Crypto change Kraken met with the US Securities and Change Fee’s Crypto Process Drive on Monday to debate the tokenization of conventional belongings and a tokenized buying and selling system.

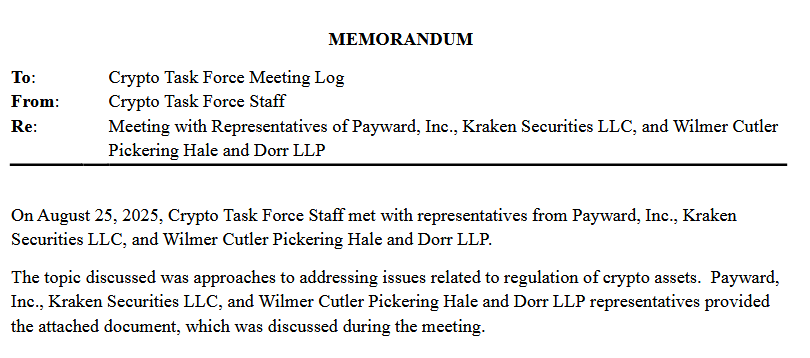

A memorandum filed on Monday famous that SEC workers met with 4 representatives of Payward, Inc., Kraken Securities LLC, and two from the regulation agency Wilmer Cutler Pickering Hales and Dorr LLP.

The agenda was to debate the tokenized buying and selling system, the regulatory framework and authorized necessities for working the system and the potential advantages of tokenization.

Kraken’s SEC assembly comes at a time when conventional change trade associations and world regulators have urged the SEC to take a stricter regulatory strategy towards tokenized shares.

The associations have argued that there’s a lack of investor safety safeguards which might be current within the conventional markets.

Tokenized shares are sometimes not sure by the restrictions of conventional markets and could be traded 24/7. Kraken and Robinhood are the 2 most distinguished platforms to supply these providers.

Kraken introduced its tokenized shares service on Might 22, which might enable non-US buyers the flexibility to purchase US equities across the clock.

Robinhood began providing tokenized shares of US equities to customers within the European Union on June 30.

On Wednesday, Kraken introduced that it had expanded its tokenized inventory product providing to the Tron blockchain.

Associated: SBI Group, Chainlink associate to carry crypto tech to Asia’s finance scene

Tokenized shares nonetheless in early stage

At the moment, tokenized shares are nonetheless in a nascent stage of development.

The full worth of all tokenized shares in circulation presently stands at $360 million, down 11% up to now 30 days, in keeping with RWA.xyz.

This represents a mere 1.35% of all Actual World Property (RWAs) which were tokenized, as almost $26.5 billion price of RWAs are presently onchain.

In keeping with Binance analysis, tokenized shares characterize a trillion-dollar alternative. If 1% of your complete world equities market will get tokenized, that would propel the sector to surpass the $1.3 trillion mark in market capitalization.

A Kraken survey launched final week revealed that 65% of the 1,000 US buyers who spend money on each equities and crypto anticipate crypto to outperform equities over the subsequent decade.

In July, Mark Greenberg, World head of Kraken’s Client Enterprise Unit, instructed Cointelegraph that tokenized shares ought to supply new ranges of accessibility, programmability and world attain as an alternative of merely replicating the Wall Avenue system onchain.

Journal: ETH ‘god candle,’ $6K subsequent? Coinbase tightens safety: Hodler’s Digest, Aug. 17 – 23