Technique co-founder Michael Saylor signaled an impending Bitcoin (BTC) buy, and, if accomplished, the transaction will mark the corporate’s third BTC acquisition in August.

The corporate’s most up-to-date Bitcoin purchase occurred on August 18, when Technique bought 430 BTC for $51.4 million, bringing its complete holdings to 629,376 BTC, valued at over $72 billion on the time of this writing.

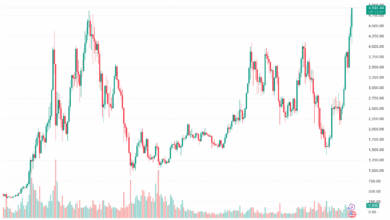

Knowledge from SaylorTracker exhibits Technique is up over 56% on its BTC funding, representing over $25.8 billion in unrealized positive factors at present costs.

The corporate’s BTC acquisitions in August have been comparatively slim. Technique sometimes acquires hundreds or tens of hundreds of BTC in each buy, but it has solely acquired 585 BTC thus far, in two separate transactions, this month.

Technique leads the cost in company BTC acquisition and is the most important BTC treasury firm by a large margin. Saylor continues to advocate for Bitcoin by orange-pilling particular person buyers and monetary establishments, sparking a motion in company finance.

Associated: Are struggling corporations utilizing crypto reserves as a PR lifeline?

Technique will not be immediately impacting Bitcoin market costs with its acquisition plan

Shirish Jajodia, the corporate’s company treasurer, just lately informed podcaster Natalie Brunell that Technique doesn’t transfer the BTC market with its purchases.

The corporate acquires BTC by means of over-the-counter transactions, non-public agreements between events that happen exterior of spot exchanges, and different strategies that don’t influence market worth.

Institutional buyers maintain BTC long-term, which raises the ground worth of Bitcoin over time. Nevertheless, different components, like worth hypothesis and merchants, have a extra speedy influence on the short-term market worth of BTC, Jajodia stated.

“Bitcoin’s buying and selling quantity is over $50 billion in any 24 hours — that is big quantity. So, if you’re shopping for $1 billion over a few days, it is not really shifting the market that a lot,” he added.

Technique continues to build up BTC for its company treasury, even amid sinking share costs, which have impacted most Bitcoin treasury corporations within the second half of 2025.

The corporate’s inventory sank to its lowest level in almost 4 months on Wednesday, hitting a low of about $325 per share, ranges not seen since April. Nevertheless, the value rebounded to round $358 per share on Friday.

Journal: Scottie Pippen says Michael Saylor warned him about Satoshi chatter