ETHZilla (ETHZ) has approved a $250 million inventory repurchase program as the corporate doubles down on its ether-focused treasury technique, the agency mentioned in a press launch Monday.

The Florida-based agency mentioned its board accepted the buyback efficient instantly, with this system set to run till June 30, 2026, or till the total $250 million allocation is exhausted.

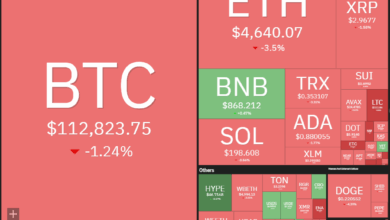

Alongside the transfer, The Nasdaq-listed firm disclosed that it now holds 102,237 ETH, acquired at a median worth of $3,948.72.

At present market valuations, the stash is value roughly $489 million. The corporate additionally reported holding roughly $215 million in U.S. greenback money equivalents.

“As we proceed to scale our ETH reserves and pursue differentiated yield alternatives, we consider an aggressive inventory repurchase program on the present inventory worth underscores our dedication to maximizing worth for shareholders,” mentioned McAndrew Rudisill, government chairman of ETHZilla, within the launch.

ETHZilla additionally launched its proprietary Electrical Asset Protocol, which it says will likely be used to generate increased yields on its crypto holdings.

As of August 24, 2025, the corporate reported 102,237 ETH valued at about $489 million, $215 million in money equivalents, and 165,478,655 shares excellent, as of August 22.

The buyback provides one other layer to ETHZilla’s technique of aggressively constructing ether reserves whereas leveraging new yield protocols to bolster returns.

ETHZilla shares tumbled almost 30% on Friday after the corporate disclosed that shareholders filed to supply as much as 74.8 million convertible shares. The inventory was was buying and selling 4.5% decrease, round $3.15, at publication time.

Learn extra: ETHZilla Shares Plunge Nearly 30% as Dilution Fears Overshadow $349M Ether Treasury