Right now in crypto, alternate commerce teams are working with international regulators to sluggish the rise of tokenized shares. Galaxy Digital, Multicoin Capital and Leap Crypto are mentioned to be elevating $1 billion to build up Solana. In the meantime, Bitcoin dropped to $112,174, with some analysts linking the transfer to a $2 billion whale sell-off.

International regulators, exchanges push again on tokenized shares in SEC letter: Report

Change trade associations and international regulators are becoming a member of forces to curb the expansion and adoption of tokenized shares, arguing that these merchandise don’t characterize precise equities and expose buyers to important dangers.

In line with Reuters, the European Securities and Markets Authority (ESMA), the Worldwide Group of Securities Commissions (IOSCO), and the World Federation of Exchanges (WFE) have despatched a letter to the US Securities and Change Fee’s (SEC) Crypto Activity Drive, urging stricter regulatory oversight of tokenized shares.

The organizations argue that tokenized shares “mimic” the equities they’re designed to characterize however lack the investor protections constructed into conventional markets.

“We’re alarmed on the plethora of brokers and crypto-trading platforms providing or intending to supply so-called tokenized US shares,” the WFE instructed Reuters, with out naming particular companies or platforms. “These merchandise are marketed as inventory tokens or equal to the shares when they aren’t.”

The push carries weight given the affect of the signatories. EMSA is a European Union company and one of many bloc’s three principal monetary supervisory authorities.

IOSCO is a world physique that units requirements for securities regulation and investor safety throughout international markets.

WFE, headquartered within the UK, is an trade group representing exchanges and clearing homes worldwide.

The decision for clampdowns comes as tokenized securities acquire traction on Wall Road and past, pushed by the promise of higher effectivity, decrease prices and broader market entry by means of blockchain expertise.

Galaxy Digital, Multicoin, Leap Crypto plan $1B Solana fund: Report

Digital asset corporations Galaxy Digital, Multicoin Capital and Leap Crypto are reportedly working to boost $1 billion to purchase Solana.

A Bloomberg report citing nameless sources mentioned on Monday that the three corporations want to kind the biggest treasury devoted to Solana (SOL). It added that the three corporations have tapped Cantor Fitzgerald as lead banker.

The plan reportedly includes taking on a publicly traded entity to create a digital asset treasury firm targeted on SOL. Bloomberg mentioned that the Solana Basis has endorsed the efforts of the three corporations, backing the treasury transfer.

SOL stays the sixth-largest token by market capitalization, in response to CoinGecko. It at present trades at nearly $200, up 6.6% within the final 30 days.

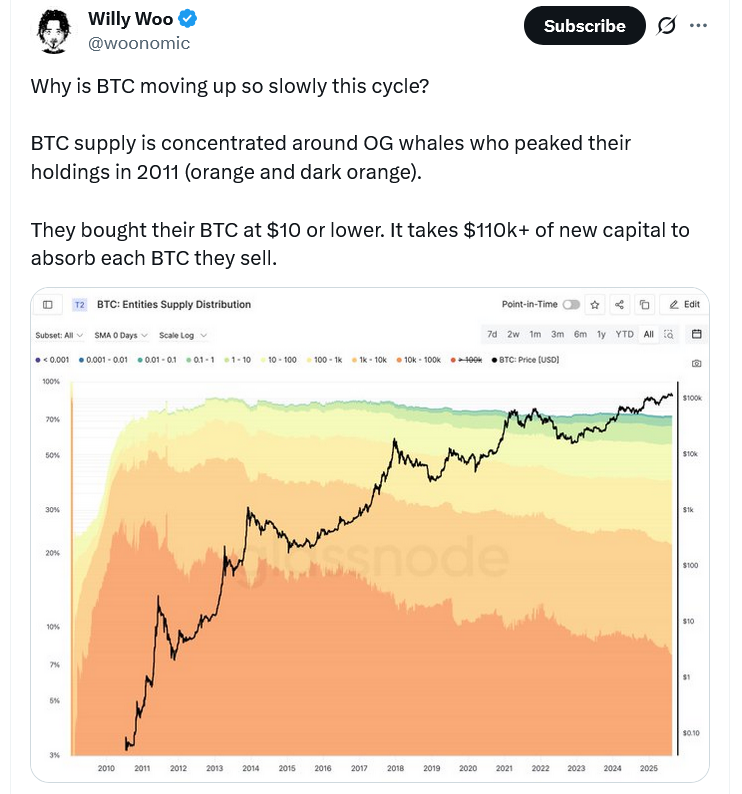

Bitcoin falls to $112K as neighborhood factors to Bitcoin whale gross sales

Bitcoin noticed a pointy fall to $112,174 on Sunday, and Bitcoiners like Willy Woo are blaming the drop and slower worth motion on Bitcoin’s oldest whales cashing out after holding the asset for years.

“This differential in value foundation, the provision they maintain and their price of promoting has profound impacts on how a lot new capital that should are available to elevate worth,” the Bitcoiner mentioned, noting it now takes over $110,000 of latest capital to soak up each Bitcoin.

His feedback had been made after a seven-year Bitcoin whale rotated nearly $2 billion price of Bitcoin into Ether during the last week, triggering a 2.2% fall in Bitcoin’s worth in a brief 10-minute window on Sunday.

Bitcoin fell as little as $112,174 earlier than rebounding, whereas Ether dropped 4% earlier than making the same restoration.

It additionally comes 4 days after one other crypto whale made a related transfer, promoting 670 Bitcoin price $76 million to open an extended ETH place.