French semiconductor firm Sequans Communications filed for a $200 million at-the-market fairness providing on Monday to gas its Bitcoin treasury technique — with the longer-term purpose to amass 100,000 Bitcoin by 2030.

This system will permit the 4G and 5G chipmaker to concern American Depositary Shares — US dollar-denominated fairness shares of a international firm which can be traded on US inventory exchanges — at its discretion, it stated in a submitting to the Securities and Trade Fee on Monday.

“We intend to make use of it judiciously to optimize our treasury, enhance Bitcoin per share, and ship long-term worth to shareholders,” Sequans CEO Georges Karam stated in a press release.

BitBo’s Bitcoin treasury information exhibits the Paris-based firm at the moment holds 3,171 Bitcoin (BTC) value $349 million on its steadiness sheet, making it Europe’s second-largest company Bitcoin treasury after Germany’s Bitcoin Group SE, which owns 12,387 BTC.

Sequans first unveiled its plan to make use of Bitcoin as a core treasury asset on June 23, becoming a member of a rising development of publicly traded corporations adopting the cryptocurrency as an inflation hedge and retailer of worth. It has beforehand stated it’s striving to amass 100,000 Bitcoin by 2030.

The variety of public corporations holding Bitcoin has risen to 174, up from fewer than 100 at the beginning of 2025.

Sequans may notch 5,000 Bitcoin with the proceeds

The semiconductor firm stated the timing and quantity of any share gross sales beneath the fairness program shall be on the firm’s discretion, decided by market circumstances and different components.

Web proceeds from the providing are anticipated to be “primarily used to proceed accumulating Bitcoin in alignment with the Firm’s treasury technique,” Sequans stated.

At present market costs, $200 million may purchase Sequans one other 1,814 BTC, bringing its complete Bitcoin stash to just about 5,000 BTC — roughly the identical quantity as what Semler Scientific at the moment holds.

Sequans closed Monday buying and selling at $0.96, down 6.8% over the buying and selling day. It has since risen 0.41% in after-hours buying and selling.

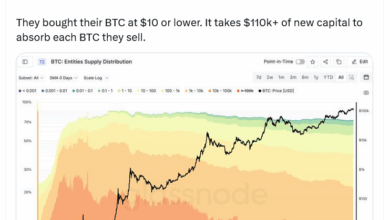

Bitcoin treasury corporations are shopping for the dip

The $200 million fairness providing comes amid a Bitcoin pullback to $110,045, 11.6% off the $124,517 all-time excessive it set on Aug. 14.

The biggest company Bitcoin holder, Technique, scooped up one other 3,081 Bitcoin on Monday — bringing its complete to 632,457 BTC — whereas Metaplanet purchased 103 BTC to begin the week

ETH treasury corporations steal the highlight

Company Bitcoin adoption has slowed lately because of the rise of Ether (ETH) treasury corporations, with BitMine Immersion Applied sciences — initially a Bitcoin mining firm, now turned ETH treasury firm — now holding the second-largest crypto treasury with $7.5 billion in ETH.

Associated: Technique buys $357M in Bitcoin as worth drops to $112K

SharpLink and The Ether Machine spherical out the highest three ETH treasury firm holdings with $3.24 billion and $1.51 billion in holdings, respectively, in line with StrategicETHReserve.xyz.

The ETH treasury adoption has contributed to ETH’s 198% worth rally since April 9, making up misplaced distance on Bitcoin from earlier within the present bull cycle.

Journal: Bitcoin’s long-term safety finances drawback: Impending disaster or FUD?