Key takeaways:

-

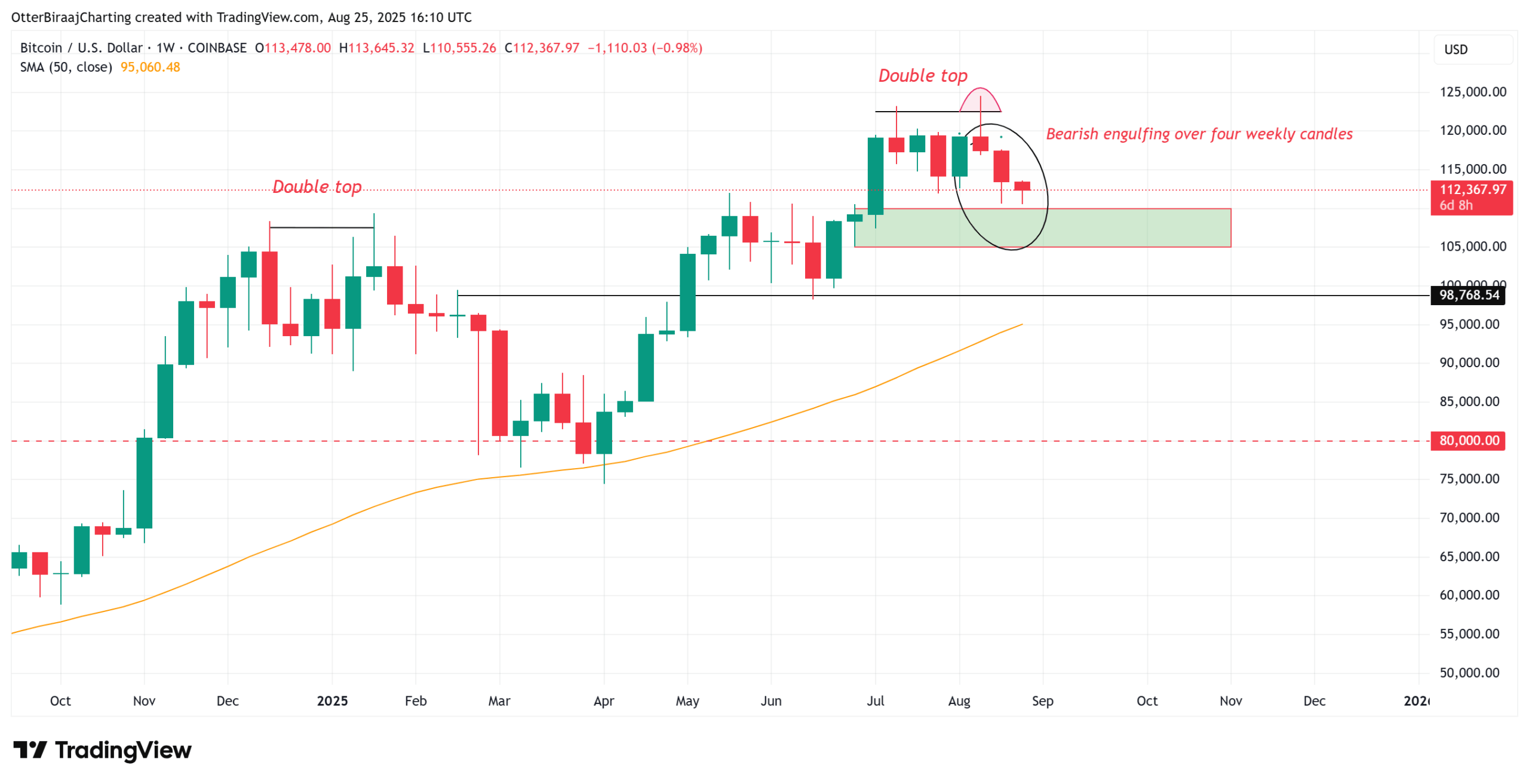

Bitcoin’s sharp rebound after Jackson Gap fizzled right into a bearish weekly engulfing candle.

-

Onchain knowledge exhibits $105,000 as the important thing assist as mid-size wallets promote.

-

Seasonal weak point and spot BTC ETF fatigue elevate dangers of a drop towards $100,000–$92,000.

Bitcoin (BTC) posted a pointy rebound on Friday, gaining 3.91% to $117,300 from $111,700 after dovish commentary from the Jackson Gap symposium boosted threat urge for food.

It marked BTC’s strongest each day return since July 10, fueling optimism for one more leg towards contemporary all-time highs. Nevertheless, momentum shortly evaporated, with Bitcoin reversing over the weekend and sliding to $110,600 on Monday.

A bearish weekly engulfing candle underscores draw back vulnerability, as onchain knowledge factors to broad distribution amongst holders.

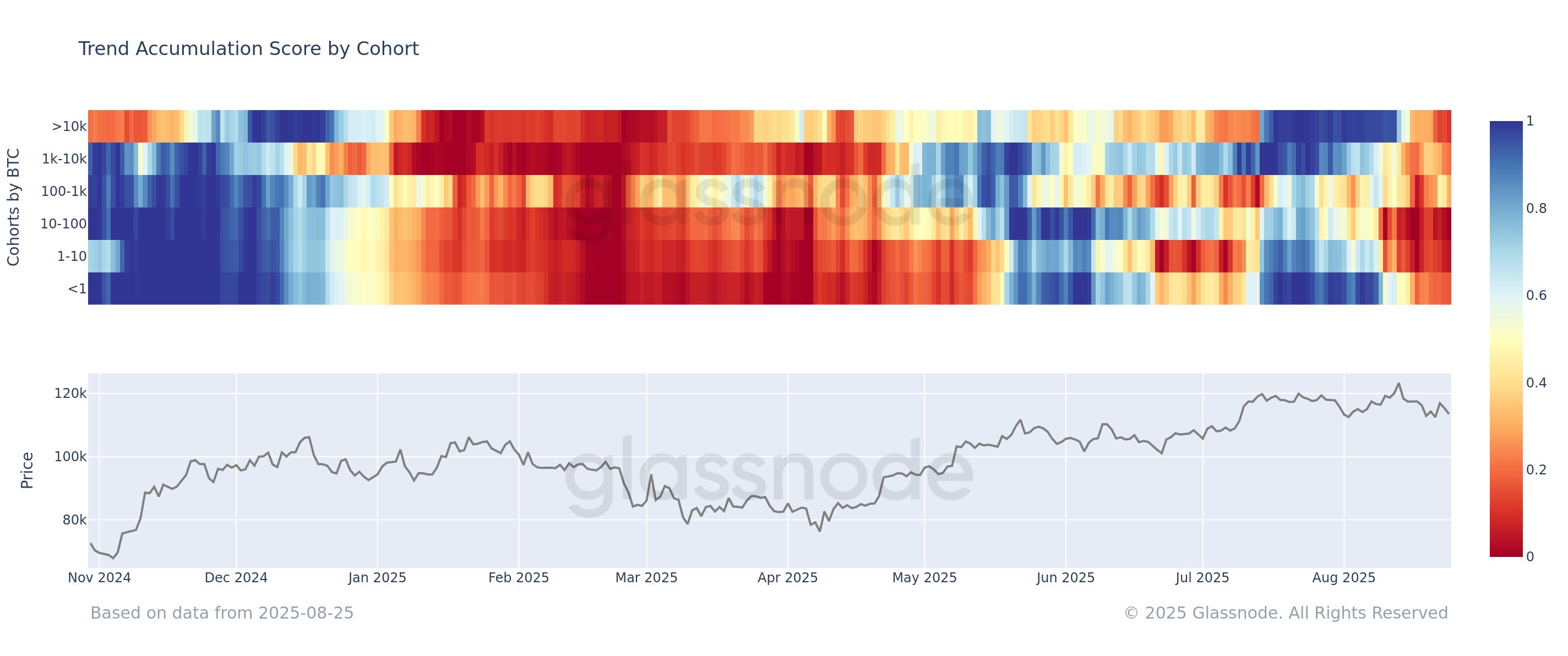

Knowledge from Glassnode exhibits all BTC pockets cohorts have now shifted into distribution, led by the ten–100 BTC group. The synchronized habits throughout pockets sizes highlights uniform sell-side strain, weighing on value stability.

Equally, analyst Boris Vest notes a break up throughout pockets habits: smaller holders (0–1 BTC) have steadily amassed for the reason that peak, whereas 1–10 BTC wallets resumed shopping for under $107,000. Against this, 10–100 BTC wallets flipped to web sellers after $118,000, whereas giant holders above 1,000 BTC stay constant distributors.

Nevertheless, the 100–1,000 BTC group is break up between accumulation and distribution round $105,000, marking it as the important thing assist zone and the final stronghold earlier than main corrections.

Bitcoin realized value knowledge underscores this inflection. The realized value for one to three-month holders sits at $111,900, whereas the three to six-month and 6–12 month cohorts are anchored a lot decrease at $91,630 and $89,200, respectively.

The huge hole displays heavy short-term positioning close to latest highs, versus longer-term holders with price bases nearer to $90,000.

Market evaluation means that if Bitcoin loses $105,000, the shortage of dense price assist between present ranges and $90,000 may speed up draw back momentum. Such a breakdown may power latest consumers to capitulate, leaving the $92,000–$89,000 vary as the following main demand zone.

Associated: Bitcoin late longs worn out as sub-$110K BTC value calls develop louder

Bitcoin seasonality and ETF fatigue kick in

The present pullback additionally aligns with Bitcoin’s seasonal tendencies. Traditionally, August to September has marked a interval of weak point, typically amplified by Asia’s “ghost month,” which runs this yr from Aug. 23 to Sept. 21. Cointelegraph reported that this era has typically coincided with softer threat urge for food and profit-taking amongst merchants.

Since 2017, Bitcoin has posted a median ghost month decline of 21.7%, with notable drops of –39.8% in 2017 and –23% in 2021. Based mostly on these averages, a retreat towards the $105,000–$100,000 vary stays according to seasonal patterns and technical assist zones.

Including to the cautious tone, crypto dealer Roman Buying and selling flags structural dangers in BTC’s present rally. The analyst stated that BTC/EUR has not registered a brand new all-time excessive since final yr, suggesting that latest upside is extra carefully tied to a weakening US greenback than natural demand.

Roman additional warns that the post-spot Bitcoin exchange-traded fund (ETF) launch enthusiasm could also be fading, with higher-timeframe exhaustion resembling previous distribution phases.

Associated: Bitcoin OG whales responsible for BTC’s painful rise: Willy Woo

This text doesn’t comprise funding recommendation or suggestions. Each funding and buying and selling transfer entails threat, and readers ought to conduct their very own analysis when making a call.