Hyperliquid surpasses Robinhood in month-to-month buying and selling quantity for the third consecutive month

Hyperliquid registered extra buying and selling quantity than Robinhood for the third consecutive month, with July marking the biggest hole between platforms at 39.1%.

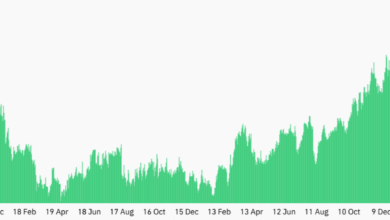

DefiLlama knowledge reveals the decentralized derivatives alternate traded $330.8 billion in mixed spot and perpetual quantity throughout July, whereas Robinhood processed $237.8 billion throughout all merchandise.

Robinhood’s July quantity was made up of $209.1 billion from equities, $195.8 million from choices, and $28.7 billion from crypto, primarily based on its Aug. 13 attestation.

Hyperliquid’s $93 billion benefit represents its strongest month-to-month efficiency towards the retail buying and selling platform since starting its successful streak.

Knowledge shared by Jon Ma from Artemis reveals Hyperliquid traded $256 billion in Might in comparison with Robinhood’s $192 billion, adopted by June volumes of $231 billion versus $193 billion, respectively.

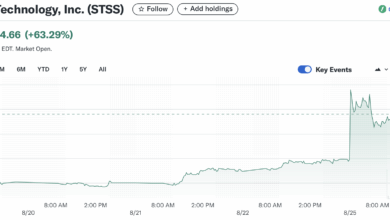

Additional, Hyperliquid approaches $2 trillion in year-to-date cumulative quantity from spot and perpetuals as of Aug. 25.

The protocol has been rising since June, when it registered $226.4 billion, then jumped to the $330.8 billion seen in July. As of Aug. 25, Hyperliquid has already surpassed $349 billion in month-to-month buying and selling quantity with spot and perpetual mixed.

Most effectivity

The constant outperformance positions Hyperliquid amongst dominant forces in crypto derivatives buying and selling regardless of minimal staffing necessities.

CEO Jeff Yan confirmed that the alternate operates with simply 11 core contributors, producing annualized income of $1.167 billion primarily based on DefiLlama estimates as of Aug. 20.

The platform achieved $106 million in income per worker on Aug. 20, surpassing know-how giants and former document holder Tether Restricted at $93 million per worker.

Knowledge gathered by Hyperliquid France locations OnlyFans third at $37.6 million, whereas established tech corporations path significantly with Nvidia at $3.6 million, Apple at $2.4 million, and Meta at $2.2 million per worker.

The buying and selling quantity dominance happens amid institutional adoption of crypto derivatives merchandise, with Hyperliquid capturing market share from centralized exchanges and conventional buying and selling platforms.

Hyperliquid’s constant quantity management over Robinhood demonstrates the competitiveness of decentralized finance protocols towards established monetary know-how corporations.

This distinction is especially true in crypto-native buying and selling merchandise, the place conventional platforms face regulatory and operational constraints limiting their market attain.