Crypto liquidations reached $806.44 million prior to now 24 hours, wiping out leveraged positions at a scale not seen in weeks.

The liquidation cascade adopted a steep drawdown in costs: Bitcoin fell from a gap stage of $114,163 to a detailed close to $111,931, with intraday extremes stretching from $114,373 all the way down to $110,802.

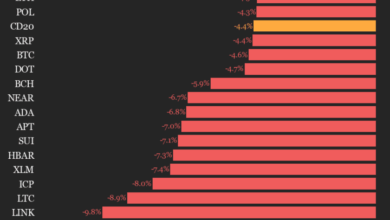

Ethereum mirrored this transfer, sliding from $4,784 to $4,635, with a buying and selling vary between $4,798 and $4,621. Each misplaced greater than 2.5% on the day.

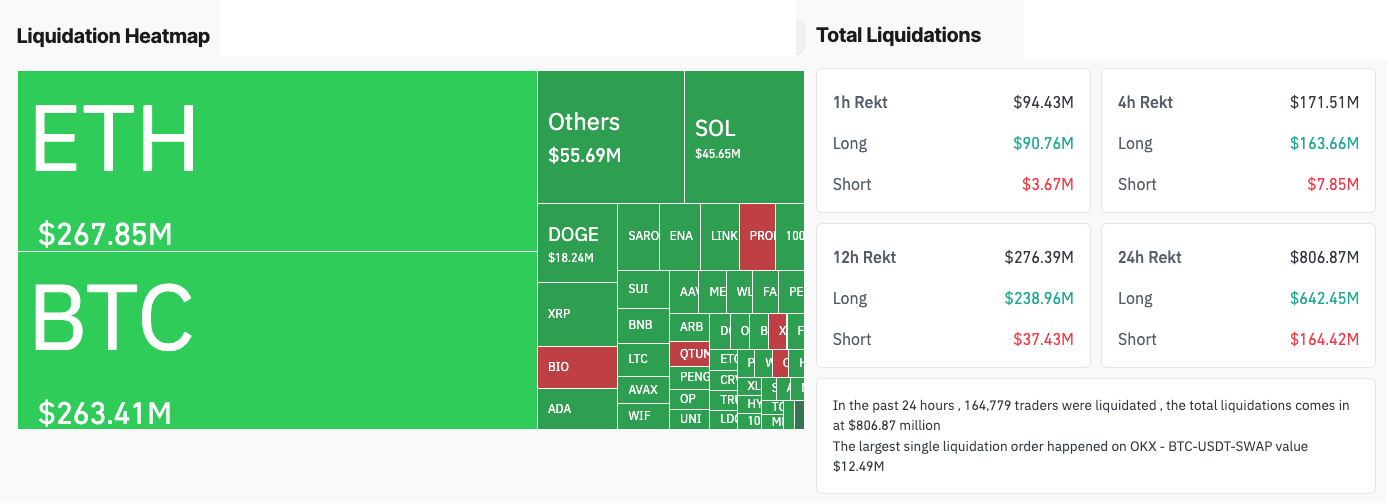

Lengthy positions had been hit the toughest. Of the $807.44 million complete liquidations, $642.45 million got here from longs, in comparison with $162.4 million from shorts. Bitcoin accounted for $267.85 million of the entire, whereas Ethereum was shut behind at $263.41 million.

The close to parity between BTC and ETH liquidations exhibits that speculative curiosity continues to be concentrated in these two belongings, which made up greater than two-thirds of all liquidations prior to now 24 hours.

Bybit was the epicenter of pressured closures, accountable for $304 million in liquidations, 87% of which had been lengthy positions. Binance adopted with $209 million in liquidations, once more skewed towards longs at over 75%. OKX noticed $117 million flushed out, whereas smaller platforms like Gate and HTX contributed tens of tens of millions extra.

Curiously, Bitfinex and Bitmex had been the outliers the place brief positions dominated liquidations. This tells us that exchange-specific positioning can deviate sharply from the final market.

The dimensions of lengthy liquidations factors to the overextension of bullish leverage at elevated worth ranges. Merchants had been constructing directional bets on continued energy, particularly given Ethereum’s new peak over the weekend. However, when Bitcoin didn’t maintain above $114,000 and Ethereum slipped under $4,700, cascading margin calls triggered pressured promote orders.

This intensified the draw back transfer and strengthened the suggestions loop of liquidation-driven promoting stress. The most important single order throughout this era occurred on OKX, with a BTC-USDT swap liquidation valued at $12.49 million.

The load of BTC and ETH is clearly seen within the liquidation heatmap. Collectively, they accounted for over $530 million in pressured closures.

Different large-cap tokens like Solana and Dogecoin had been hit as properly, although at a lot smaller magnitudes, reflecting their decrease share of speculative leverage.

Altcoins with thinner liquidity swimming pools noticed pockets of sharp pressured promoting, however the dominant theme of the day was the structural unwinding of BTC and ETH leverage.