Ether (ETH) pushed into uncharted territory Sunday, clearing $4,900 on Coinbase at 5:40 p.m. UTC and surpassing its prior report of $4,867 set on Nov. 8, 2021.

The five-year ETH-USD value chart from TradingView exhibits a clear, multi-year breakout: ETH has lastly vaulted the 2021 excessive after an extended consolidation, leaving no historic overhead ranges to lean on.

That is what merchants name value discovery — the market is printing new highs with solely psychology and order movement to information it moderately than prior chart resistance.

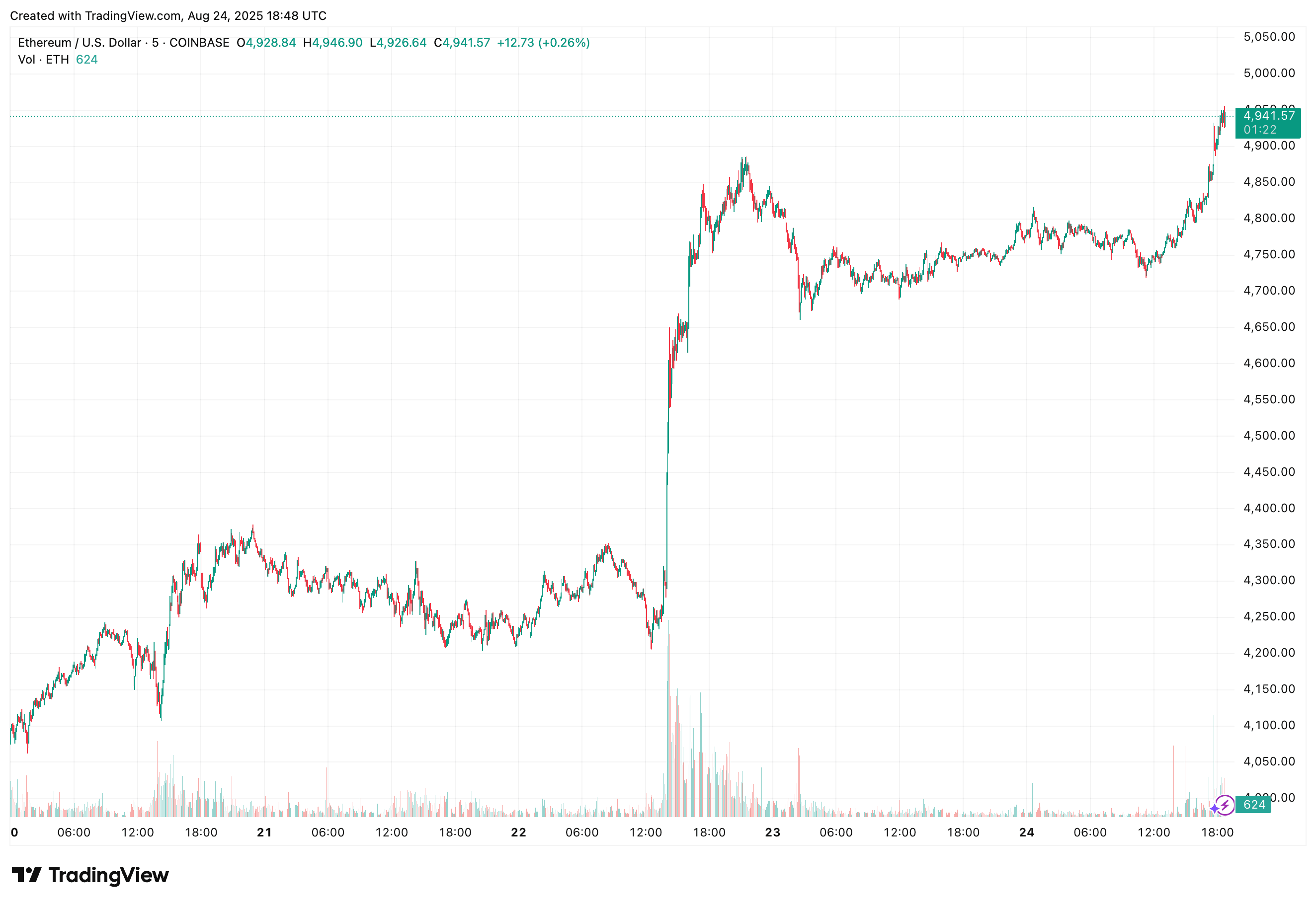

The 5-day view fills within the tape motion. After a quick run from the mid-$4,700s, ETH pushed by means of $4,900 and reached an intraday excessive round $4,946.90. On the time of the chart snapshot — 6:48 p.m. UTC — the final value was about $4,941.57. That sequence indicators consumers absorbed provide close to the outdated ceiling after which compelled a contemporary excessive, a traditional breakout sample.

Analyst Miles Deutsher summed up the management shift as “BTC is exhausted, ETH isn’t.” In plain English, he’s flagging relative momentum: bitcoin’s rallies have stalled close to current highs whereas ether simply broke into value discovery.

When a market says one asset is “exhausted,” it often means upside makes an attempt are fading, follow-through is weak, and sellers hold assembly pushes greater; “isn’t” means the other — stronger follow-through, contemporary highs, and energetic dip-buying. Merchants typically rotate towards the asset exhibiting greater relative power when the opposite chief tires.

Crypto Rover targeted on provide on exchanges. “Alternate reserves” refers to cash held in wallets managed by centralized buying and selling venues.

When these balances development down, fewer cash are instantly obtainable to promote. If demand rises as liquid provide thins, value can speed up as a result of consumers should bid greater to coax cash off-exchange again into circulation. That’s the mechanic behind his “provide shock” phrasing — not a assure of straight-up costs, however a setup the place shortage can amplify strikes as soon as momentum begins.

Michaël van de Poppe supplied a threat examine. He highlighted the unusually massive weekly candle and cautioned that weekend breakouts typically retrace when liquidity normalizes early within the week.

The concept is easy: weekend order books will be thinner, so strikes lengthen extra simply; when fuller participation returns on Monday, costs typically retest the breakout space to substantiate it as help earlier than trending once more. In apply, meaning a pullback towards the breakout zone wouldn’t, by itself, negate the bigger bullish break you see on the 5-year chart.