Right this moment in crypto, alternate commerce teams are working with international regulators to sluggish the rise of tokenized shares. Galaxy Digital, Multicoin Capital and Soar Crypto are stated to be elevating $1 billion to build up Solana. In the meantime, Bitcoin dropped to $112,174, with some analysts linking the transfer to a $2 billion whale sell-off.

World regulators, exchanges push again on tokenized shares in SEC letter: Report

Alternate trade associations and international regulators are becoming a member of forces to curb the expansion and adoption of tokenized shares, arguing that these merchandise don’t signify precise equities and expose buyers to important dangers.

In line with Reuters, the European Securities and Markets Authority (ESMA), the Worldwide Group of Securities Commissions (IOSCO), and the World Federation of Exchanges (WFE) have despatched a letter to the US Securities and Alternate Fee’s (SEC) Crypto Activity Pressure, urging stricter regulatory oversight of tokenized shares.

The organizations argue that tokenized shares “mimic” the equities they’re designed to signify however lack the investor protections constructed into conventional markets.

“We’re alarmed on the plethora of brokers and crypto-trading platforms providing or intending to supply so-called tokenized US shares,” the WFE instructed Reuters, with out naming particular companies or platforms. “These merchandise are marketed as inventory tokens or equal to the shares when they don’t seem to be.”

The push carries weight given the affect of the signatories. EMSA is a European Union company and one of many bloc’s three important monetary supervisory authorities.

IOSCO is a global physique that units requirements for securities regulation and investor safety throughout international markets.

WFE, headquartered within the UK, is an trade group representing exchanges and clearing homes worldwide.

The decision for clampdowns comes as tokenized securities acquire traction on Wall Road and past, pushed by the promise of higher effectivity, decrease prices and broader market entry by means of blockchain know-how.

Galaxy Digital, Multicoin, Soar Crypto plan $1B Solana fund: Report

Digital asset firms Galaxy Digital, Multicoin Capital and Soar Crypto are reportedly working to boost $1 billion to purchase Solana.

A Bloomberg report citing nameless sources stated on Monday that the three firms wish to type the most important treasury devoted to Solana (SOL). It added that the three firms have tapped Cantor Fitzgerald as lead banker.

The plan reportedly includes taking up a publicly traded entity to create a digital asset treasury firm targeted on SOL. Bloomberg stated that the Solana Basis has endorsed the efforts of the three firms, backing the treasury transfer.

SOL stays the sixth-largest token by market capitalization, in keeping with CoinGecko. It at the moment trades at nearly $200, up 6.6% within the final 30 days.

Bitcoin falls to $112K as neighborhood factors to Bitcoin whale gross sales

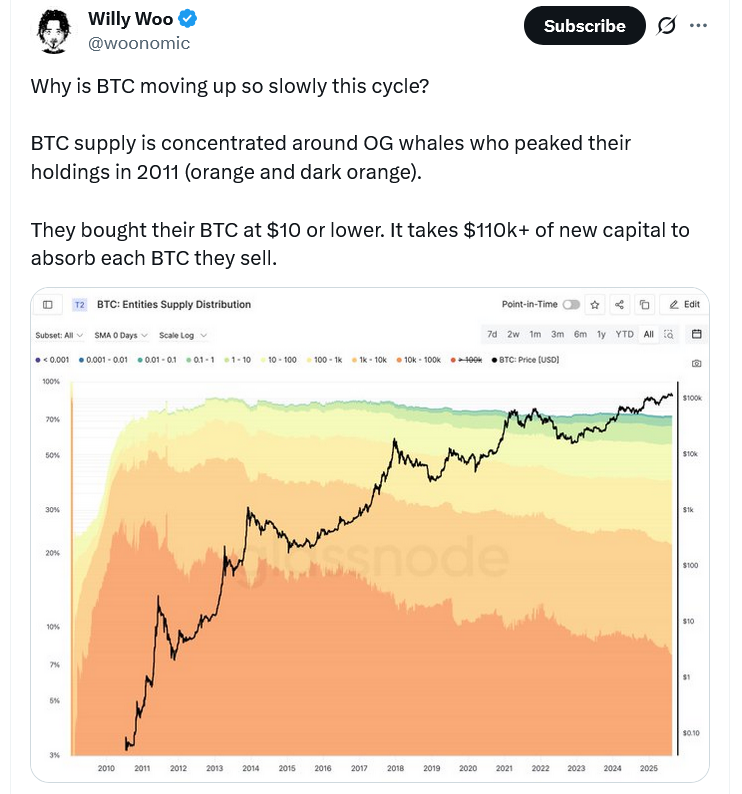

Bitcoin noticed a pointy fall to $112,174 on Sunday, and Bitcoiners like Willy Woo are blaming the drop and slower value motion on Bitcoin’s oldest whales cashing out after holding the asset for years.

“This differential in price foundation, the availability they maintain and their price of promoting has profound impacts on how a lot new capital that should are available in to raise value,” the Bitcoiner stated, noting it now takes over $110,000 of recent capital to soak up each Bitcoin.

His feedback had been made after a seven-year Bitcoin whale rotated nearly $2 billion price of Bitcoin into Ether during the last week, triggering a 2.2% fall in Bitcoin’s value in a brief 10-minute window on Sunday.

Bitcoin fell as little as $112,174 earlier than rebounding, whereas Ether dropped 4% earlier than making an identical restoration.

It additionally comes 4 days after one other crypto whale made a comparable transfer, promoting 670 Bitcoin price $76 million to open an extended ETH place.