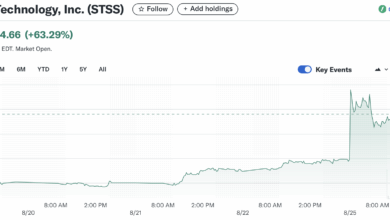

Nasdaq-listed agency Sharps Know-how (STSS) rallied as a lot as 70% on Monday on elevating $400 million to determine what it says may turn into the biggest company digital asset treasury of Solana .

The agency’s fundraising drew backing from a number of the most lively buyers in digital property, together with ParaFi, Pantera, FalconX, CoinFund and Arrington Capital. Beneath the deal, shares had been bought at $6.50 per unit with hooked up warrants exercisable at $9.75. Closing is anticipated by August 28.

The inventory briefly topped $13 within the morning U.S. hours earlier than paring features, up 53% from $7.3 at Friday’s shut.

The corporate plans to allocate the funds primarily towards buying SOL, the native token of the Solana blockchain. Alice Zhang, co-founder of Solana-backed undertaking Jambo, additionally joined the agency as chief funding officer and board member.

The Solana Basis, the non-profit growth group specializing in the Solana community, has dedicated to promoting $50 million in SOL tokens at a 15% low cost to a 30-day time-weighted common value, topic to circumstances, in line with the press launch.

Sharps is the newest public agency pivoting to build up cryptocurrencies, a current development that has captivated inventory markets. These companies, usually dubbed digital asset treasuries (DATs), elevate cash on capital markets to purchase cryptos, aiming to duplicate the success of Michael Saylor’s Technique (MSTR). Technique has turn into the biggest company proprietor of bitcoin with a stash value north of $70 billion.

The fever has already prolonged to Solana, with SOL Methods (HODL), DeFi Improvement (DFDV) and Upexi (UPXI) being amongst listed companies stacking SOL.

DATs a as a proxy play on crypto costs and most of them commerce at a premium relative to the underlying holdings. Nevertheless, they may come beneath strain throughout market downturns when the premium contracts, capping their skill to lift funds to gas purchases.

Learn extra: Company Bitcoin Treasuries Might Elevate Credit score Dangers, Morningstar DBRS Says

Upcoming $1B SOL Treasury, DFDV to Promote Fairness

Sharps’ transfer was not the one Solana treasury-related information on Monday.

Outstanding crypto companies Galaxy Digital, Multicoin Capital and Bounce Crypto are reportedly looking for to lift $1 billion to construct a treasury centered on SOL. They plan to purchase out a listed agency and employed Cantor Fitzgerald because the lead banker.

In the meantime, DeFi Improvement (DFDV), led by former executives of Kraken, introduced on Monday to lift $125 million by promoting fairness, looking for to extend its SOL holdings.

The inventory tumbled 19% on the information.

Learn extra: BNB-Centered Treasury Agency B Technique Appears to Elevate $1B With Backing From CZ’s YZi Labs