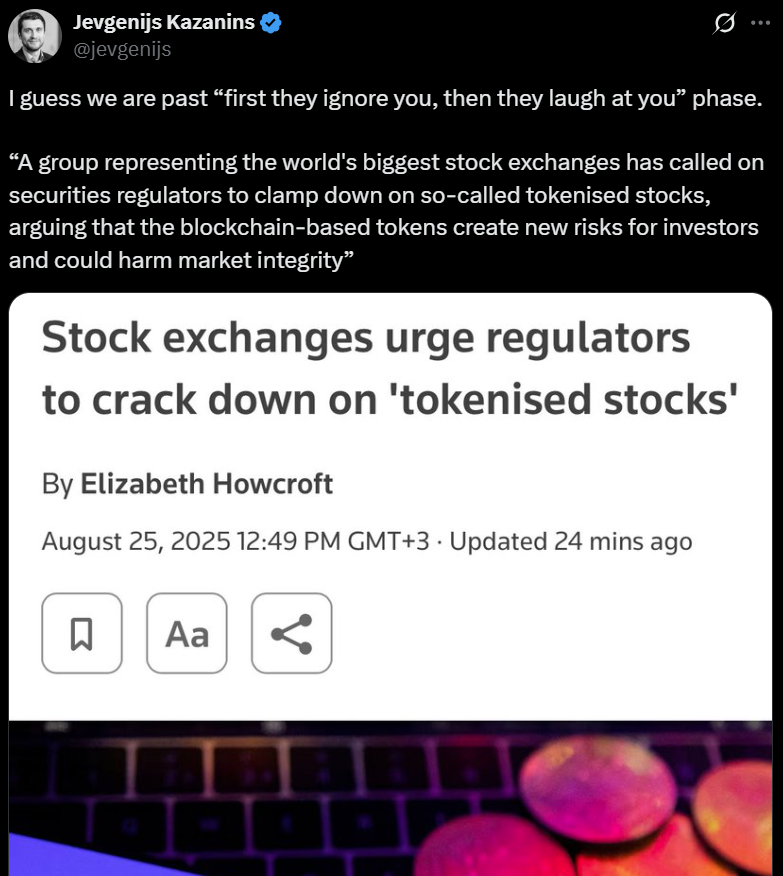

Change trade associations and world regulators are becoming a member of forces to curb the expansion and adoption of tokenized shares, arguing that these merchandise don’t symbolize precise equities and expose traders to important dangers.

In response to Reuters, the European Securities and Markets Authority (ESMA), the Worldwide Group of Securities Commissions (IOSCO), and the World Federation of Exchanges (WFE) have despatched a letter to the US Securities and Change Fee’s (SEC) Crypto Activity Drive, urging stricter regulatory oversight of tokenized shares.

The organizations argue that tokenized shares “mimic” the equities they’re designed to symbolize however lack the investor protections constructed into conventional markets.

“We’re alarmed on the plethora of brokers and crypto-trading platforms providing or intending to supply so-called tokenized US shares,” the WFE advised Reuters, with out naming particular companies or platforms. “These merchandise are marketed as inventory tokens or equal to the shares when they aren’t.”

The push carries weight given the affect of the signatories. EMSA is a European Union company and one of many bloc’s three foremost monetary supervisory authorities.

IOSCO is a global physique that units requirements for securities regulation and investor safety throughout world markets.

WFE, headquartered within the UK, is an trade group representing exchanges and clearing homes worldwide.

The decision for clampdowns comes as tokenized securities acquire traction on Wall Avenue and past, pushed by the promise of higher effectivity, decrease prices and broader market entry via blockchain know-how.

The worth of tokenized property has already climbed previous $26 billion, in accordance with trade information.

Tokenized shares — digital representations of conventional equities issued on a blockchain — stay a small slice of that market, however their footprint is predicted to develop as main platforms resembling Coinbase, Kraken and Robinhood transfer into the area.

Associated: The way forward for crypto within the Asia-Center East hall lies in permissioned scale

Foyer teams ramp up efforts to dam crypto takeover

This isn’t the primary time conventional trade lobbies have joined forces to gradual the expansion of blockchain innovation. As US lawmakers mulled over the GENIUS stablecoin invoice, banking teams quietly lobbied to exclude yield-bearing stablecoins — a function that might have straight competed with their service choices.

They have been in the end profitable, with GENIUS explicitly barring stablecoin issuers from paying curiosity to holders.

Whereas the passage of GENIUS was extensively seen as a win for the stablecoin trade, it additionally got here with a trade-off. “By explicitly prohibiting stablecoin issuers from providing yield, the GENIUS Act truly protects a serious benefit of cash market funds,” Temujin Louie, CEO of crosschain interoperability protocol Wanchain, advised Cointelegraph.

Nonetheless, the SEC seems open to tokenization on the highest ranges. In July, SEC Chair Paul Atkins described tokenization as an “innovation” that ought to be superior throughout the US financial system.

That very same month, SEC Commissioner Hester Peirce careworn that tokenized securities, together with tokenized equities, should nonetheless adjust to current securities legal guidelines.

Associated: VC Roundup: Bitcoin DeFi surges, however tokenization and stablecoins acquire steam