This can be a day by day evaluation by CoinDesk analyst and Chartered Market Technician Omkar Godbole.

Bitcoin: Powell brings bearish decrease excessive

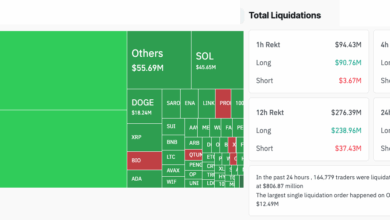

Bitcoin has retraced to ranges final seen earlier than Federal Reserve Chair Jerome Powell’s dovish remarks on Friday, which set expectations for a possible fee minimize in September.

On the time of writing, BTC is buying and selling simply above $112,000, having peaked at round $117,440 on Friday. Technical scrutiny of the day by day chart reveals that the pullback from the $117,000 peak has established a decrease excessive in shut proximity to the resistance line outlined by the earlier bullish trendline originating from the April lows.

This decrease excessive reinforces the prior trendline breakdown, signaling a continuation of bearish value motion. Complementing this remark, the Guppy A number of Transferring Common (GMMA) indicator is poised to verify a bearish momentum shift, highlighted by the approaching crossover of the short-term exponential transferring averages (white band) under the longer-term averages (pink band).

On the weekly chart, the MACD histogram has initiated the brand new buying and selling week with a sub-zero studying, highlighting the potential acceleration of downward momentum.

In abstract, what do you say a few market that not solely resists a sustainable rally on the again of favorable information – akin to Powell’s speech – but in addition maintains a collection of bearish technical patterns? I am going to depart it to the readers’ discretion.

Key technical assist lies on the $110,756 stage, akin to the decrease boundary of the Ichimoku cloud, with a extra substantial assist zone marked by the 200-day easy transferring common close to $100,000. Conversely, reclaiming Friday’s excessive of $117,440 is crucial to resurrect the bullish case.

- Help: $110,756, $100,887, $100,000.

- Resistance: $117,440, $120,000, $122,056.

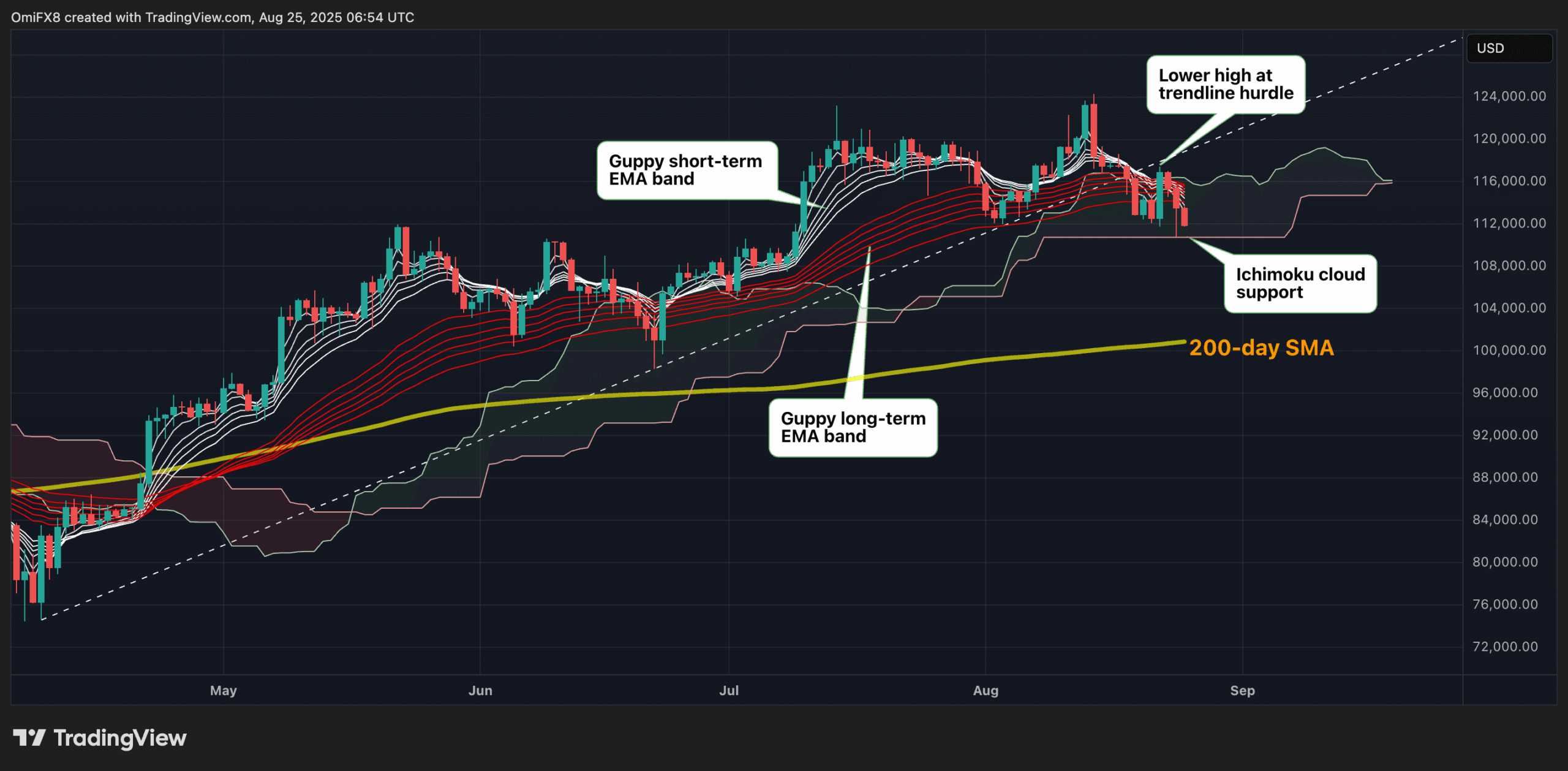

Ether: Lack of upward momentum

Ether (ETH) printed a doji candle with a distinguished higher wick on Sunday, signaling market indecision at report highs. This candlestick sample kinds when the opening and shutting costs converge, reflecting a stalemate between consumers and sellers.

Nonetheless, the comparatively lengthy higher shadow, on this case, signifies that the bull’s makes an attempt to push costs larger confronted vital pushback from bears, who managed to tug the worth again down earlier than the shut.

Whereas the doji itself doesn’t assure a reversal, it highlights uncertainty and a doable lack of upward momentum. It warrants warning because it typically precedes a possible reversal or a consolidation section the place the market awaits additional catalysts for path.

A pullback seems seemingly, because the 14-day relative energy index continued to print decrease highs over the weekend, contradicting the brand new value excessive. The so-called bearish divergence signifies a lack of upward momentum and infrequently yields corrections.

Curiously, ether traded 3% decrease on the day at $4,624 at press time, with charts indicating assist at $4,065, the extent from which ETH turned larger on August 20.

- Help: $4,065, $4,000, $3,805 (the 50-day SMA).

- Resistance: $5,000, report highs.

Learn extra: Bitcoin Reverses Powell Spike With a Flash Crash as Choices Market Indicators Jitters Forward