Fundstrat International Advisors managing companion Tom Lee has tipped Ether to backside out on Tuesday amid a crypto market dip as his ETH treasury agency Bitmine purchased one other $21 million of Ether.

“Calling ETH backside to occur in subsequent few hours,” mentioned Tom Lee on X on Tuesday at 1 am UTC as crypto markets noticed pink within the $200 billion market cap liquidation occasion.

There’s the prospect Lee’s so-called backside is already in, as Ether (ETH) had already began to get better on the time of writing, returning to commerce above $4,430 once more.

Lee made his prediction as he shared a message from Mark Newton, the managing director of technical technique at Fundstrat International Advisors, who mentioned, “ETH is an excellent threat/reward right here,” including that he was “extremely skeptical” that it breaks the pattern or breaks final week’s low.

“Ideally, this could backside out someday within the subsequent 12 hours close to $4,300 and begin to push again as much as new highs and get above $5,100 and as much as close to $5,400 to $5,450,” Newton mentioned.

Ether is down 11% from all-time excessive

Lee’s name comes amid a crypto market crash initiated by Bitcoin (BTC), which plummeted to a seven-week low on Tuesday morning.

Ether additionally suffered, tanking greater than 7% to backside out at $4,313 on Coinbase, based on TradingView.

Associated: After $400M splurge, ETH treasurer eyes inventory buyback amid leverage considerations

BitMine ETH holdings attain $7.5 billion

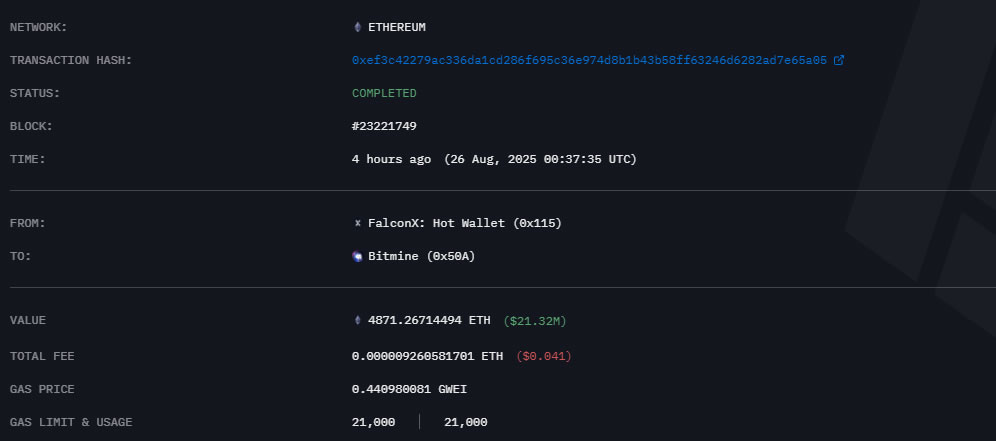

In the meantime, BitMine Immersion Applied sciences has continued its aggressive accumulation of Ether, shopping for the dip on Tuesday with the acquisition of 4,871 ETH price $21.3 million, based on Arkham Intelligence.

This brings its whole holdings to 1.72 million ETH, price round $7.5 billion at present market costs.

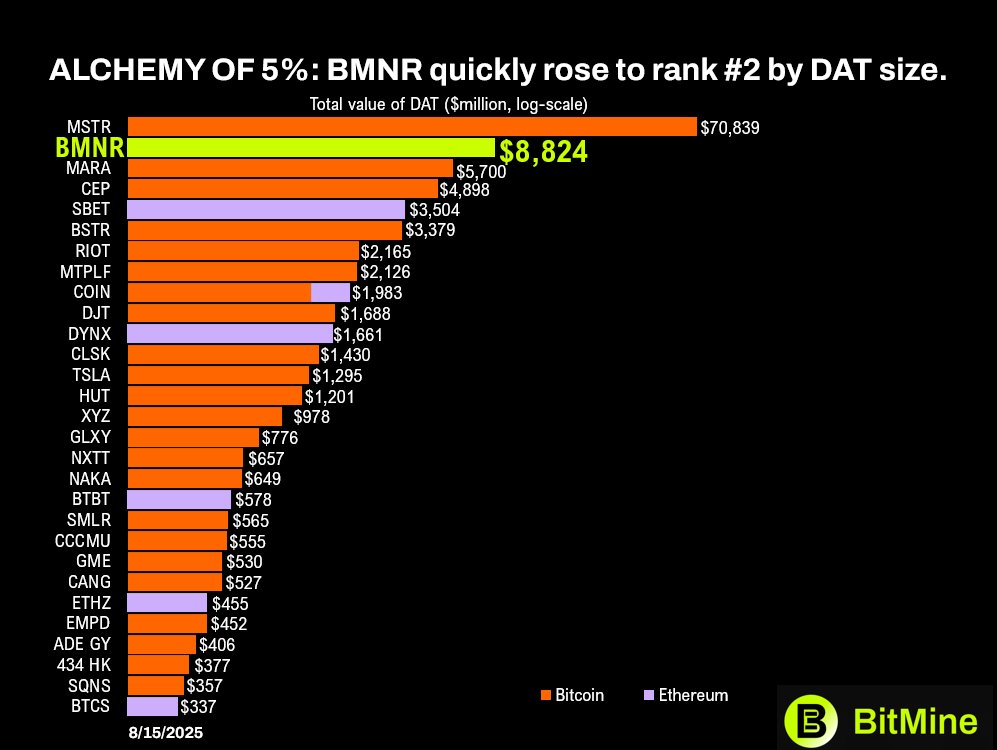

On Monday, BitMine disclosed it had elevated its crypto and money holdings by $2.2 billion to $8.8 billion, including over 190,500 tokens over the previous week.

Its crypto plus money internet asset worth per share climbed to $39.84, up from $22.84 in late July.

Crypto NAV is calculated because the crypto and money asset worth divided by totally diluted shares excellent, of which the agency has 221.5 million.

ETH treasuries proceed to develop

BitMine is the clear market chief for Ether treasuries with a 40% share of the whole 4.3 million ETH held by company entities, based on StrategyEthReserve.

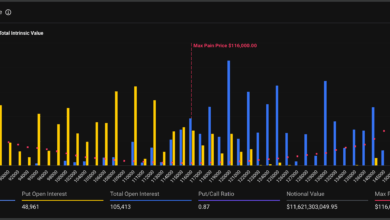

In the meantime, the world’s largest crypto treasury agency, Michael Saylor’s Technique, purchased the dip once more on Monday, scooping up 3,081 BTC for $357 million at $115,829 per Bitcoin.

Journal: ETH ‘god candle,’ $6K subsequent? Coinbase tightens safety: Hodler’s Digest