Crypto Markets At the moment: Bitcoin Dominance Slip Whereas Hyperliquid's Quantity Soars to $3.4B

What would a market that refuses to rally sustainably on the again of constructive catalysts be referred to as? A weak one, presumably.

Trying underneath the hood, there may be a couple of single catalyst that's driving this market's volatility.

Bitcoin (BTC) has retraced again to roughly the place it was earlier than the Fed Chairman Jerome Powell spoke dovishly on Friday. Extra losses may very well be within the pipeline if the assist close to $107,500 provides method, technical charts point out.

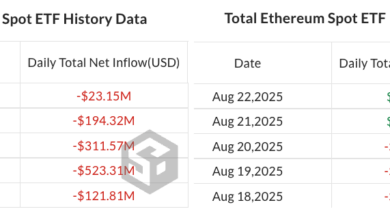

In the meantime, spot and choices market flows level to a rotation into ether from bitcoin.

“BTC dominance slipped from 60% to 57% on the rotation. Whereas nonetheless above the sub-50% ranges of the 2021 altcoin season, positioning is feeding discuss that whales anticipate ETH to outperform. If staking ETFs for ETH win approval later this 12 months, that narrative would achieve additional assist,” Singapore-based QCP Capital stated in its day by day market replace.

Derivatives Positioning

- BTC and HYPE's international futures open curiosity have elevated by 1% and three%, respectively, previously 24 hours, bucking the broader pattern of outflows noticed in different prime 10 tokens.

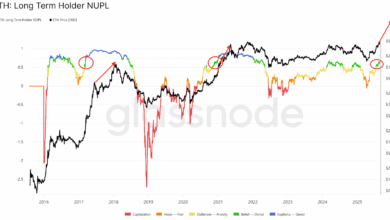

- Cumulative open curiosity in USD and USDT-denominated perpetual futures throughout main exchanges similar to Binance, Bybit, OKX, Deribit, and Hyperliquid remained flat on Friday regardless of the worth rally. Nonetheless, since then, open curiosity has risen from roughly 260,000 BTC to 282,000 BTC, indicating a “promote on rally” sentiment amongst merchants.

- The other is the case within the ether market, the place the OI ticked greater throughout Friday's rally and has retreated with the worth pullback. This sample suggests a short lived pause in bullish momentum somewhat than the institution of recent brief positions, indicating a bullish breather somewhat than a shift towards bearish sentiment.

- Talking of funding charges, apart from ADA, most tokens see constructive charges, indicating a web bias for bullish lengthy positions.

- Altcoin futures OI exploded by greater than $9.2 billion in a single day on Friday, pushing the mixed complete tally to a brand new excessive of $61.7 billion. “Such fast inflows spotlight how altcoins are more and more driving leverage, volatility, and fragility throughout digital asset markets,” Glassnode stated.

- On the CME, open curiosity in ether choices hit a notional file excessive of over $1 billion on Friday. This follows a file variety of massive holders within the futures market early this month. Ether futures OI hit a brand new excessive above 2 million ETH.

- Notional open curiosity in BTC choices rose to $4.85 billion, the very best since April, as futures exercise remained subdued.

- On Deribit, BTC choices continued to point out a bias for places out to the December expiry, contradicting the post-Powell bullish sentiment available in the market. In ether's case, calls traded at a slight premium.

Token Speak

- Hyperliquid hit a brand new 24-hour spot quantity ATH of $3.4B, powered by surging BTC and ETH deposits and buying and selling through Hyperunit.

- This spike positioned Hyperliquid because the second-largest venue for spot BTC buying and selling, throughout each centralized and decentralized platforms, with $1.5B in BTC quantity alone.

- Such quantity milestones enhance Hyperliquid’s enchantment by proving its capacity to deal with institutional-scale order move.

- The platform’s structure — constructed on HyperCore (Layer‑1 with HyperBFT consensus) and HyperEVM — delivers sub-second finality, excessive throughput, and EVM compatibility, making it extremely enticing to each high-frequency merchants and DeFi builders.

- Its rising quantity, particularly in BTC spot markets, strengthens Hyperliquid’s worth proposition as a liquidity layer in DeFi, reinforcing its “AWS of liquidity” thesis pushed by efficiency and infrastructure depth.

- Spot development enhances its perpetuals dominance—the place the platform already captures 60–70% of DEX market share, delivering extra on-chain income than even Ethereum.

- Excessive spot quantity interprets into actual advantages for HYPE holders — its token advantages from common buybacks funded by buying and selling price flows through its Help Fund, tying platform utilization on to long-term token worth.

Learn extra: Right here Is Why Bitcoin's Flash Crash Could Sign Altcoin Season: Crypto Daybook Americas