Blockchain analytics agency Bubblemaps launched a report on Aug. 25 alleging that Hayden Davis coordinated a sniping operation on Kanye West’s YZY token that generated $12 million in earnings by 14 related wallets.

The investigation started with a timing evaluation exhibiting Davis, often known as Kelsier, acquired entry to $57 million in beforehand frozen funds, with YZY launching the next day.

Davis has confronted earlier controversies associated to the LIBRA token collapse, the place he denied fraud and insider buying and selling accusations.

A US choose unfroze $57.6 million in USDC stablecoins tied to the LIBRA token scandal on Aug. 20, giving Davis and former Meteora DEX CEO Ben Chow entry to funds that had been frozen in Might as a part of a class-action lawsuit.

Bubblemaps tracked a number of addresses funded from centralized exchanges the day earlier than YZY’s launch, discovering a cluster ready to snipe the token by funding transactions, Cross-Chain Switch Protocol transfers, and shared deposits linking again to Davis.

The related wallets bought YZY tokens as early as 1:54 A.M. UTC, only one minute after the announcement. The agency famous this sample displays Davis’s earlier involvement in sniping high-profile tokens, together with MELANIA and LIBRA.

Bubblemaps stated it couldn’t affirm whether or not Davis had insider data or direct connections to the YZY group, however documented the coordinated buying sample and revenue extraction.

The investigation continues as blockchain forensics corporations study celeb token launches for potential manipulation.

Controversial launch adopted by value colapse

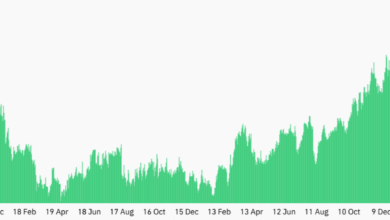

YZY’s controversial launch noticed buying and selling exercise drive its market capitalization close to $3 billion earlier than collapsing inside hours.

The token initially attracted fast inflows, pushing its absolutely diluted valuation into multibillion-dollar territory earlier than costs retreated greater than 90%, leaving its capitalization nearer to $137 million.

Impartial evaluation from Conor Grogan estimated that 94% of the preliminary provide was managed by insiders, together with a single multisig pockets that held 87% of tokens earlier than dispersing.

The YZY pool featured a 1% base charge with dynamic changes reaching 2.68%, mixed with wider bin steps introducing extra 4-5% slippage, creating estimated 10% round-trip prices for merchants.

YZY is down 82% from its all-time excessive of $3.1633 and was buying and selling at $0.5670 as of press time.