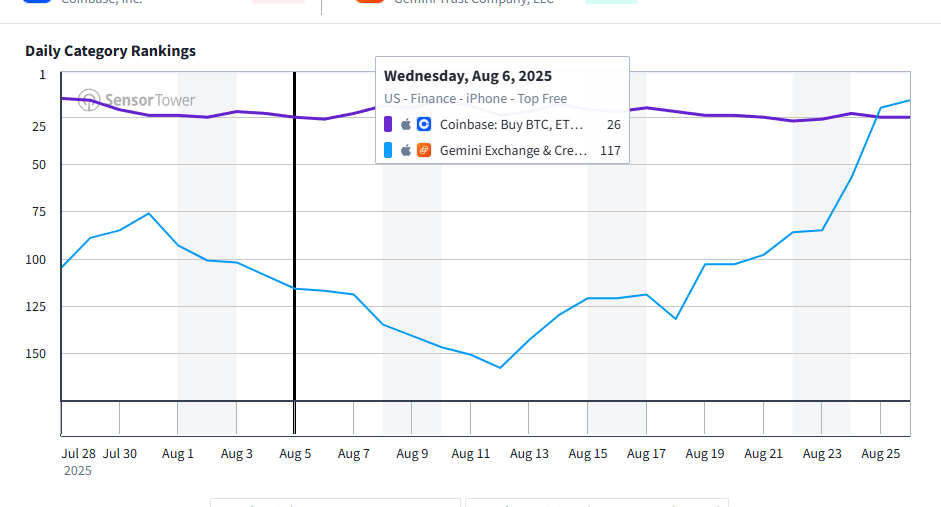

Gemini, the cryptocurrency change based by the Winklevoss twins, has surpassed Coinbase within the app retailer charts after launching a XRP-rewards bank card with Ripple Labs and Mastercard.

“This restricted version steel card offers as much as 4% again in XRP immediately. No ready, simply stacking,” Gemini stated in an X put up on Monday.

Sensor Tower knowledge exhibits Gemini overtook Coinbase within the finance class rankings within the US after the announcement, with Gemini at sixteenth place on the time of publication, in comparison with Coinbase at twentieth.

The occasion may very well be seen as vital as Coinbase has over thrice the every day buying and selling quantity of Gemini, latest knowledge from Messari exhibits.

“The flippening is accelerating,” says Tyler Winklevoss

Gemini co-founder Tyler Winklevoss stated, “The flippening is accelerating” in an X put up on Monday, and different crypto market individuals additionally highlighted the brand new milestone on social media.

In keeping with App Retailer intelligence platform App Tweak, rankings on the App Retailer are primarily influenced by key phrases, downloads, consumer critiques, app efficiency, and retention.

Ripple Labs CEO Brad Garlinghouse stated in an X put up on Monday, “An XRP rewards bank card out on the earth?! What a time to be alive, XRP household.”

Coinbase posts considerably greater buying and selling quantity than Gemini

Coinbase ranks third amongst crypto exchanges by buying and selling quantity, recording $4.54 billion up to now 24 hours, whereas Gemini sits at twenty fourth with $382.49 million, CoinMarketCap knowledge exhibits.

Associated: Gemini crypto change provides USD fee rails for European establishments

It comes simply weeks after Gemini filed with the US Securities and Alternate Fee to record its Class A typical inventory on the Nasdaq International Choose Market below the ticker GEMI.

In keeping with its submitting, the IPO will mark the primary time its shares are publicly traded, with pricing anticipated between an undisclosed vary. The providing will probably be led by a syndicate of main banks, together with Goldman Sachs, Morgan Stanley, and Citigroup.

Journal: Bitcoin’s long-term safety finances downside: Impending disaster or FUD?