The world’s number-one crypto is trying extra like a mature asset class day by day as Bitcoin volatility continues to drop (sure, even because it blasts previous all-time highs and promptly retraces its steps).

Bitcoin volatility has reached a five-year low

Bitcoin has lengthy been thought to be one of the vital risky monetary property; its turbulent value fluctuations through the years have deterred many traders. However what if I informed you that Bitcoin is now much less risky than a blue-chip tech inventory?

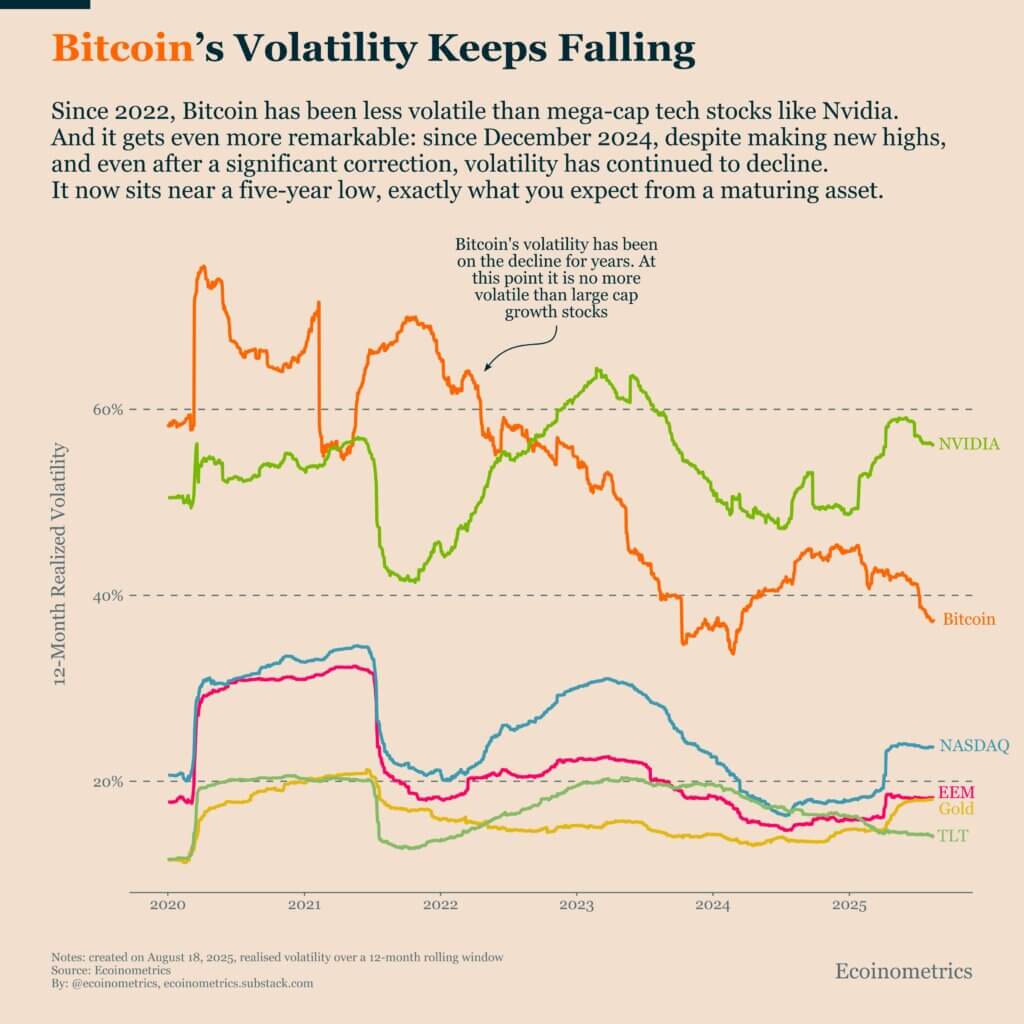

In keeping with ecoinometrics, Bitcoin’s 30-day realized volatility is now at its lowest level in practically 5 years, and it’s a development that has continued even by way of Bitcoin’s headline-making rallies and corrections over the past 5 years:

“Precisely what you count on from a maturing asset.”

Since 2022, Bitcoin has typically been much less risky than a few of Wall Road’s greatest names, together with mega-cap shares like Nvidia. Through the sharp tech sector swings of 2023 and 2024, Nvidia’s value was extra unpredictable than Bitcoin, an asset notorious for its hair-raising strikes.

Even throughout this present Bitcoin bull run, the worth swings have remained notably tamer than earlier cycles. Macro analyst Lyn Alden lately informed CryptoSlate she believes that Bitcoin’s cycles are altering.

We must always count on this one to be longer and “much less excessive” than earlier runs, with robust strikes upward adopted by durations of consolidation, “relatively than going to the moon and collapsing.”

All of the indicators of asset class maturity

Bitcoin volatility declining is only one marker of its rising maturity. The launch of spot Bitcoin ETFs within the U.S. in early 2024 was a landmark occasion, opening up the asset to the mainstream viewers.

Main asset managers like BlackRock and Constancy provide direct Bitcoin publicity to retail and institutional traders by way of regulated exchange-traded merchandise. This has launched broader possession and liquidity, dampening giant value swings and integrating Bitcoin extra deeply into conventional markets.

Furthermore, latest regulatory adjustments now permit Individuals to incorporate Bitcoin of their 401k retirement accounts. As diversified portfolios take up BTC allocations, Bitcoin volatility additional subsides.

Pension funds, endowments, and insurance coverage firms have begun allocating to Bitcoin as a part of their various asset methods. This will increase buying and selling by subtle traders and reduces the affect of short-term speculative flows.

Sturdy-willed children turn out to be adults who change the world

More and more, Bitcoin’s value exhibits the next correlation with broader fairness markets throughout risk-on and risk-off durations, one other signal of integration and maturity. Whilst you can argue whether or not that is what we meant for Bitcoin, it does replicate mainstream market adoption. And hey, strong-willed children turn out to be adults who change the world, as Bitcoin is undoubtedly doing.

For on a regular basis traders and establishments alike, decrease Bitcoin volatility interprets to much less danger and a smoother funding profile.

It’s additionally an indication that Bitcoin is outgrowing its adolescent section of untamed speculative swings and turbulence, and settling into its function as a official member of society and staple of diversified portfolios. It’s time to confess, our child is totally grown.