B Technique, a digital asset funding agency based by former Bitmain executives, plans to launch a $1 billion crypto treasury centered on investing in BNB, the native token of the Binance ecosystem.

In response to a Monday announcement, the brand new BNB (BNB) treasury is backed by YZi Labs, the household workplace of Binance co-founder Changpeng Zhao.

The brand new firm will likely be structured equally to 10X Capital, which lately launched a BNB treasury with YZi Labs’ assist, a spokesperson for B Technique instructed Cointelegraph.

To fund its crypto treasury, 10X Capital raised $250 million with YZi Labs’ assist in July, allocating the capital to build up and maintain BNB as a long-term reserve asset.

“We plan to collaborate with a US-listed firm via a personal placement,” the consultant mentioned. “Following the capital injection from this placement, the listed firm will buy BNB, transitioning its enterprise mannequin to give attention to holding and managing BNB belongings as a devoted treasury entity.

“We goal to function a bridge between the US and Asian markets. There’s vital demand from Asian traders in search of entry to the US inventory market, and so they belief our workforce to assist handle their investments inside this treasury technique.”

YZi Labs, previously referred to as Binance Labs, is led by Ella Zhang and is overseen by Binance’s Zhao.

Associated: ‘Wealthiest US prisoner’: How did Binance founder CZ get there?

BNB treasury firms rise and fall

In response to Cointelegraph indexes, BNB is the fourth-largest crypto token by market capitalization, price $120.3 billion at this writing. Past buying and selling, BNB is used to pay transaction charges, take part in staking and governance, making it central throughout the Binance’s broader ecosystem.

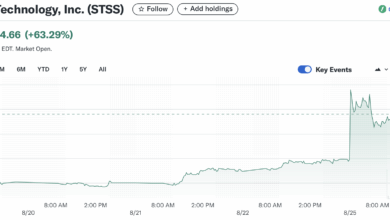

Corporations embracing BNB as a reserve asset have emerged in current months, with traders sending combined indicators via inventory efficiency.

Shares of CEA Industries surged 550% after the corporate unveiled plans for a BNB treasury. Equally, BMB Community Firm’s $500 million BNB treasury automobile was oversubscribed in its newest funding spherical.

Forbes reported in June 2024 that Zhao managed about 64% of your complete BNB provide.

Journal: Crypto Metropolis Information to Seattle: Website of CZ’s downfall and pot crypto distributors