Cryptocurrency funding merchandise reversed an rising influx development, with vital outflows final week as Bitcoin and Ether costs declined.

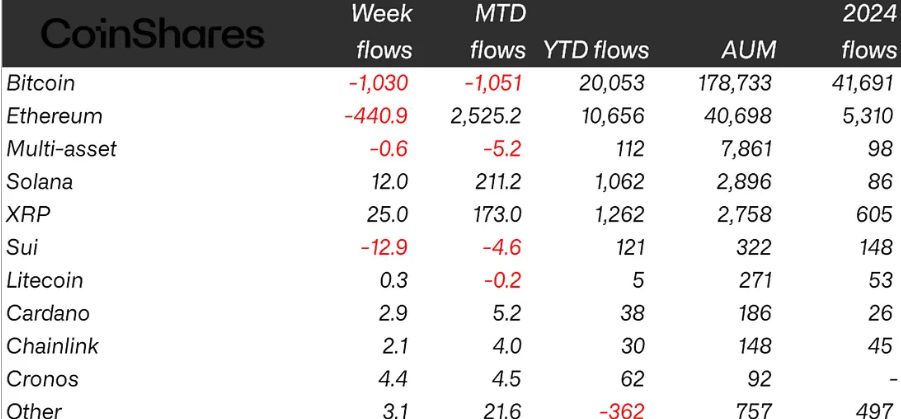

International crypto exchange-traded merchandise (ETPs) noticed $1.43 billion of outflows final week, ending a two-week influx run that introduced in $4.3 billion, CoinShares reported on Monday.

The outflows got here amid Bitcoin (BTC) dipping from above $116,000 on Aug.18 to $112,000 by the top of the buying and selling week, whereas Ether (ETH) tumbled beneath $4,100 on Tuesday after beginning the week at round $4,250, in line with CoinGecko.

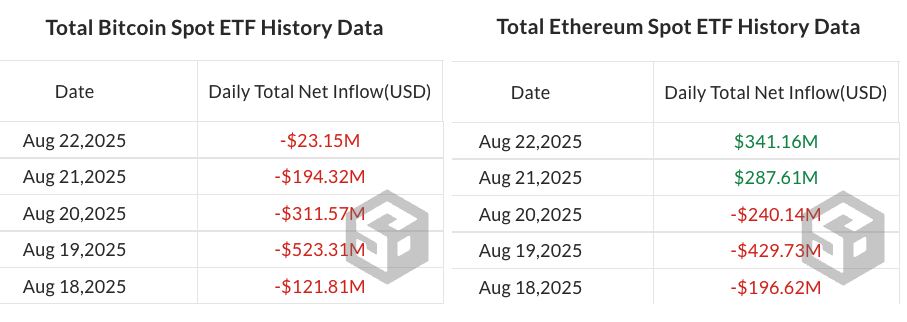

Final week’s losses marked the second-biggest outflows on report for spot Ether exchange-traded funds (ETFs), with nearly $430 million withdrawn on Tuesday alone, in line with SoSoValue.

Largest outflows since March

In keeping with CoinShares’ head of analysis, James Butterfill, the $1.4 billion in outflows from crypto funds have been the largest losses since March 2025.

Butterfill attributed the sell-off to “more and more polarized” investor sentiment over US financial coverage, with pessimism across the Federal Reserve’s stance driving $2 billion outflows early within the week.

“Nevertheless, sentiment shifted later within the week following Jerome Powell’s deal with on the Jackson Gap Symposium, which was broadly interpreted as extra dovish than anticipated, sparking inflows of $594 million,” he added.

Shift in tone mirrored in Ethereum

Butterfill stated the shift in tone was extra strongly mirrored in Ether, which noticed a pointy mid-week restoration, leading to $440 million of outflows.

Bitcoin ETPs noticed considerably greater outflows, totaling greater than $1 billion.

The analyst emphasised a notable change in investor sentiment towards Bitcoin and Ether given the month-to-date inflows, the place Bitcoin has skilled $1 billion outflows versus Ether’s $2.5 billion of inflows.

Associated: Bitcoin ETFs hit 5-day dropping streak, however Pomp says BTC is oversold

“Inflows year-to-date for Ethereum symbolize 26% of complete property underneath administration in comparison with simply 11% for Bitcoin,” Butterfill added.

Within the meantime, altcoin flows have been blended, with XRP (XRP) seeing $25 million in inflows, Solana (SOL) posting $12 million good points, whereas Sui (SUI) and Toncoin (TON) noticed outflows of $13 million and $1.5 million, respectively.

Journal: ETH ‘god candle,’ $6K subsequent? Coinbase tightens safety: Hodler’s Digest, Aug. 17 – 23