- The Dow Jones backslid on Monday from all-time peak final Friday.

- Investor sentiment stays excessive, however market has trimmed slightly off the highest.

- A quiet begin to the week offers method to the most recent batch of US inflation information.

The Dow Jones Industrial Common (DJIA) noticed a slight decline on Monday, with the foremost fairness index easing again from file highs posted final week. Market exuberance at what buyers are broadly deciphering as a dovish look from Federal Reserve (Fed) Chair Jerome Powell has given method to a sedate begin to the week as buyers brace for the most recent spherical of key US inflation information.

Jerome Powell’s look on the Jackson Gap Financial Symposium despatched world markets scrambling to ramp up bets of an rate of interest minimize on September 17. In keeping with market individuals, Fed Chair Powell gave a much more dovish speech than many had anticipated. To the Fed head’s credit score, regardless of the big day calling for some further verbiage, little or no of Powell’s testimony strayed very removed from the usual “information dependent” speech notes which have circled the Fed over the previous yr.

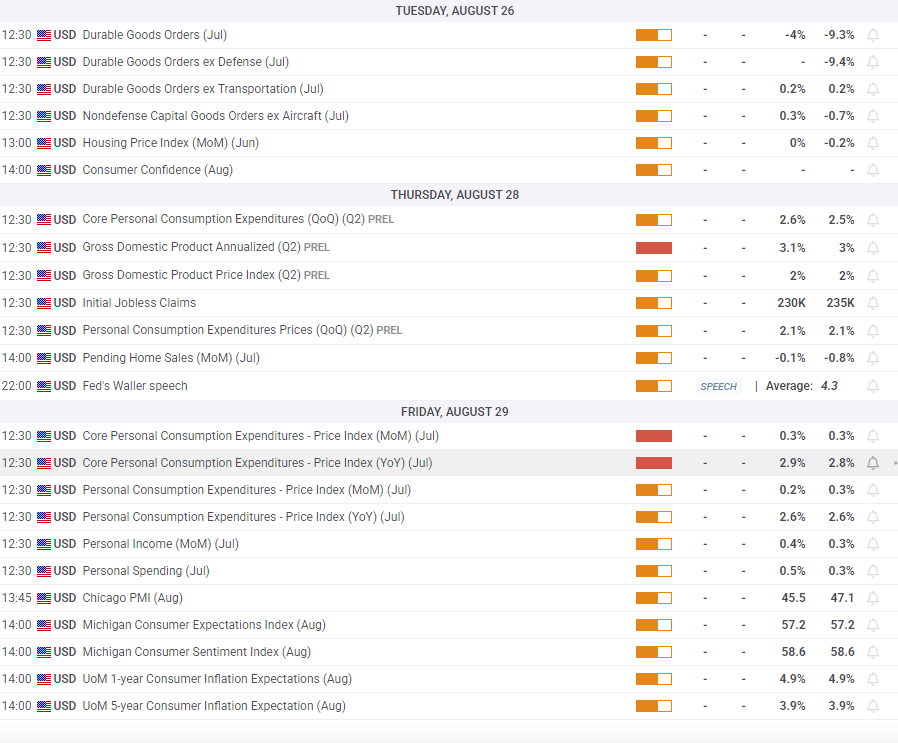

With Jackson Gap now fading into reminiscence, buyers are pivoting to face a harmful week: US Sturdy Items Orders, Gross Home Product (GDP) development, and Private Consumption Expenditure Worth Index (PCE) inflation. The important thing information launch this week will likely be PCE inflation, which is slated for Friday. Markets are nonetheless betting that the Fed will likely be extra involved about quickly declining US job figures than near-term inflation results when the Fed’s subsequent rate of interest name rolls round on September 17.

Nonetheless, any unpleasantness on this week’s PCE inflation print might throw a tough wrench into the works. Regardless of very actual issues that the US labor market is softening a lot sooner than many anticipated, a pointy upswing in inflation will nonetheless be greater than sufficient to push Fed policymakers deeper into their long-running wait-and-see method earlier than making any arduous calls on transferring charges.

Dow Jones day by day chart

Dow Jones FAQs

The Dow Jones Industrial Common, one of many oldest inventory market indices on the earth, is compiled of the 30 most traded shares within the US. The index is price-weighted slightly than weighted by capitalization. It’s calculated by summing the costs of the constituent shares and dividing them by an element, presently 0.152. The index was based by Charles Dow, who additionally based the Wall Avenue Journal. In later years it has been criticized for not being broadly consultant sufficient as a result of it solely tracks 30 conglomerates, in contrast to broader indices such because the S&P 500.

Many various components drive the Dow Jones Industrial Common (DJIA). The combination efficiency of the element corporations revealed in quarterly firm earnings studies is the principle one. US and world macroeconomic information additionally contributes because it impacts on investor sentiment. The extent of rates of interest, set by the Federal Reserve (Fed), additionally influences the DJIA because it impacts the price of credit score, on which many companies are closely reliant. Due to this fact, inflation generally is a main driver in addition to different metrics which impression the Fed selections.

Dow Concept is a technique for figuring out the first pattern of the inventory market developed by Charles Dow. A key step is to match the course of the Dow Jones Industrial Common (DJIA) and the Dow Jones Transportation Common (DJTA) and solely comply with traits the place each are transferring in the identical course. Quantity is a confirmatory standards. The idea makes use of components of peak and trough evaluation. Dow’s principle posits three pattern phases: accumulation, when sensible cash begins shopping for or promoting; public participation, when the broader public joins in; and distribution, when the sensible cash exits.

There are a variety of the way to commerce the DJIA. One is to make use of ETFs which permit buyers to commerce the DJIA as a single safety, slightly than having to purchase shares in all 30 constituent corporations. A number one instance is the SPDR Dow Jones Industrial Common ETF (DIA). DJIA futures contracts allow merchants to invest on the long run worth of the index and Choices present the best, however not the duty, to purchase or promote the index at a predetermined value sooner or later. Mutual funds allow buyers to purchase a share of a diversified portfolio of DJIA shares thus offering publicity to the general index.