In keeping with a poignantly on-point instructional video by Bitcoin media firm TFCT, which depicts a society in decline, leaving the gold customary was the “most expensive mistake we ever made” and the start of generational spoil.

The video, launched to mark the anniversary of Nixon closing the gold window, depicts a grandfather on his porch imparting his phrases of knowledge (and remorse) to his grandson, who questions:

“What was so unhealthy about gold?”

To which his grandfather replies:

“It stored them trustworthy.”

Folks assume that is ‘simply how life’s presupposed to be’

For many individuals, this miserable paradigm of hovering costs, family debt, damaged households, and an financial system powered by countless credit score is the pure order of issues. Because the grandfather laments:

“Of us right now assume that is simply how life’s presupposed to be.”

But, it wasn’t at all times this manner. Earlier generations had been capable of assist a household on one wage, and eat dinner collectively each night (fairly than working time beyond regulation, glued to a pc display screen, or speeding from one job to a different).

The very basis of our financial system modified, he argues, when America deserted the gold customary; an financial choice that had hefty penalties that rippled by means of households, tradition, and the very cloth of society.

Leaving the gold customary: a expensive mistake

America’s greenback was as soon as backed by gold. This was not only a coverage, however a promise, a power that stored governments “trustworthy” and curbed the temptation to spend past their means.

The gold customary mandated restraint. As soon as the greenback’s convertibility to gold was eliminated, a brand new period of fiat cash dawned.

Politicians gained the unchecked means to finance no matter they wished:

“They printed paper backed by nothing, funded wars we couldn’t afford and shouldn’t have been concerned in.”

Whereas some nations like France understood the risks of this shift and despatched a warship demanding their gold again, nearly all of the world allowed the delicate system constructed on belief to flourish.

The decline wasn’t on the spot, however fairly corrosive over time. Costs surged, salaries stagnated, “life bought harder, and no one knew why.” The normal family, one job supporting a household, home-cooked dinners, and a way of certainty, grew to become a relic:

“Seems once you pretend the cash, every little thing else follows, and also you screw the following era over.”

Bitcoin gives hope for brand new generations

As paychecks shrank in buying energy after leaving the gold customary, and households had much less time, they “outsourced parenting” to authorities faculties and tv. The tradition shifted towards debt, not financial savings. Consumerism boomed, however so did anxiousness and prescriptions. Grandpa explains:

“They discovered debt, not financial savings. Purchased homes they couldn’t afford. Performed video video games. Playing, antidepressants, and crimes. Households fractured. Divorce charges doubled. Beginning charges plummeted. Issues bought so unhealthy, individuals began financing Chipotle… We bought softer, sicker, and lazier. A nation in decline.”

The lesson from this generational lament couldn’t be clearer: pretend the cash, and every little thing else unravels. When foreign money may be endlessly debased, the door opens to continual deficits, generational inequity, and a perpetual cycle of “kicking the can down the street.”

But, inside this somber reflection lies a name to motion:

“We didn’t get it proper, however you’ve nonetheless bought an opportunity. So, take the reins, child. Maintain your floor, and don’t surrender on sound cash.”

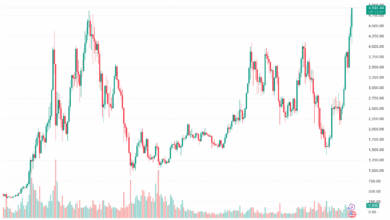

Leaving the gold customary would be the architect of all our ills, however because of Bitcoin, newer generations get a shot at fixing the cash and fixing the world.

In contrast to fiat foreign money, Bitcoin is capped at 21 million cash and resistant to the whims of politicians or central bankers. It’s digital, divisible, borderless, and most significantly, fastened in provide. The place gold stored earlier generations trustworthy, Bitcoin does the identical in a digital world.