Bitcoin (BTC) dropped below $111,000 in a sudden weekend flash crash after a whale offloaded 24,000 BTC, or greater than $300 million at present costs, into skinny liquidity.

The whale despatched the total stability to Hyperunite, with 12,000 BTC transferred Sunday alone, as CoinDesk reported earlier Monday. That transfer erased beneficial properties from Fed Chair Jerome Powell’s speech on Friday and sparked heavy compelled promoting throughout the market.

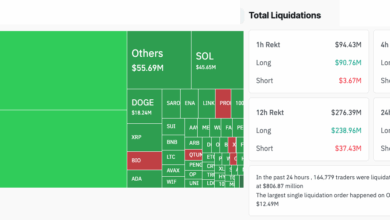

The sudden selloff fueled liquidations price $238 million in bitcoin positions and $216 million in ether (ETH), a part of greater than $550 million cleared previously day. BTC costs briefly touched beneath $111,000 earlier than stabilizing close to $112,800 as of Asian morning hours Monday.

Liquidations function a stark reminder of how fragile positioning could be within the crypto market. When merchants pile in with leverage and the market strikes towards them, exchanges step in and robotically shut these bets.

A flush of lengthy liquidations can reset the marketplace for a cleaner bounce, whereas a cluster of quick wipes can gas the following leg larger.

Regardless of the BTC flush, ether has held firmer, buying and selling at $4,707 — up 9% previously week. Some analysts say whales and establishments are rotating publicity from bitcoin to ether, betting the pending Fed charge reduce might elevate Ethereum tougher given its smaller market cap.

“Ethereum continued to soar due to the continued consideration from DATs,” mentioned Jeff Mei, COO at BTSE. “The BTC/ETH ratio has rebounded again to technically attention-grabbing ranges.”

SignalPlus’s Augustine Fan agreed, pointing to a structural shift in demand: “ETH derivatives and tokenized asset flows are gaining relative to bitcoin,” he mentioned in a Telegram message.

“Merchants now see a state of affairs the place institutional accumulation and macro tailwinds push ether larger, with altcoins like Solana and Dogecoin additionally catching flows,” Fan mentioned.

Analysts say the rally isn’t only a macro commerce. Institutional shopping for and treasury allocations have added a tailwind, feeding hypothesis that Ethereum might turn into Wall Road’s most well-liked blockchain.

“Ether’s new all-time excessive is a transparent signal of investor demand past simply bitcoin,” mentioned Samir Kerbage, chief funding officer at Hashdex, mentioned in an electronic mail to CoinDesk over the weekend, as reported.

That $10,000 goal, as soon as deemed overly optimistic, is more and more voiced as Ethereum cements itself because the spine for stablecoins, tokenization, and sensible contracts particularly throughout conventional incumbents. The year-to-date acquire for ETH now stands at 45%.

Learn extra: Bitcoin Reverses Powell Spike With a Flash Crash as Choices Market Alerts Jitters Forward