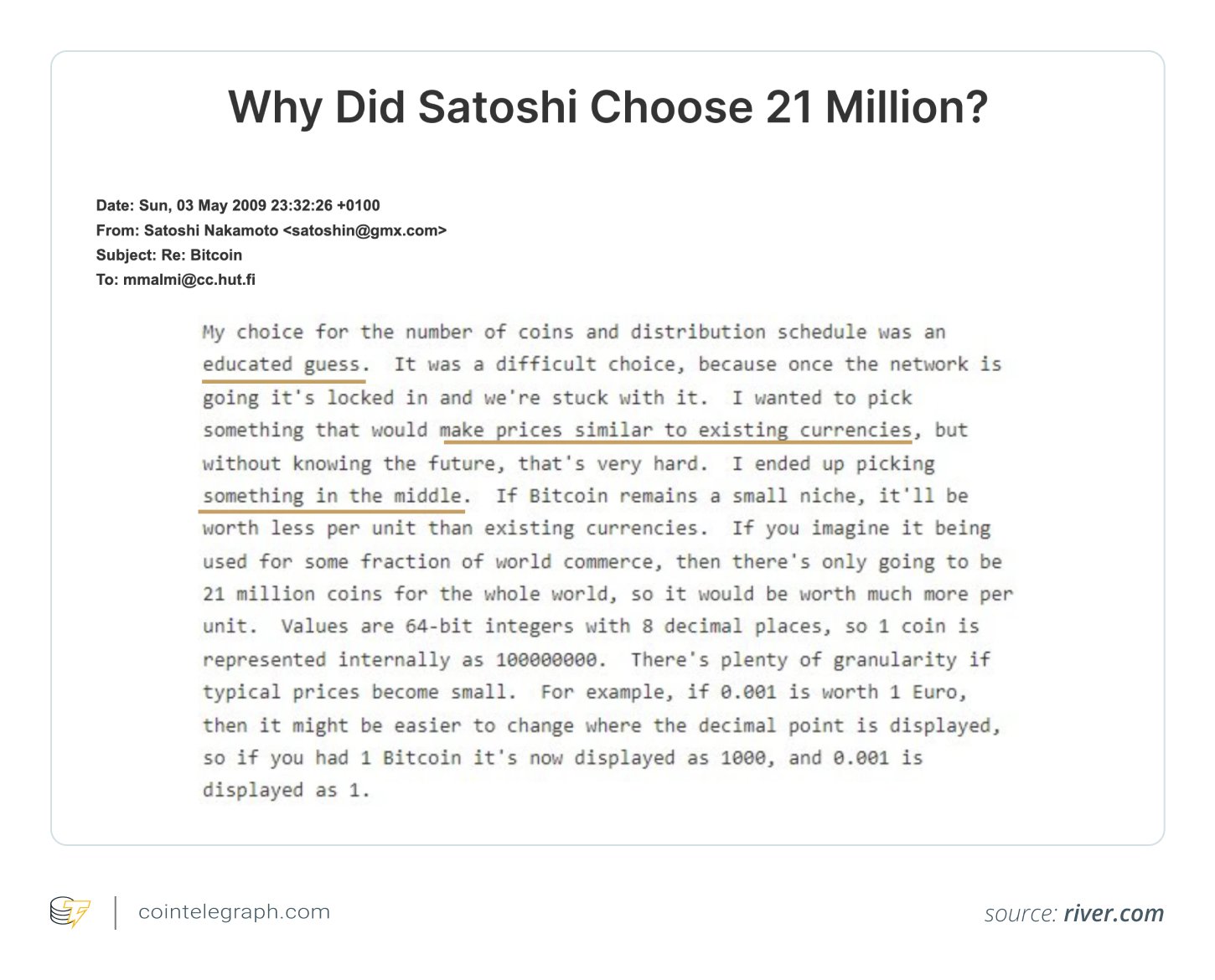

- Predictable financial coverage: Bitcoin’s provide grows at a predictable fee, because of the halving occasion that occurs roughly each 4 years. This occasion cuts the mining reward in half, slowing down the creation of recent BTC till the 21-million cap is reached.

As of 2025, over 19.8 million BTC has already been mined, leaving lower than 1.2 million left to be created. This shortage is an enormous a part of what drives Bitcoin’s worth, at present hovering round $100,000 per coin.

Proposals to vary the 21-million cap

Whereas the 21-million cap is a cornerstone of Bitcoin, previous debates, from early inflation considerations to the 2017 block dimension wars, present how tough altering Bitcoin’s core guidelines can be.

Whereas the 21-million cap is just about gospel within the Bitcoin world, there have been just a few whispers about altering it through the years. Let’s check out a few of these discussions.

Again in Bitcoin’s early days, some individuals questioned if an inflationary mannequin may be vital. The priority was that when all BTC was mined, miners would possibly lose the inducement to safe the community.

However Satoshi Nakamoto had an answer: transaction charges. As block rewards lower over time, charges would take over as the principle incentive for miners. This concept has held up fairly properly up to now.

Hal Finney, certainly one of Bitcoin’s earliest adopters (and probably the primary individual to obtain a Bitcoin transaction from Satoshi), as soon as mused about the potential of introducing some inflation after the 21-million cap was reached. However he was clear that this was only a thought experiment, not a severe proposal. In his phrases:

“Think about if Bitcoin is profitable and turns into the dominant fee system in use all through the world. Then the whole worth of the forex must be equal to the whole worth of all of the wealth on this planet.”

Even so, Finney remained a staunch supporter of Bitcoin’s shortage.

Whereas circuitously concerning the provide cap, the block dimension debates of 2017 confirmed simply how onerous it’s to vary Bitcoin’s core guidelines. The group was deeply divided over whether or not to extend the block dimension, and the disagreement finally led to a tough fork, creating Bitcoin Money. If one thing as comparatively minor as block dimension could cause such a rift, think about the chaos that may ensue if somebody tried to mess with the 21-million cap.

What would occur if Bitcoin’s 21-million onerous cap modified?

Altering Bitcoin’s 21-million cap would shatter belief, set off market panic, and certain result in a tough fork, however historical past reveals the group fiercely protects its shortage.

Some within the crypto area have speculated that, as Bitcoin adoption grows and mining rewards dwindle, there could possibly be strain to introduce a small inflationary mechanism.

However let’s be actual, this might be attempting to rewrite the structure of the biggest crypto asset. The Bitcoin group is fiercely protecting of its rules, and any try to vary the provision cap would seemingly face huge resistance.

However it’s price pondering by: What would occur if the onerous cap had been modified?

Let’s play out this state of affairs. What if somebody truly tried to vary Bitcoin’s onerous cap? Spoiler alert: It wouldn’t go properly.

- Lack of belief and credibility: Bitcoin’s whole worth proposition is constructed on belief. If the provision cap had been modified, that belief can be shattered. As investor and creator Nassim Taleb as soon as stated: “Bitcoin is the start of one thing nice: a forex and not using a authorities, one thing vital and crucial.” Messing with the onerous cap would undermine that greatness.

- Market response and worth influence: Bitcoin’s worth is closely tied to its shortage. If the provision cap had been elevated, the market would seemingly panic. We might see an enormous sell-off as traders lose confidence in Bitcoin’s worth. Bear in mind, Bitcoin’s worth has traditionally been pushed by its mounted provide, and any change to that may be a seismic occasion.

- Onerous fork and community break up: If a proposal to vary the provision cap gained traction, it could nearly definitely result in a tough fork. The group would break up into two camps: those that help the change and people who don’t. The consequence? Two competing variations of Bitcoin. However historical past reveals us that forks like this not often succeed. Simply have a look at Bitcoin Money; it’s nonetheless round, but it surely’s nowhere close to as helpful or broadly adopted as Bitcoin.

- Developer and group help: Bitcoin Core builders would want to get on board with the thought. However these people are just like the guardians of Bitcoin’s rules. They’re not prone to help one thing that undermines its core worth.

- Miner settlement: Miners would additionally have to comply with the change. However why would they? Miners have a vested curiosity in Bitcoin’s worth. Growing the provision would dilute their holdings and cut back their long-term income. There may be an argument that if, within the course of of accelerating provide, the issue of mining goes down, successfully making Bitcoin mining extra economical. This might make miners extra viable and supportive of the rise in provide cap.

- Node consensus: Even when builders and miners agreed, nearly all of node operators would additionally have to get on board. Nodes are the spine of the Bitcoin community, and so they have the ultimate say in what modifications are adopted from a governance perspective.

One other chance price retaining in thoughts is the position of enormous institutional Bitcoin holders like BlackRock and Technique. In the event that they see advantages in rising the provision by a fork and are keen to maneuver capital at scale into the forked Bitcoin, that may probably set off the start of a significant various to Bitcoin.

Even with higher capital backing than Bitcoin Money, the group’s acceptance is essential for any forked chain to turn out to be a significant Bitcoin various. Bitcoin’s onerous cap is certainly one of its most sacred rules, fiercely guarded by its group.

As Andreas Antonopoulos, a widely known Bitcoin advocate, as soon as stated:

“Bitcoin isn’t just a forex; it’s a motion. It’s about taking management of your individual monetary future.”

So, in idea, it’s potential to vary Bitcoin’s onerous cap. In spite of everything, it’s simply code, and code may be rewritten. However in follow? It’s a complete totally different story. Altering the onerous cap would undermine that motion and the belief that’s been constructed through the years.

Bitcoin’s 21-million cap isn’t only a quantity; it’s a promise that the Bitcoin group intends to maintain. So, whereas the thought of fixing the cap would possibly make for an fascinating thought experiment, it’s extremely unlikely to pan out as a reputable various to Bitcoin. Bitcoin’s shortage is right here to remain, and that’s an enormous a part of what makes it so particular.