Tokenized real-world property might finally symbolize trillions of {dollars} value of conventional finance property in a multichain future, in response to Animoca.

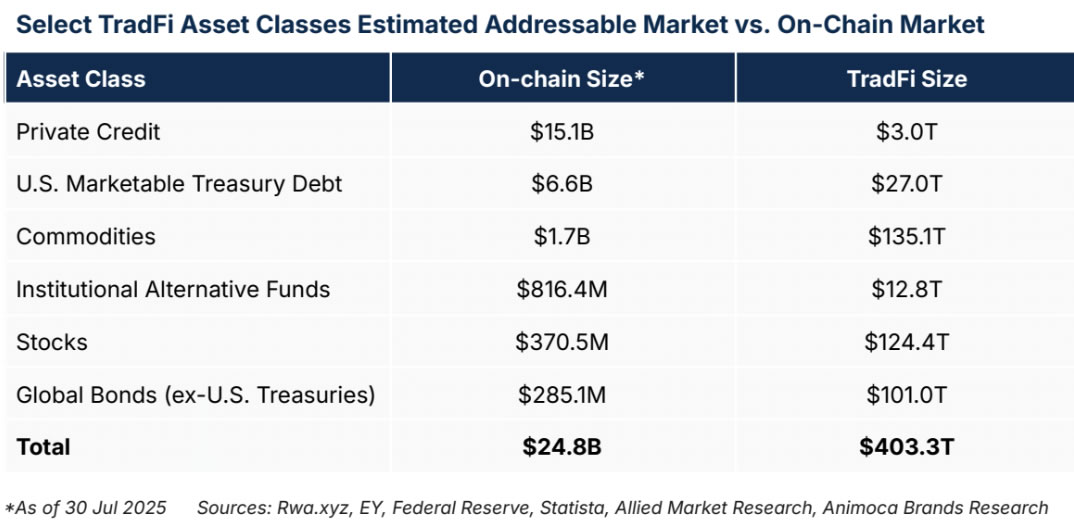

“The estimated $400 trillion addressable TradFi market underscores the potential progress runway for RWA tokenization,” stated researchers Andrew Ho and Ming Ruan in an August analysis paper from Web3 digital property agency Animoca Manufacturers.

The researchers discovered that the tokenized real-world asset (RWA) sector is only a small fraction ($26 billion) of the overall addressable market at present, which is over $400 trillion.

These asset lessons embody non-public credit score, treasury debt, commodities, shares, different funds and world bonds.

There’s at present “a strategic race to construct full-stack, built-in platforms” by massive asset managers, and long-term worth will accrue to those that can “management asset lifecycle,” the researchers stated.

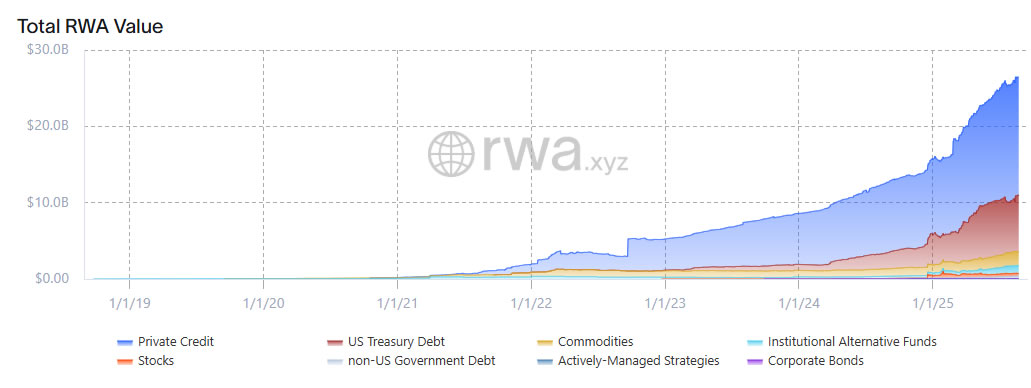

RWA worth hits an all-time excessive

The nascent RWA tokenization market is at present at an all-time excessive of $26.5 billion, having grown 70% because the starting of this 12 months, in response to business tracker RWA.xyz.

That is “signaling clear momentum and rising institutional confidence,” the researchers stated.

The present RWA panorama is dominated by two classes: non-public credit score and US Treasurys, and collectively, they account for practically 90% of tokenized market worth.

Associated: Centrifuge tops $1B TVL as establishments drive tokenized RWA increase: CEO

RWA future is multichain, not simply Ethereum

Ethereum is the market chief for RWA tokenization with a 55% market share, together with stablecoins, and $156 billion in onchain worth.

When Ethereum layer-2 networks reminiscent of ZKsync Period, Polygon, and Arbitrum are included, that share grows to 76%, in response to RWA.xyz.

“Its main place is probably going on account of its safety, liquidity, and the most important ecosystem of builders and DeFi purposes,” the researchers stated.

The expansion of the RWA tokenization might drive additional demand for associated crypto property reminiscent of Ether (ETH), which hit an all-time excessive on Sunday, and oracle supplier Chainlink (LINK), each of which have seen beneficial properties outpace the broader crypto market in current weeks.

Nonetheless, the researchers stated that RWA tokenization exercise is “unfolding throughout a multichain ecosystem encompassing private and non-private blockchains,” including that Ethereum’s present lead is being challenged by “high-performance and purpose-built networks, indicating that interoperability might be key to success.”

Animoca Manufacturers launched its personal tokenized RWA market known as NUVA earlier this month.

Journal: ETH ‘god candle,’ $6K subsequent? Coinbase tightens safety: Hodler’s Digest