Technique and Metaplanet collectively management 651,448 BTC price $72.6B after shock $367M purchase

Company demand for Bitcoin continues regardless of its unstable value efficiency, as Technique and Metaplanet each expanded their holdings in late August.

On Aug. 25, the 2 corporations introduced that they acquired greater than 3,100 BTC, reflecting how institutional treasuries straight scale back accessible provide and form market liquidity.

Technique’s first main buy in August

Technique, the world’s largest company holder of Bitcoin, confirmed on Aug. 25 that it bought 3,081 BTC for $356.9 million.

The agency stated it paid a mean of $115,829 per coin, utilizing proceeds from current gross sales of its Class A standard inventory and most well-liked share choices.

This acquisition raised Technique’s complete stash to 632,457 BTC, gathered at a price of roughly $46.5 billion. The corporate’s common buy value now stands at $73,527 per Bitcoin.

At present market ranges, these holdings are valued at practically $70.56 billion, equating to a revenue margin of round 51.7%.

The transfer represents Technique’s most important purchase this month, following smaller acquisitions of 155 BTC and 430 BTC earlier in August.

It additionally strengthened the agency’s technique of steadily constructing reserves amid heightened volatility. Yr-to-date, Technique’s Bitcoin place has delivered a yield of 25.4%.

Metaplanet provides 103 BTC, joins FTSE Japan Index

In the meantime, Tokyo-based Metaplanet, usually in comparison with Technique for its aggressive treasury technique, revealed that it acquired 103 BTC for roughly ¥1.736 billion ($11.8 million). The cash have been purchased at a mean value of ¥16.86 million per BTC.

With this addition, Metaplanet’s reserves climbed to 18,991 BTC, bought at an combination value exceeding $1.9 billion.

Primarily based on present market costs, these holdings are price roughly $2.12 billion, giving the corporate a revenue margin close to 9%.

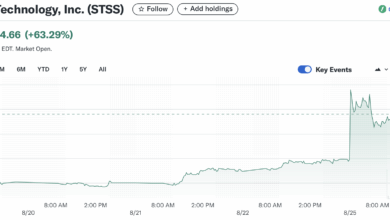

The announcement coincided with the agency’s inclusion within the FTSE Japan Index.

In an X put up, Metaplanet CEO Simon Gerovich said:

“Metaplanet has been added to the FTSE Japan Index within the September evaluation. One other vital milestone on our journey as Japan’s main Bitcoin treasury firm.”

The FTSE Japan Index measures the efficiency of medium- and large-capitalization corporations listed on Japanese exchanges. The inclusion of the Bitcoin-focused firm means it has been upgraded from a small-cap to a mid-cap standing.