US digital asset funding agency Canary Capital Group has filed with the Securities and Change Fee (SEC) to launch the Canary American-Made Crypto ETF (MRCA).

Based on a Friday submitting, the proposed fund would monitor an index of cryptocurrencies created, mined or primarily operated in the USA, with shares slated to commerce on Cboe BZX underneath the ticker MRCA. The belief additionally plans to stake its proof-of-stake holdings by third-party suppliers, including rewards to its internet asset worth.

The Made-in-America Blockchain Index will admit solely property that meet strict standards set by an oversight committee. Tokens have to be eligible for custody with a regulated US belief or financial institution, keep minimal liquidity, and commerce on a number of established venues.

Stablecoins, memecoins, and pegged tokens are excluded, and the index might be rebalanced quarterly.

Associated: Can Bitcoin ETFs exchange bonds in institutional portfolios?

The belief will present direct publicity to those property with out leverage or derivatives, whereas custody might be dealt with by a South Dakota-chartered belief firm, with most property saved in chilly storage.

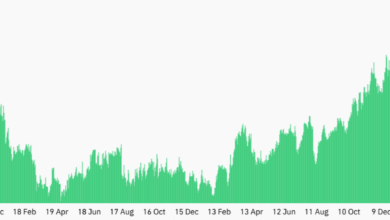

Based on Coinmarketcap’s “Prime Made in America Tokens by Market Cap” index, some tasks with American roots that may doubtless be within the index embody XRP (XRP), Solana (SOL), Dogecoin (DOGE), Cardano (ADA), Chainlink (LINK), Stellar (XLM), and others.

The submitting follows Canary’s latest software for a Trump Coin ETF, tied to the US President’s memecoin launched in January forward of his inauguration. Canary has additionally filed for ETFs tied to SOL, XRP, SUI, and TRX, which presently all stay underneath SEC overview.

Associated: Solana SSK ETF breaks $100M as Wall Avenue warms to crypto staking

On the heels of a shift in US coverage

Canary’s newest ETF submitting comes amid a broader pivot in US crypto coverage. In July, former SEC Commissioner Paul Atkins launched “Mission Crypto,” a plan to carry the regulator into the digital finance period by setting clearer tips for cryptocurrencies and tokenized property within the US.

On Aug. 5, the SEC additionally issued a employees assertion clarifying that particular liquid staking preparations don’t fall underneath securities legal guidelines, a transfer that might open the door for staking-based ETFs like Canary’s.

The SEC continues to push again choices

Regardless of its softened stance towards cryptocurrency, the SEC has continued to train warning when approving crypto ETFs.

This month, the company delayed a number of crypto ETF submitting choices, together with NYSE Arca’s Fact Social Bitcoin and Ethereum ETF to Oct. 8, whereas 21Shares and Bitwise’s Solana ETFs have been delayed to Oct. 16, and the 21Shares Core XRP Belief to Oct. 19.

The SEC on Monday prolonged its overview of Cboe BZX Change’s proposal to checklist and commerce shares of the WisdomTree XRP Fund as a commodity-based belief ETF, setting Oct. 24, 2025, as the brand new deadline.

The identical day, it additionally pushed again a call on the Canary PENGU ETF, giving itself till Oct. 12, 2025, to subject a ruling.

Journal: How crypto legal guidelines are altering the world over in 2025