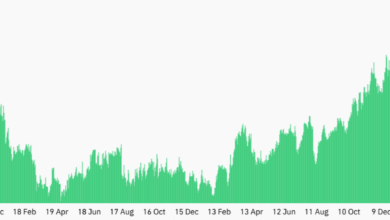

Digital asset funding merchandise recorded their most vital withdrawal in months final week, with outflows totaling $1.43 billion, CoinShares‘ newest weekly report revealed.

CoinShares reported that the sell-off marked the third-largest outflow of the yr and the largest since March. In keeping with the agency, buying and selling exercise additionally intensified final week, with exchange-traded merchandise (ETPs) producing $38 billion in quantity, almost 50% above the yearly common.

James Butterfill, head of analysis at CoinShares, defined that withdrawals early within the week mirrored deep concern over the Fed’s tightening path. “Outflows of $2 billion occurred within the first few days,” he famous, linking the motion to fears of additional charge hikes.

Nonetheless, market positioning shifted later within the week after Jerome Powell’s remarks on the Jackson Gap Symposium have been interpreted as softer than anticipated, triggering a partial rebound. Inflows of $594 million on Thursday and Friday minimize the week’s losses.

Bitcoin and Ethereum dominate withdrawals

Bitcoin bore the brunt of the promoting, with $1 billion leaving associated merchandise. Ethereum adopted with $440 million in outflows, although midweek good points softened the decline.

Regardless of the setback, month-to-date figures spotlight Ethereum’s stronger positioning. The asset has attracted $2.5 billion in inflows in August, in comparison with Bitcoin’s $1 billion in internet outflows.

12 months-to-date, Ethereum inflows account for 26% of whole belongings below administration, whereas Bitcoin lags at 11%.

Past the 2 majors, investor urge for food is cut up throughout different main altcoins.

XRP attracted $25 million in new capital because the US Securities and Change Fee (SEC) formally closed its case towards Ripple, whereas Solana and Cronos added $12 million and $4.4 million in contemporary capital.

In distinction, Sui and Ton misplaced $12.9 million and $1.5 million, respectively, highlighting fragmented investor sentiment.

In the meantime, geographic flows additionally revealed diverging investor habits final week.

US-based funds like BlackRock’s iShares drove the majority of outflows at $1.3 billion, whereas Sweden and Switzerland contributed $135.5 million and $11.8 million.

Compared, Germany, Canada, and Hong Kong registered modest inflows of $18.4 million, $3.7 million, and $3.5 million, respectively, providing a partial offset.