Key takeaways:

-

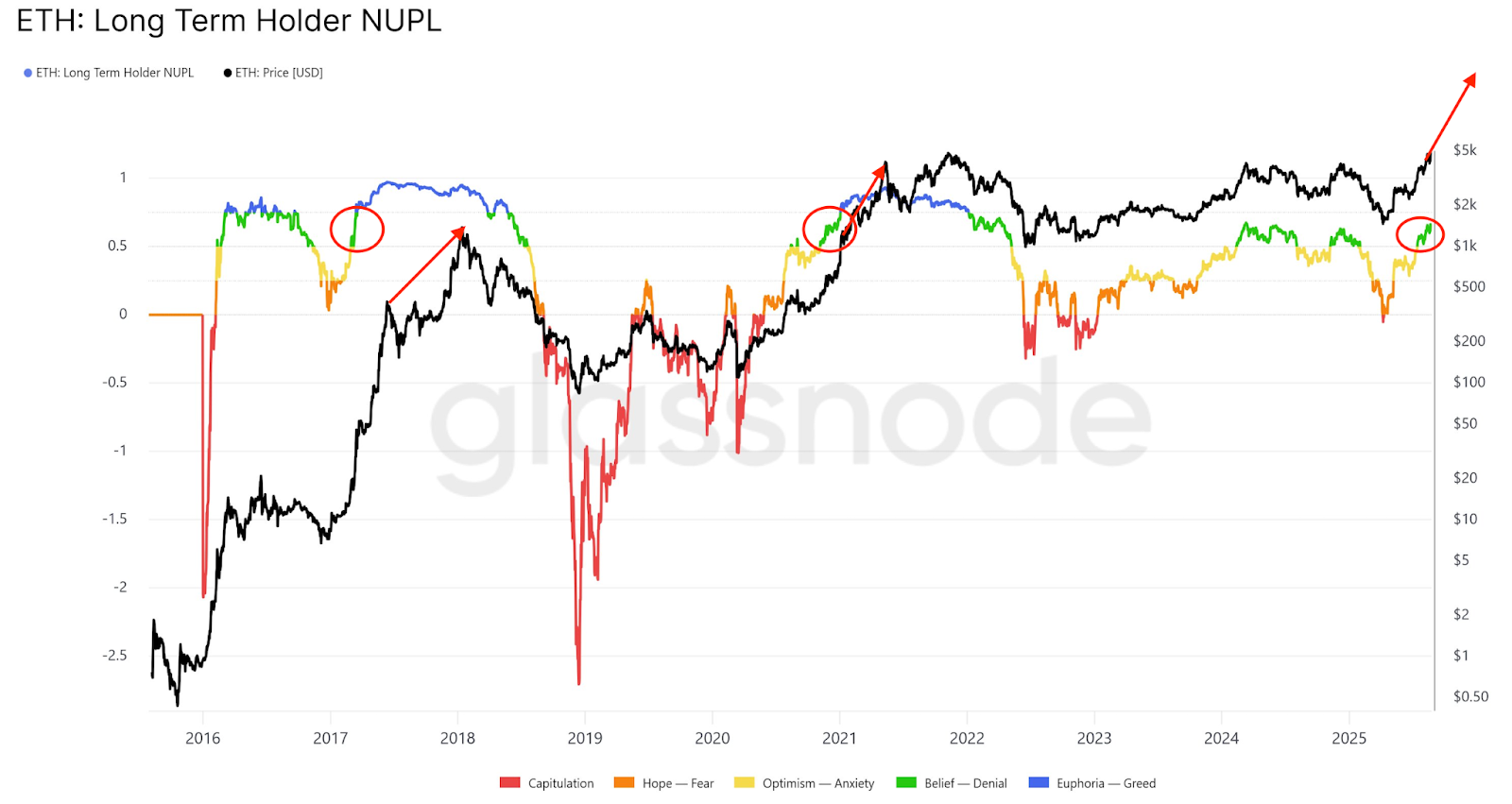

Ether’s long-term holder internet unrealized revenue/loss indicator suggests the worth has entered the “perception” section.

-

The market worth to realized worth suggests ETH is undervalued, with room to run towards $5,500.

-

Ether’s rounded backside sample targets $12,100.

Ether (ETH) worth has rallied greater than 240% since April to set a file excessive above $5,000 on Sunday. Because of this, buyers’ profitability has risen to ranges seen prior to now bull cycles, suggesting that the ETH market is coming into the “perception” section, rising the probabilities of an prolonged rally.

Ethereum investor sentiment in “perception”

Onchain information factors out similarities between the present stage of the Ether market and former bull cycles.

Ether’s long-term holder (LTH) internet unrealized revenue/loss (NUPL) indicator has entered the “belief-denial” (inexperienced) zone, a place that traditionally precedes vital worth rallies, mentioned fashionable analyst Gert van Lagen in an X submit on Monday.

The LTH NUPL measures the distinction between the relative unrealized revenue and relative unrealized lack of buyers who’ve held Bitcoin for at the very least 155 days.

Associated: Bitcoin whales swap BTC for Ether as dealer sees ETH at $5.5K subsequent

This zone is especially vital as a result of it suggests ETH has not but reached the euphoric section (blue) sometimes related to cycle peaks.

In earlier market cycles, the transition from perception to euphoria has coincided with substantial worth will increase.

For that to happen, ETH worth “nonetheless must climb additional,” van Lagen defined, including:

“$10K and $20K $ETH should not unimaginable.”

The market worth to realized worth (MVRV) ratio provides one other layer of validation to the bullish thesis. With a present each day studying of two.08, considerably decrease than a peak of three.8 in 2021 and 6.49 in 2017, the metric suggests Ethereum stays comparatively undervalued.

This decrease MVRV ratio signifies subdued profit-taking and elevated potential for sustained worth appreciation.

Ether’s MVRV excessive deviation pricing bands additionally recommend that ETH worth nonetheless has extra room for additional growth earlier than the unrealized revenue held by buyers reaches an excessive degree represented by the uppermost MVRV band at $5,500, as proven within the chart beneath.

ETH worth analysts goal $10,000 and past

However the worth can go even greater from a technical perspective. Ether’s worth motion has validated a megaphone, a chart sample that has been forming on the weekly candle chart since December 2023, as noticed by crypto analyst Jelle.

“This bullish megaphone has a goal of $10,000, and $ETH has defeated each resistance degree standing in its manner,” the analyst mentioned in an X submit on Monday, including:

“Clear skies forward. Deliver it on.”

Fellow analyst Mickybull Crypto echoed this view, saying that “ETH delivered as anticipated,” referring to Ether’s run to all-time highs above $5,000 on Sunday.

The analyst added that their cycle targets for Ether are $7,000-$11,000.

The ETH/USD pair displayed power after breaking above a rounded backside chart sample on the each day chart. The worth retested the neckline of the sample at $4,100 to substantiate the breakout.

The bulls will now try and push the worth towards the technical goal of the prevailing chart sample at $12,130, or a 161% rise from the present worth.

Different analysts additionally predict that Ether may attain $12,000 and even greater in 2025, citing potential rate of interest cuts, capital inflows by way of spot Ethereum ETFs, and demand from ETH treasury firms, which stay notably sturdy.

This text doesn’t include funding recommendation or suggestions. Each funding and buying and selling transfer includes danger, and readers ought to conduct their very own analysis when making a call.