By Omkar Godbole (All occasions ET until indicated in any other case)

Bitcoin has retraced to roughly the place it was earlier than Federal Reserve Chair Jerome Powell’s dovish remarks on Friday, which briefly sparked a rally in U.S. shares and cryptocurrencies.

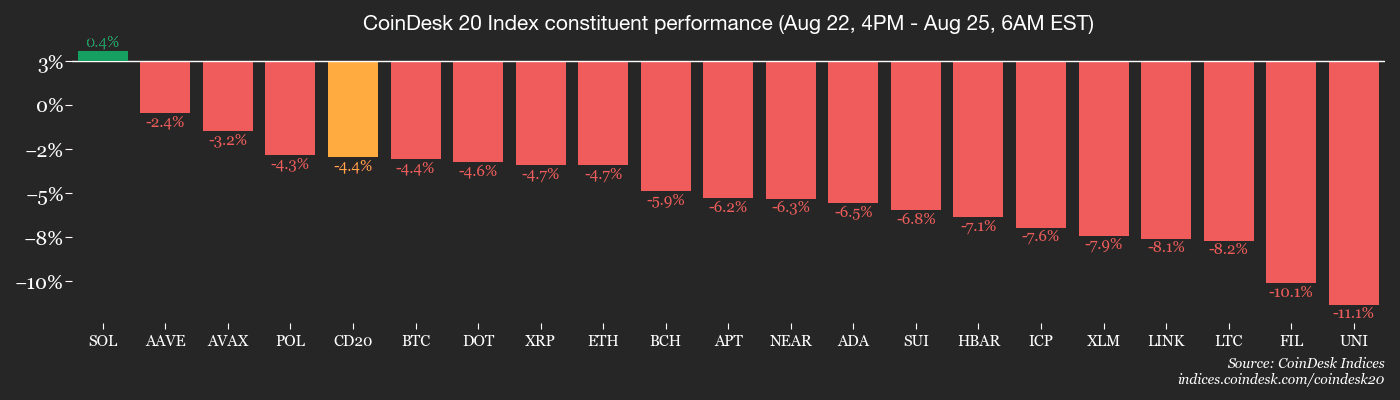

The reversal in BTC value has paused ether’s rally and triggered losses throughout the broader altcoin market. The CoinDesk 20 (CD 20) Index is down 3% on a 24-hour foundation, whereas the broader CoinDesk 80 (CD 80) index has fallen 3.74% as of writing.

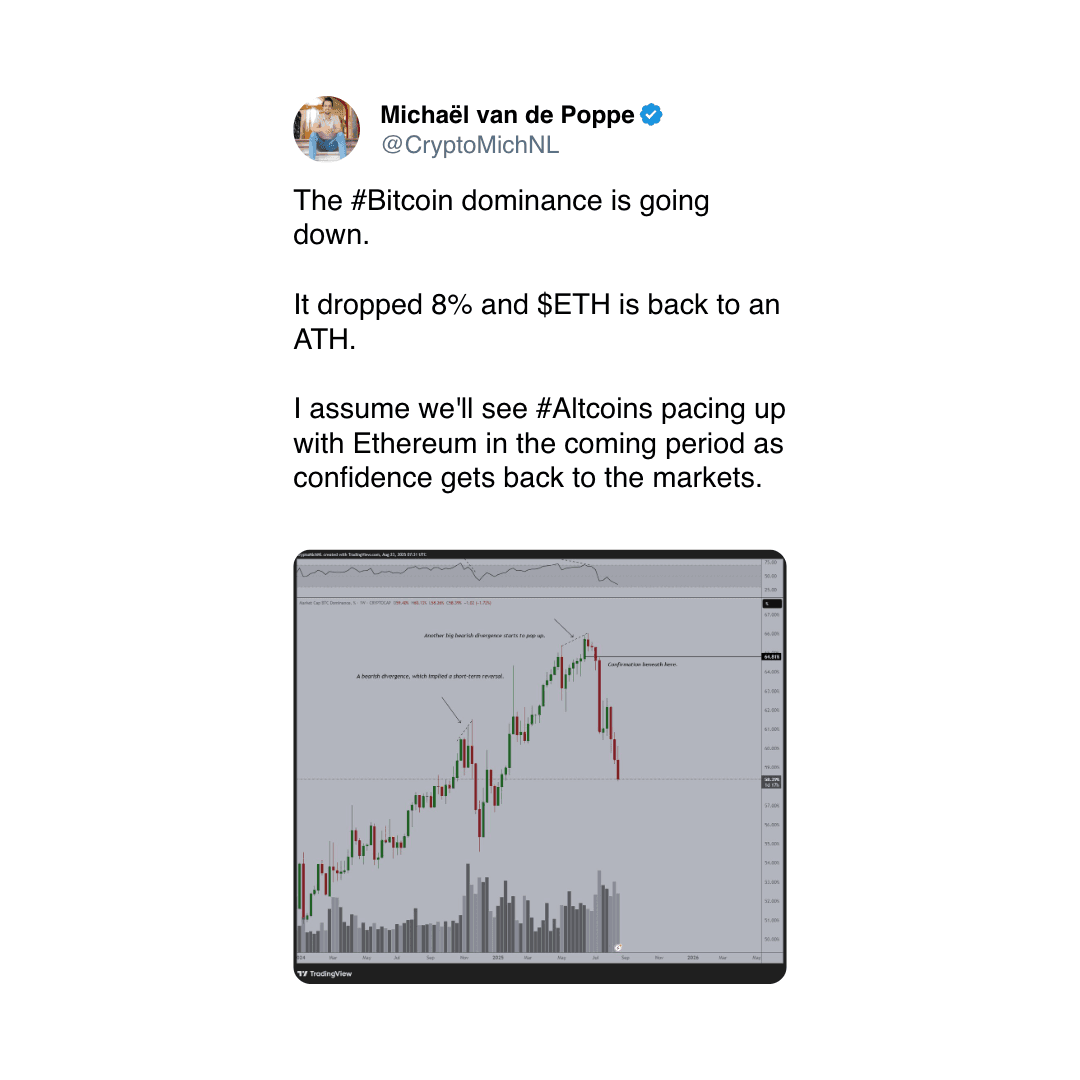

Alex Kuptsikevich, senior analyst at FxPro, famous that liquidity seems to be shifting from bitcoin into altcoins. “Bitcoin is buying and selling at $112,000, having fallen to a low of $110,000—its weakest stage since early July. Friday’s surge attracted recent sellers, pushing BTC under its 50-day transferring common. To this point, liquidity appears to be migrating from BTC to Ethereum and different altcoins like Solana. Nonetheless, we can not rule out that it is a precursor, with Bitcoin doubtlessly beginning a ‘sell-on-rise’ part that will quickly prolong to altcoins,” Kuptsikevich stated in an electronic mail.

Including to the narrative, blockchain analytics agency Lookonchain reported {that a} outstanding bitcoin whale, who obtained 100,000 BTC a protracted whereas in the past, started diversifying into ether over the weekend.

Singapore-based QCP Capital chimed in with a longer-term perspective, stating, “Close to time period, BTC seems to be ceding momentum to ETH, however our structural outlook on Bitcoin stays optimistic. Much like July’s absorption of roughly 80,000 BTC of legacy provide, we count on establishments to proceed shopping for dips selectively.”

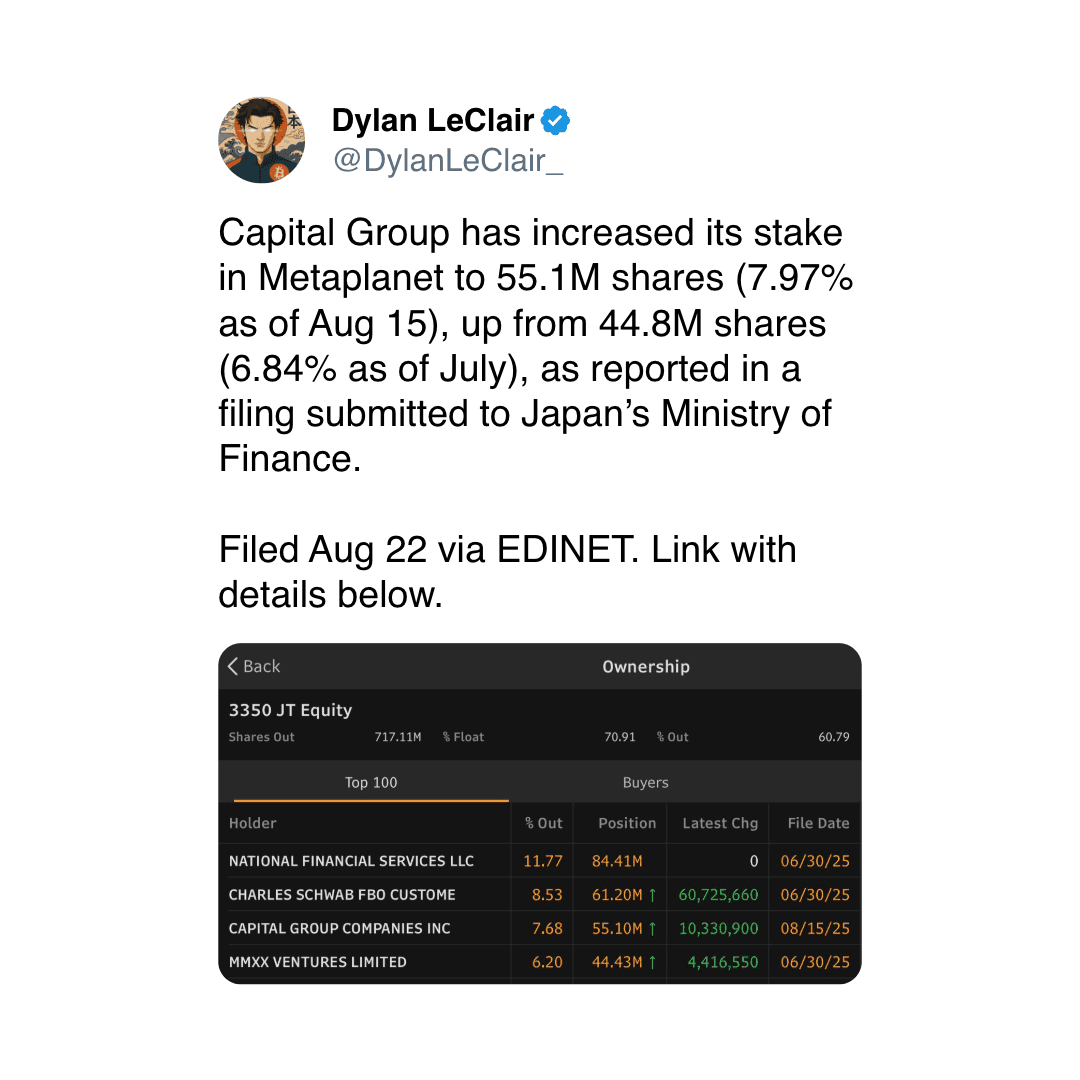

Highlighting institutional curiosity in dip shopping for, Tokyo-listed Metaplanet introduced the acquisition of an extra 103 BTC, elevating its holdings to 18,991 BTC. These developments come on the heels of Japan’s Finance Minister endorsing regulated crypto property as a respectable diversification instrument inside broader portfolios.

On the derivatives entrance, the worth swings since Friday have sparked notable exercise. Hyperliquid, an on-chain perpetual futures platform, introduced hitting a brand new 24-hour all-time excessive spot quantity of $3.4 billion, pushed largely by rises in BTC and ETH deposits.

The trade now ranks because the second largest venue for spot BTC buying and selling throughout centralized and decentralized exchanges, with $1.5 billion in 24-hour BTC quantity alone. This surge displays the rising traction of specialised blockchain-based buying and selling ecosystems.

In the meantime, in conventional markets, the U.S. Greenback Index (DXY) edged up 0.22% to 97.94 following a close to 1% decline on Friday. Gold costs remained flat, whereas European shares and S&P 500 futures traded decrease, indicating a measured diploma of investor danger aversion. Keep alert!

What to Watch

- Crypto

- Aug. 27, 3 a.m.: Mantle Community (MNT), an Ethereum layer-2 blockchain, will roll out its mainnet improve to model 1.3.1, enabling assist for Ethereum’s Prague replace and introducing new options for platform customers and builders.

- Macro

- Aug. 25, 3 p.m.: The Central Financial institution of Paraguay releases July producer value inflation information.

- Aug. 26, 8:30 a.m.: The U.S. Census Bureau releases July manufactured sturdy items orders information.

- Sturdy Items Orders MoM Est. -4% vs. Prev. -9.3%

- Sturdy Items Orders Ex Protection MoM Prev. -9.4%

- Sturdy Items Orders Ex Transportation MoM Est. 0.1% vs. Prev. 0.2%

- Aug. 26, 10 a.m.: The Convention Board (CB) releases August U.S. client confidence information.

- CB Shopper Confidence Est. 98 vs. Prev. 97.2

- Aug. 27: The U.S. will impose an extra 25% tariff on Indian imports associated to Russian oil purchases, successfully elevating whole tariffs on many items to roughly 50%.

- Earnings (Estimates based mostly on FactSet information)

- Aug. 27: NVIDIA (NVDA), post-market, $1.00

- Aug. 28: IREN (IREN), post-market, $0.18

Token Occasions

- Governance votes & calls

- dYdx is voting on whether or not to approve a whitelist replace to the VIP Affiliate Program. Voting closes on Aug. 25.

- Aug. 25: Supra (SURPA) to host neighborhood name at 08:00.

- Unlocks

- Aug. 25: Venom to unlock 2.34% of its circulating provide value $9.45 million.

- Aug. 28: Jupiter to unlock 1.78% of its circulating provide value $26.36 million.

- Sep. 1: Sui to launch 1.25% of its circulating provide value $153.1 million.

- Token Launches

- Aug. 25: Kek (KEK) to checklist on Poloniex.

- Aug. 25: DNA (DNA) to checklist on BitMart.

- Aug. 25: Cudis (CUDIS) to checklist on Gate.io.

- Aug. 26: Centrifuge to checklist on Bybit.

Conferences

The CoinDesk Coverage & Regulation convention (previously often known as State of Crypto) is a one-day boutique occasion held in Washington on Sept. 10 that permits common counsels, compliance officers and regulatory executives to satisfy with public officers accountable for crypto laws and regulatory oversight. House is restricted. Use code CDB10 for 10% off your registration via Aug. 31.

Token Speak

By Shaurya Malwa

- Hyperliquid hit a brand new 24-hour spot quantity ATH of $3.4B, powered by surging BTC and ETH deposits and buying and selling through Hyperunit.

- This spike positioned Hyperliquid because the second-largest venue for spot BTC buying and selling, throughout each centralized and decentralized platforms, with $1.5B in BTC quantity alone.

- Such quantity milestones enhance Hyperliquid’s attraction by proving its skill to deal with institutional-scale order move.

- The platform’s structure — constructed on HyperCore (Layer‑1 with HyperBFT consensus) and HyperEVM — delivers sub-second finality, excessive throughput, and EVM compatibility, making it extremely engaging to each high-frequency merchants and DeFi builders.

- Its rising quantity, particularly in BTC spot markets, strengthens Hyperliquid’s worth proposition as a liquidity layer in DeFi, reinforcing its “AWS of liquidity” thesis pushed by efficiency and infrastructure depth.

- Spot development enhances its perpetuals dominance—the place the platform already captures 60–70% of DEX market share, delivering extra on-chain income than even Ethereum.

- Excessive spot quantity interprets into actual advantages for HYPE holders — its token advantages from common buybacks funded by buying and selling payment flows through its Help Fund, tying platform utilization on to long-term token worth.

Derivatives Positioning

- BTC and HYPE’s international futures open curiosity have elevated by 1% and three%, respectively, up to now 24 hours, bucking the broader pattern of outflows noticed in different high 10 tokens.

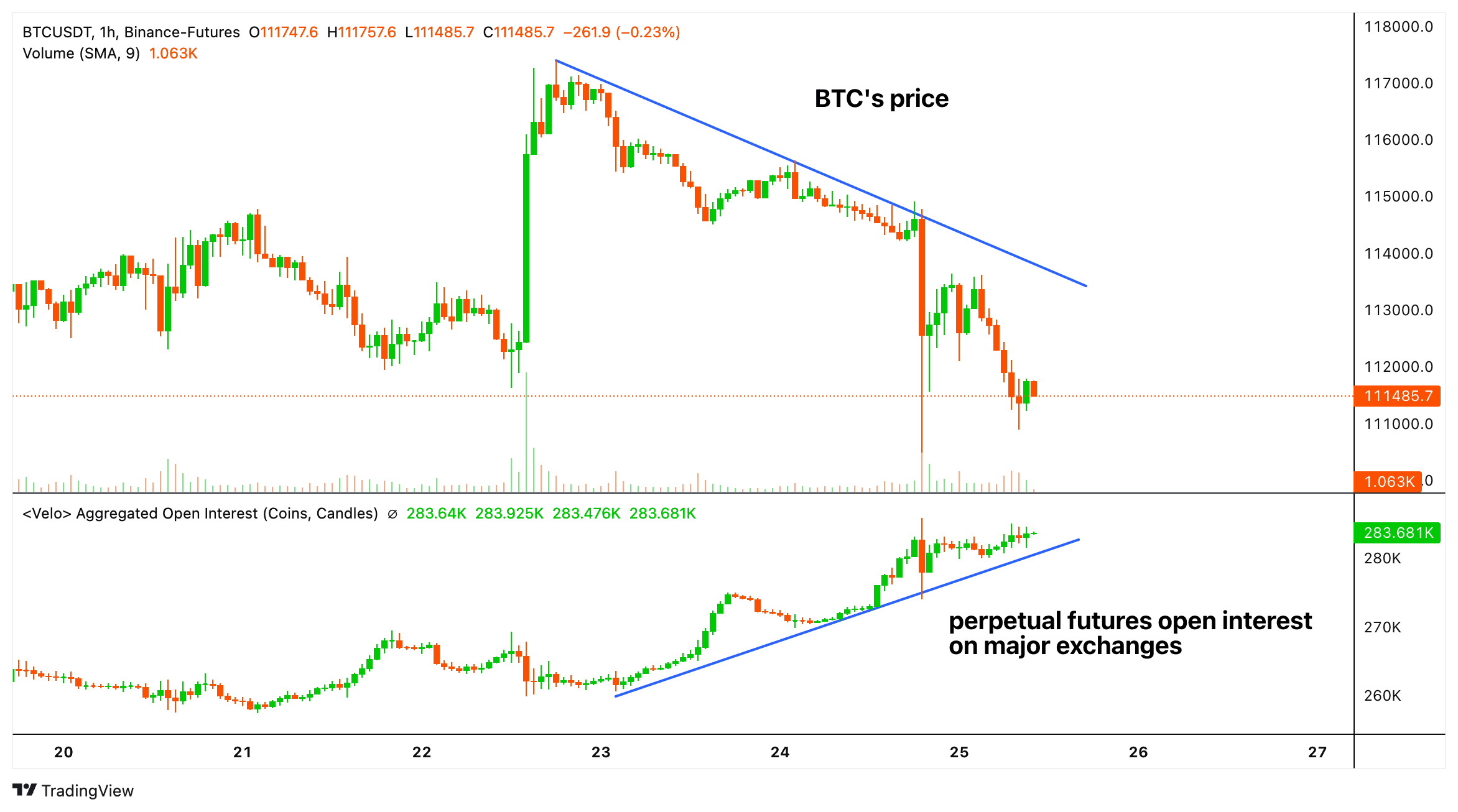

- Cumulative open curiosity in USD and USDT-denominated perpetual futures throughout main exchanges akin to Binance, Bybit, OKX, Deribit, and Hyperliquid remained flat on Friday regardless of the worth rally. Nonetheless, since then, open curiosity has risen from roughly 260,000 contracts to 282,000, indicating a “promote on rally” sentiment amongst merchants. (verify chart of the day part).

- The alternative is the case within the ether market, the place the OI ticked greater throughout Friday’s rally and has retreated with the worth pullback. This sample suggests a short lived pause in bullish momentum relatively than the institution of latest brief positions, indicating a bullish breather relatively than a shift towards bearish sentiment.

- Talking of funding charges, aside from ADA, most tokens see constructive charges, indicating a web bias for bullish lengthy positions.

- Altcoin futures OI exploded by greater than $9.2 billion in a single day on Friday, pushing the mixed whole tally to a brand new excessive of $61.7 billion. “Such fast inflows spotlight how altcoins are more and more driving leverage, volatility, and fragility throughout digital asset markets,” Glassnode stated.

- On the CME, open curiosity in ether choices hit a notional document excessive of over $1 billion on Friday. This follows a document variety of giant holders within the futures market early this month. Ether futures OI hit a brand new excessive above 2 million ETH.

- Notional open curiosity in BTC choices rose to $4.85 billion, the very best since April, as futures exercise remained subdued.

- On Deribit, BTC choices continued to point out a bias for places out to the December expiry, contradicting the post-Powell bullish sentiment available in the market. In ether’s case, calls traded at a slight premium.

Market Actions

- BTC is down 4.45% from 4 p.m. ET Friday at $111,825.43 (24hrs: -2.63%)

- ETH is down 4.84% at $4,612.09 (24hrs: -2.89%)

- CoinDesk 20 is down 4.23% at 4,125.81 (24hrs: -2.93%)

- Ether CESR Composite Staking Charge is down 14 bps at 2.83%

- BTC funding fee is at 0.0096% (10.5525% annualized) on Binance

- DXY is up 0.19% at 97.90

- Gold futures are down 0.28% at $3,408.80

- Silver futures are down 0.88% at $38.71

- Nikkei 225 closed up 0.41% at 42,807.82

- Grasp Seng closed up 1.94% at 25,829.91

- FTSE is up 0.13% at 9,321.40

- Euro Stoxx 50 is down 0.49% at 5,461.49

- DJIA closed on Friday up 1.89% at 45,631.74

- S&P 500 closed up 1.52% at 6,466.91

- Nasdaq Composite closed up 1.88% at 21,496.54

- S&P/TSX Composite closed up 0.99% at 28,333.13

- S&P 40 Latin America closed up 2.87% at 2,737.36

- U.S. 10-12 months Treasury fee is up 1.1 bps at 4.269%

- E-mini S&P 500 futures are down 0.23% at 6,468.50

- E-mini Nasdaq-100 futures are down 0.32% at 23,495.25

- E-mini Dow Jones Industrial Common Index down 0.21% at 45,619.00

Bitcoin Stats

- BTC Dominance: 58.21% (+0.45%)

- Ether-bitcoin ratio: 0.04123 (-2.07%)

- Hashrate (seven-day transferring common): 954 EH/s

- Hashprice (spot): $54.38

- Whole charges: 3.478 BTC / $387,601

- CME Futures Open Curiosity: 1453,320 BTC

- BTC priced in gold: 33.1 oz.

- BTC vs gold market cap: 9.36%

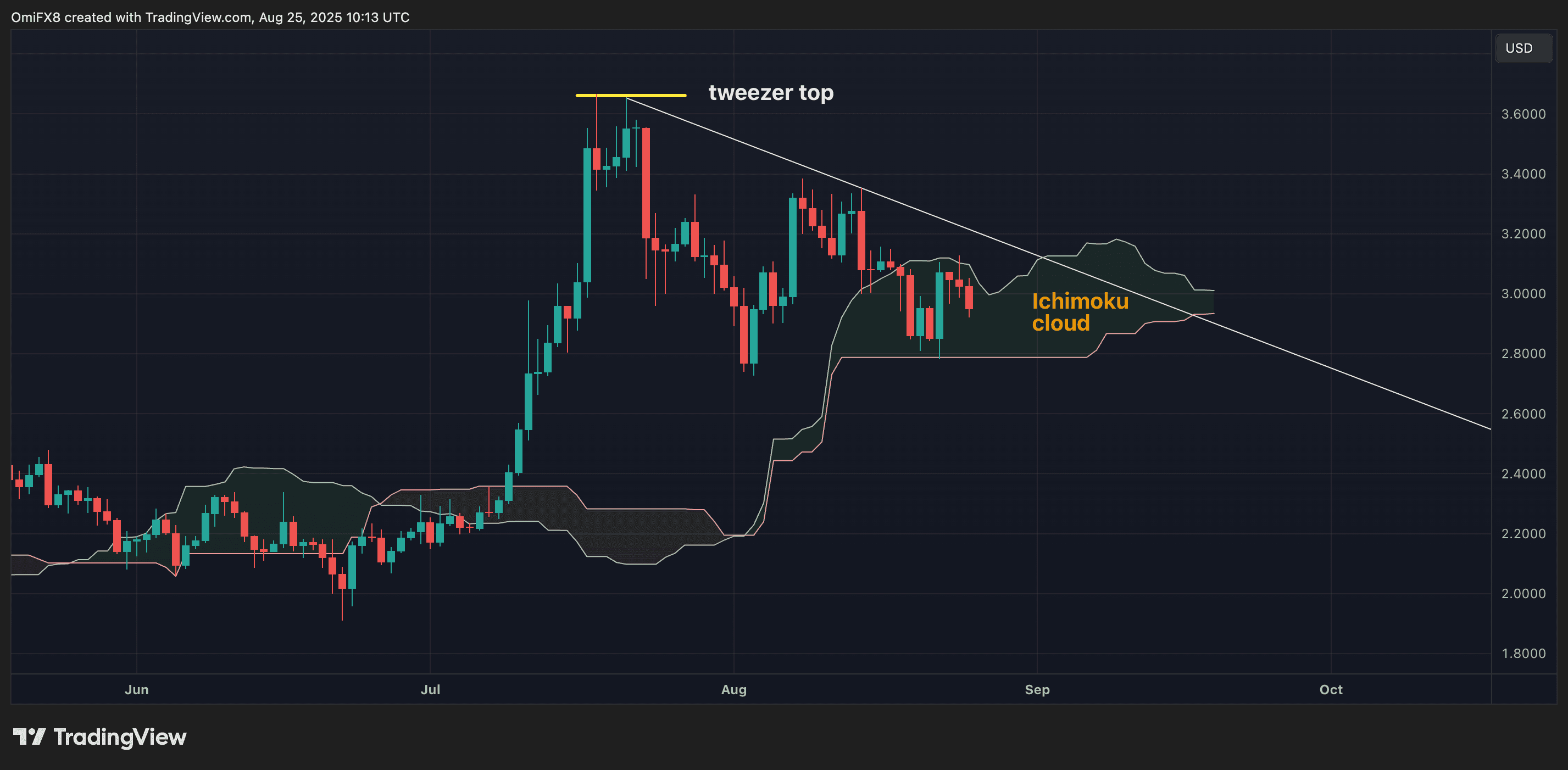

Technical Evaluation

- XRP at present trades throughout the Ichimoku cloud, suggesting uncertainty.

- A drop under the decrease finish of the cloud would sign a continuation of the broader downtrend.

- XRP peaked at $3.65 final month with a tweezer high bearish candlestick sample.

Crypto Equities

- Technique (MSTR): closed on Friday at $358.13 (+6.09%), -3.76% at $344.65 in pre-market

- Coinbase World (COIN): closed at $319.85 (+6.52%), -2.47% at $311.96

- Circle (CRCL): closed at $135.04 (+2.46%), +0.19% at $135.30

- Galaxy Digital (GLXY): closed at $25.57 (+7.03%), -4.5% at $24.42

- Bullish (BLSH): closed at $70.82 (+1.46%), -4.08% at $67.93

- MARA Holdings (MARA): closed at $16.29 (+5.03%), -4.05% at $15.63

- Riot Platforms (RIOT): closed at $13.22 (+7.74%), -3.48% at $12.76

- Core Scientific (CORZ): closed at $13.55 (-1.74%), -0.52% at $13.48

- CleanSpark (CLSK): closed at $9.82 (+5.25%), -3.56% at $9.47

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $28.29 (+5.25%)

- Semler Scientific (SMLR): closed at $31.43 (+4.42%), -2.16% at $30.75

- Exodus Motion (EXOD): closed at $27.33 (+4.51%)

- SharpLink Gaming (SBET): closed at $20.87 (+15.69%), -3.21% at $20.20

ETF Flows

Spot BTC ETFs

- Every day web flows: -$23.2 million

- Cumulative web flows: $53.8 billion

- Whole BTC holdings ~1.29 million

Spot ETH ETFs

- Every day web flows: $337.7 million

- Cumulative web flows: $12.45 billion

- Whole ETH holdings ~6.27 million

Supply: Farside Traders

Chart of the Day

- Open curiosity in BTC perpetual futures listed on main exchanges has elevated alongside a drop in costs since Saturday.

- A mix of rise in open curiosity alongside a drop in a value is claimed to substantiate the downtrend.

Whereas You Had been Sleeping

- Bitcoin Reverses Powell Spike With a Flash Crash as Choices Market Alerts Jitters Forward (CoinDesk): A whale’s $300 million bitcoin selloff briefly despatched costs beneath $111,000, erasing Powell-fueled features. Choices information exhibits places costing greater than calls as merchants brace for additional draw back.

- Philippine Congressman Proposes Bitcoin Reserve to Assault Nationwide Debt (CoinDesk): The invoice requires the central financial institution to amass 10,000 BTC over 5 years, locked for twenty years and usable solely to scale back nationwide debt, with gross sales capped at 10% each two years.

- Japan’s Finance Minister Says Crypto Property Will be A part of Diversified Portfolio (CoinDesk): Katsunobu Katō’s comment, made Monday whereas talking at an occasion in Tokyo, comes amid considerations over Japan’s excessive debt-to-GDP ratio and the potential for monetary repression and yen depreciation.

- Why Bitcoin Treasury Corporations Are a Idiot’s Paradise (Monetary Instances): Though such companies provide benefits over holding bitcoin immediately — particularly in jurisdictions the place regulatory obstacles stop this — their leveraged technique might backfire badly when the bull market ends.

- Greenback Foundation Premium Hints at Weakening Urge for food for Treasuries (Bloomberg): The greenback’s premium in FX derivatives markets has practically disappeared for the primary time in 5 years, with overseas traders now holding solely a 3rd of Treasuries versus round half in 2012.

- 5 Years On, China’s Property Disaster Has No Finish in Sight (The New York Instances): At present’s delisting of China Evergrande underscores the property sector’s unraveling, but Beijing avoids a sweeping bailout, cautious of repeating its 2015 debt-fueled rescue, at the same time as costs sink, vacancies swell and smaller companies fail.

Within the Ether