Key takeaways:

-

Bitcoin futures demand continues rising regardless of the latest worth weak point, indicating sustained dealer engagement.

-

The put choices maintained a premium over calls, reflecting persistent bearish sentiment amongst traders.

Bitcoin (BTC) traded right down to $109,400 on Monday, its lowest stage in additional than six weeks. The correction adopted an $11 billion sale by a 5-year dormant whale that had been dormant for five years, with proceeds rotating into Ether (ETH) spot and futures on decentralized change Hyperliquid.

Regardless of the value decline, demand for Bitcoin futures surged to an all-time excessive, prompting merchants to ask whether or not $120,000 is the subsequent logical step.

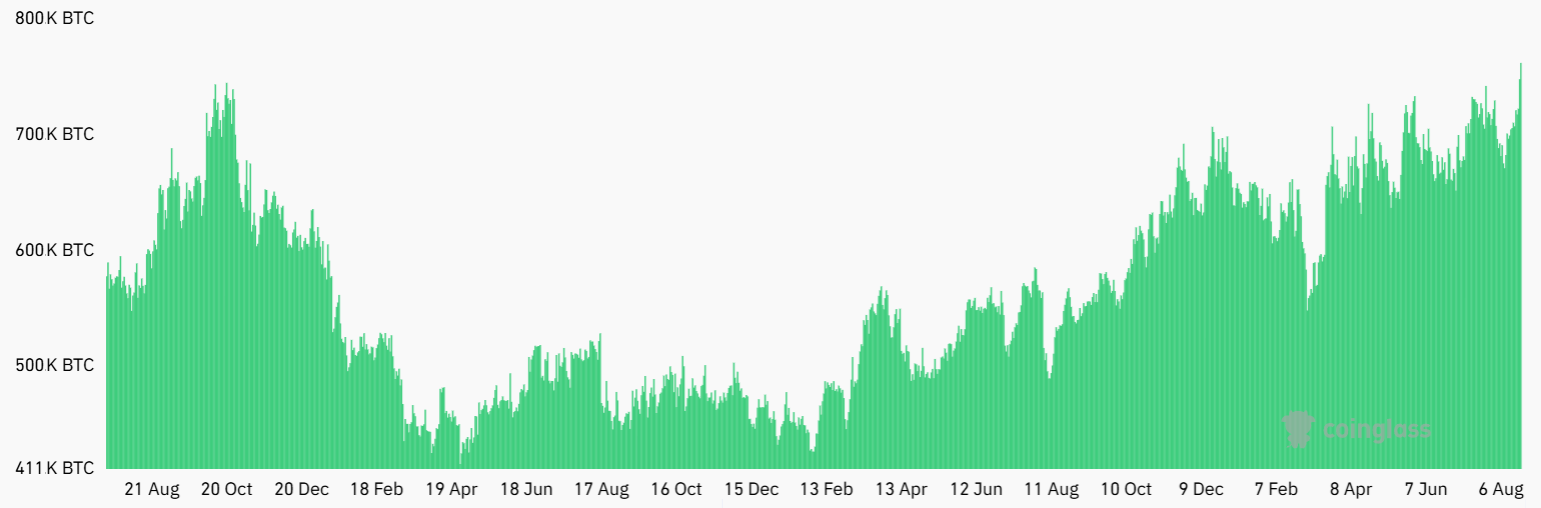

Bitcoin futures open curiosity climbed to an all-time excessive of BTC 762,700 on Monday, up 13% from two weeks earlier. The stronger demand for leveraged positions reveals merchants should not abandoning the market regardless of a ten% worth drop since Bitcoin’s all-time excessive on Aug. 14.

Whereas it is a constructive indicator, the $85 billion in futures open curiosity doesn’t essentially mirror optimism, since longs (patrons) and shorts (sellers) are at all times matched. If bulls lean too closely on leverage, a dip beneath $110,000 might set off cascading liquidations.

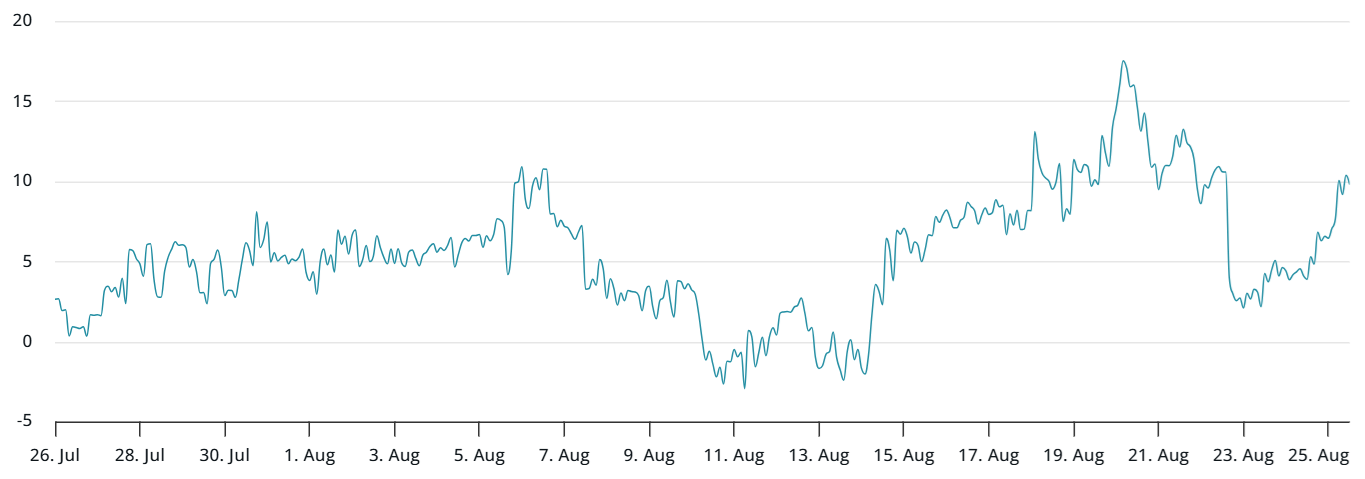

The Bitcoin futures premium is presently at a impartial 8%, up from 6% the earlier week. Notably, the metric has not remained above the ten% impartial threshold for greater than six months, which means even the $124,176 all-time excessive didn’t instill broad bullishness.

Leverage shakeout highlights liquidity however sparks suspicion

The latest decline blindsided overleveraged merchants, resulting in $284 million in liquidations of lengthy positions, in line with CoinGlass knowledge. The occasion confirmed that Bitcoin maintains deep liquidity even on weekends, however the velocity of execution raised suspicions, on condition that the vendor had held the place for years.

The Bitcoin perpetual futures funding charge dropped again to 11% after a short-lived uptick. In impartial markets, the speed often ranges between 8% and 12%. A few of the muted sentiment may be defined by $1.2 billion in web outflows from US-listed spot Bitcoin ETFs between Aug. 15 and Aug. 22.

To evaluate whether or not this stage of warning is worrying, merchants ought to study the BTC choices market.

Put (promote) choices are presently buying and selling at a ten% premium over name (purchase) devices, a transparent signal of bearish sentiment. Whereas extreme worry is clear, it isn’t uncommon following a $6,050 Bitcoin worth drop in simply two days. Market psychology has doubtless been influenced by whales shifting publicity from Bitcoin to Ether, although such flows are inclined to stabilize over time.

Associated: Technique buys $357M in Bitcoin as worth drops to $112K

Though latest weak point has weighed on sentiment, the prospect of a Bitcoin rally towards $120,000 has not vanished. Nonetheless, any sustained upside doubtless hinges on renewed spot ETF inflows, particularly as world development stays unsure. For now, the $13.8 billion month-to-month choices expiry on Friday might function the catalyst that determines whether or not traders re-enter the market.

This text is for normal data functions and isn’t meant to be and shouldn’t be taken as authorized or funding recommendation. The views, ideas, and opinions expressed listed here are the creator’s alone and don’t essentially mirror or signify the views and opinions of Cointelegraph.