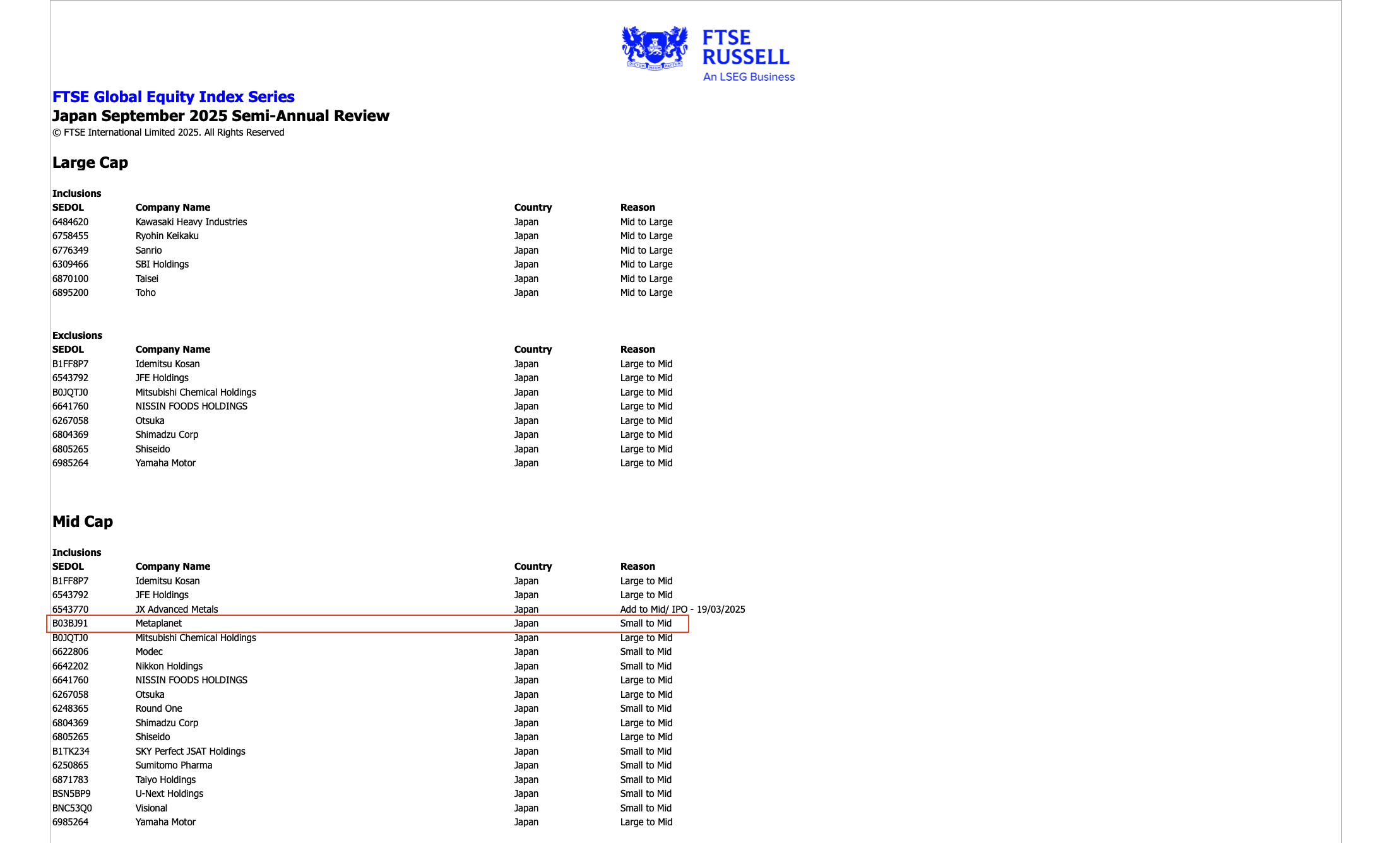

Metaplanet, a Bitcoin (BTC) treasury firm, has been upgraded from a small-cap to a mid-cap inventory in index supplier FTSE Russell’s September 2025 Semi-Annual Assessment, bumping it up for inclusion within the flagship FTSE Japan Index.

The index supplier updates and rebalances the indices quarterly, and following Metaplanet’s robust Q2 efficiency, added it to the FTSE Japan Index, a inventory market index of mid-cap and large-cap firms listed on Japanese exchanges.

Metaplanet’s inclusion within the FTSE Japan Index means it’s routinely added to the FTSE All-World Index of the most important publicly-listed firms by market capitalization in every geographic area.

The inclusion of Metaplanet in main, globally acknowledged inventory market indices means the corporate will redirect capital flows into Bitcoin from conventional monetary markets and provides passive inventory traders oblique publicity to the world’s largest cryptocurrency.

Associated: Metaplanet and Smarter Net add virtually $100M in Bitcoin to treasuries

Metaplanet outperforms Japan’s blue chip shares, because it eyes growth

Metaplanet outperformed the Tokyo Inventory Value Index (TOPIX) Core 30, a inventory market benchmark index, that includes Japanese manufacturing and know-how giants Toyota, Sony, Nintendo, and others, in response to the corporate’s Q2 monetary report.

The Bitcoin treasury firm introduced year-to-date (YTD) good points of about 187% in August, in comparison with the TOPIX 30’s 7.2% YTD appreciation.

Metaplanet at the moment holds 18,888 BTC in its company treasury, making it the seventh-largest publicly traded holder of the supply-capped coin, in response to BitcoinTreasuries.

Initially a resort operator, Metaplanet rebranded itself as a Bitcoin treasury firm in 2024. The corporate now holds extra BTC than Coinbase, Tesla, the Hut 8 mining agency, and is Japan’s largest BTC treasury firm by BTC holdings.

In July, Metaplanet CEO Simon Gerovich signaled that the corporate would use a portion of its BTC stash to purchase extra income-generating companies, and floated the potential for buying a digital financial institution or a enterprise adjoining to digital property and cash.

The corporate’s executives have set a goal to build up 210,000 BTC by 2027, 1% of the forex’s whole 21 million provide.

Journal: US dangers being ‘entrance run’ on Bitcoin reserve by different nations: Samson Mow